Private sector sidelined in tariff talks

Business leaders and trade experts have expressed frustration over the government's handling of negotiations with the United States on punitive tariffs, warning that poor preparation, lack of transparency, and minimal private-sector involvement have left Bangladesh vulnerable in its most crucial export market.

Their concerns were aired at a roundtable hosted yesterday by The Daily Star, titled "What's Next for Bangladesh After US Tariff Talks?", where participants criticised the government's reactive and disjointed response to the Trump administration's imposition of a steep 35 percent tariff on Bangladeshi goods.

As Dhaka prepares for a third round of negotiations with the Office of the United States Trade Representative -- after two earlier rounds failed to secure a deal -- a deepening trust deficit between the government and industry stakeholders has come to the surface.

Business leaders warned that without their direct involvement, negotiators risk accepting terms that could render large parts of the country's garment industry uncompetitive.

Some participants said Bangladesh's failure to act swiftly and strategically has resulted in one of the highest tariff rates among exporting nations. In contrast, Vietnam, a direct competitor in the global apparel market, secured a significantly lower rate of 20 percent, leaving Bangladesh at a distinct disadvantage.

"This is our single biggest export market. And we may lose it because we weren't proactive," said AK Azad, chairman and CEO of Ha-Meem Group. He argued that the government had failed to hire experienced lobbyists or involve the private sector at a critical early stage when the direction of talks could have been influenced.

"Global brands are already anxious," Azad added. "They see us lagging while others move forward... We didn't even know what our neighbours were negotiating."

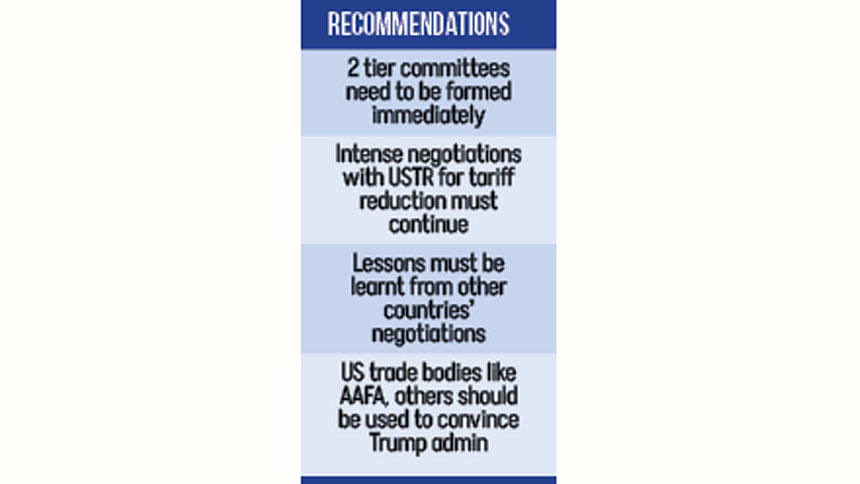

He called for forming formal negotiation support committees that include BGMEA leadership and relevant business leaders. "If we, the stakeholders, are not told where the problem is, how can we help?" he asked.

Mahmud Hasan Khan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), confirmed that the industry was not part of the negotiation process at the outset. "We've been engaged in a limited capacity only in recent days," he said.

He, however, cautioned that broader geopolitical considerations beyond trade seem to be at play. Due to a non-disclosure agreement (NDA) signed between Dhaka and Washington, stakeholders remain unable to access the full details of the discussions.

"As it is a government-to-government matter and protected under an NDA, we respect the confidentiality. We do not want to compromise the trust or breach the agreement. If the main negotiators can protect our interests, we are satisfied," Khan said.

The BGMEA chief reiterated the association's demand for a tariff structure that is both affordable and aligned with regional competitors such as India, Pakistan, Vietnam, and Cambodia. "If the tariff is slightly higher but allows for a level playing field, that would still be acceptable," he said.

However, Khan stressed that the association is pushing for a rate at least 10 percentage points lower than our competitors to ensure Bangladesh remains competitive in the US market.

Khan also flagged a looming crisis surrounding new US requirements for 40 percent local value addition. While BGMEA wants a lower threshold, confusion persists over how "value addition" is defined. "If only raw materials are included in the calculation, factories would struggle to comply," he said.

"Many factories that depend entirely on the US market will simply not survive," he added. "That could trigger widespread factory closures and mass layoffs."

He further cautioned that factories exporting more than 40 percent of their products to the US would be the hardest hit. "Some factories are even 100 percent dependent on the US market. If they fail to comply with the new tariff structure, they will not survive."

Former BGMEA president Rubana Huq, speaking virtually, described the current standoff as "personal and bilateral" for President Donald Trump, and criticised the government for failing to meaningfully engage stakeholders at an early stage.

She emphasised that no strategic alignment is possible without first addressing the deep-rooted trust deficit between the government and the business community.

Huq suggested Bangladesh should learn from countries like Pakistan, which actively involved its private sector in high-stakes trade talks with the US.

"We need a two-tier structure -- both a steering and a working committee -- to ensure inclusivity. BGMEA must be part of the process," she said.

Expanding on the broader implications, Huq argued that the US's defiance of global trade norms, particularly rules of origin and special differential treatment, has created a precarious situation for countries like Bangladesh. Even so, she pointed to signals from Washington that suggest room for dialogue.

"The White House is signalling: 'Meet us halfway.' That's a hint of flexibility," she said.

Huq stressed that Bangladesh must recognise its limitations when compared to Vietnam, India, or Pakistan in terms of geopolitical alignment and negotiating leverage. As an example, she cited China's rare earth minerals deal with the US, which she said underscores how strategic trade relations have become.

"Even China is headed toward a truce with the US. Meanwhile, we are exposed," she said.

She also warned against complacency over projections that estimate the impact at $8 billion in lost trade. According to her, the risks are far greater. "It's far worse. We are seeing customers frontload orders out of fear. In just five months, exports to the US totalled $3.38 billion."

Huq outlined a bleak scenario if the situation continues unresolved: sharp declines in export volume, massive layoffs, intensified pricing pressure, reduced foreign direct investment, and serious disruptions to supply chains. She said the country's GDP could contract as a result.

"Let's be clear -- America is our single biggest growing market. And just when we were opening up and attracting even Chinese investors, this shock hits us."

She insisted that consulting the private sector is no longer optional, but essential to avoid deep economic fallout.

"This is not just about big businesses. Millions of jobs are at stake. And as some exporters shift from the US to the EU, it's affecting even those outside direct US trade."

Kihak Sung, chairman of Youngone Corporation, said the tariff shock marks a reversal of decades of free trade gains. "In general, we have enjoyed the benefits of a globalised world and free trade. But now, I think we are going backwards," he said.

He pointed to a core supply chain vulnerability: "Many companies in Bangladesh still rely heavily on raw materials and components imported from China."

He appealed for transitional relief. "If they could negotiate an implementation period of at least six months, it would help companies to do alternative sourcing," he said.

Economist Mohammad Abdur Razzaque, chairman of RAPID, warned that the private sector must brace for a worst-case scenario.

"So far, we haven't seen meaningful discussion between the government, researchers, and stakeholders," he said. "If non-trade issues are on the table, we need to know what those are, at least in principle."

He added that a bad deal may be worse than no deal, but panic should also be avoided if the talks stretch beyond August. "Negotiations must continue beyond artificial deadlines."

Razzaque also called for political consensus on what kind of trade deal would be best for Bangladesh in the medium to long term.

THE BIGGEST INSULT

Fazlul Hoque, managing director of Plummy Fashions, delivered a blunt critique of the government's decision to exclude the private sector from the negotiation process.

He called it "the biggest insult" and said the excuse of the NDA was being used to cover up a lack of planning. "They could've consulted us on red lines and fallback options," he said.

"That should not have been the case," he said. "I'm not claiming that everything would have turned out differently if we had been involved, but there's no logic in excluding stakeholders who account for more than 98 percent of the country's import and export activity."

Hoque criticised the justification offered in the name of national interest, noting that "had a private sector representative been included in the committee from the beginning, they would have automatically been bound by the non-disclosure agreement."

"Why shouldn't the largest representatives of the stakeholders have the same status?" Hoque asked. "We are also sons of this country. We feel just as responsible for its future. If a secretary, deputy secretary, or joint secretary can be trusted with confidentiality, why can't we?"

Expressing his disappointment with the government's approach, he said, "I'm very sorry. This government is trying to do good things and bring meaningful change across Bangladesh. But, unfortunately, from the very first day, the private sector has somehow been neglected. I don't know the reason, but it's happening."

Iftekhar Ahmed Chowdhury, a former caretaker government adviser on foreign affairs, said the 35 percent tariff is inconsistent with WTO norms.

"However, they don't care about the WTO. US domestic law supersedes all international law, including norms followed by multilateral organisations of which the United States is a member."

Chowdhury called for a comparative study of Vietnam's strategy, where an initial 46 percent tariff was slashed by 26 percentage points in just three months.

"We have to understand the methodology that Vietnam uses and its negotiating strategy. Vietnam moved swiftly at the very first warning signs, started high-level contacts and immediately entered into negotiations for a framework trade deal," he said.

A framework agreement provides a forum for continuing discussions across a varied spectrum of trade, investment and intellectual property.

Chowdhury added that American concerns span para-tariffs, non-tariff barriers, procurement, corruption, copyright, foreign equity caps and repatriation.

Lutfe M Ayub, chairman of Fountain Garments Manufacturing Ltd, said half his output goes to the US and half to the EU. Now, buyers like Walmart are in a "wait-and-see" mode.

"This waiting period could cost us several idle months -- a difficult situation for our factories," he said.

"When we approached the government for clarity, we were warned by other agencies that delays and a lack of proactive action would cost us. And that seems to be what's happening."

"The government responded by saying they're bound by a non-disclosure agreement. That's quite frustrating. They didn't need to share the full agreement, but they could have consulted us on key points. We understand how to run our businesses best."

"If we lose $8 billion in business, that could mean one million jobs lost -- with devastating social consequences," Ayub said. "We need a decisive deal before August 1."

M Masrur Reaz, chairman of Policy Exchange Bangladesh, called for a new market-based approach. "We need a market-based strategy where exporters and US buyers -- brands and retailers -- share the added cost."

"BGMEA must play a guardian or curating role. If left to individual firms, it'll lead to undercutting -- a race to the bottom."

He said the most sustainable strategy is to enhance competitiveness: "We need to bring down trade and business costs through better logistics and ease of doing business, and improve productivity through tech and skills."

"We're at a disadvantage compared to Vietnam, India, Indonesia -- this has to change," he said.

"Competitiveness improvement is a medium to long-term agenda, but it must start now. It should have started 10 years ago."

"If we are offering politics, security, and defence, then we must ask for the best possible tariff outcome in return."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments