| Home - Back Issues - The Team - Contact Us |

|

| Volume 10 |Issue 24 | June 24, 2011 | |

|

|

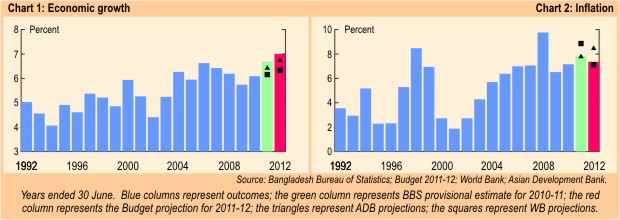

Economy Two Sides of the Economic Outlook Jyoti Rahman Income and expenditure, debit and credit, every budget has two sides. But this piece is not about the accounting sides of the 2011-12 Budget. Rather, the focus here is on two sides of the macroeconomic outlook that underpins the Budget. On the one hand, the economy appears well placed to grow at a brisk pace (Chart 1) the official projection is for 7 percent in 2011-12 (FY12), coming on the heels of 6.7 percent estimated for 2010-11 (FY11). Not only does this mark the two fastest years of growth in the two decades that the Bangladesh Bureau of Statistics has official data for, these growth rates also imply the strongest macroeconomic performance in the fifty years that the World Bank estimates date back to. While the official projections are somewhat rosier than forecasts by the World Bank and the Asian Development Bank, both agencies expect the economy to rebound from the mild slowdown experienced in 2008-09. There is unmistakably a general optimism about economic growth. Years ended 30 June. Dark grey columns represent outcomes; the light grey column represents BBS provisional estimate for 2010-11; the white column represents the Budget projection for 2011-12; the triangles represent ADB projections; the squares represent WB projections. Juxtaposed against this rosy expectation, on the other hand, is a more worrisome outlook for inflation (Chart 2). The Budget is predicated on consumer price inflation peaking in FY11 at 8 percent, before easing to 7.5 percent next year. The WB also sees inflation peaking this year, but at a higher rate. Meanwhile, the ADB agrees with the official projection in FY11, but sees inflation rise to 8.5 percent next year. And a combination of factors point to high if not accelerating inflation. The bounce back Some commentators have questioned the Budget's economic growth figures on the ground that there is no commensurate rise in investment. Typically, economic accelerations are accompanied by an investment boom or a productivity surge. However, it may still be possible for the economy to accelerate in the short term without significant changes to investment or productivity if there is a bounce back from a slowdown or recession. As it happens, Bangladesh did experience a moderate slowdown towards the end of the last decade. In the middle of the 2000s, Bangladesh was growing by an average of 6¼ percent a year. In 2006-07, the economy grew by 6.6 percent. Then, over the following years, growth slowed, to 5.7 percent in 2008-09. First, the political uncertainty associated with 1/11 took its toll. Then the Great Recession hit. However, there is no reason to believe that either factor has left a permanent damage to the economy's capacity to grow. Suppose the trend rate of growth is 6¼ percent a year. Had the economy continued to grow at that rate, it would have been about one per cent bigger in FY10. The faster FY11 and FY12 growth rates in the Budget would barely take the economy to the level that it would have reached by FY12 had the trend rate been maintained over the past few years. Seen this way, the 'investment-less growth' is just a bounce back from the earlier slowdown.

External sources Nowhere is this 'bounce back' more apparent than in the exports sector. Exports are expected to have grown by 38 percent in FY11, before to 14.5 percent in FY12, broadly similar to the rates seen before the Great Recession. The official projections are largely in line with the expectations of the WB and the ADB (though both expect a slightly slower pace of growth in FY11 and slightly faster rate in FY12 than the government figures). There is also a general agreement about the reasons behind the boom: inventory replenishment in the key markets; rising wages in competitive countries; product and market diversification; and relaxed rules of origin to the European Union. Beyond these strong numbers, there may be further good news on the exports front. We may be witnessing early stages of product diversification whereas ready made garments made up 69 percent of total exports in 2009, its share fell to 66 percent in 2010. It's not that garments exports are falling, rather exports of other products are growing even faster in the year to February, for example, garments exports grew by 48 percent, but exports of jute products grew by a whopping 79 percent. To be certain, garments will dominate the exports scene for a while yet, but it's definitely good news that other products are coming to the market. A diversification is happening in the destination market as well. In 2008-09, exports to China amounted to 5.8 billion taka. In 2009-10, it rose to 10.5 billion. In the same period, exports to major Southeast Asian economies went from 7.7 billion taka to 13.2 billion taka, while exports to the Gulf went from 7.9 billion taka to 10.5 billion taka, and to the East Asian tigers, up from 16.8 billion to 23.1 billion. Granted, these are tiny numbers compared with the 2009-10 total exports of over a trillion taka. But there is an unmistakable trend here. Five years ago, the United States and major European countries made up nearly three-fifths of the exports market. Now it is less than half. The exports boom is reflected in the manufacturing sector growing by 9.5 percent in FY11. Manufacturing boom is expected to continue in FY12, with flow on effects on employment, income, and consumption of goods and services. These flow on effects are expected to be strong enough to off set the impacts of slowing remittance, which appears to be the key dampener on economic growth. The official projections are for remittance growth of 5 percent this year and 10 percent next year. The ADB is more pessimistic, with expected growth rates of 3 percent and 4 percent. But the World Bank is more optimistic. Everyone acknowledges the risks to remittance coming from the political uncertainty in the Arab world. Deficits and inflation The remittance slowdown is expected to push the current account into a modest deficit of 0.3 percent of GDP in FY11 and 0.2 percent of GDP in FY12. Booming imports are also contributing to the current account deficit. However, to the extent that a large part of the imported goods find their way into investment and exports, rising imports is not a cause of worry. Nor is a modest current account deficit worrisome, particularly if there are sufficient foreign exchange reserves. And the official projections are for sufficient reserves to pay for nearly 15 weeks of imports, which is considered 'safe' by the financial markets.

However, should the current account deficit widen suddenly, or turns out to be much bigger than expected, we may see a hit on taka. As it happens, the government projections of the current account deficit are similar to the ADB's (they actually expect a small surplus in FY11). But the WB projects larger deficits (0.8 percent of GDP in FY11, widening to 1.6 percent of GDP in FY12). While current account deficits of even that magnitude should be manageable by the central bank, the recent performance of the Bangladesh Bank in managing the money or financial markets doesn't exactly inspire much confidence. And therein lies the worry. Should taka depreciate suddenly, it's going to see prices spike. As it is, the government acknowledges that inflation is running at an uncomfortably high rate of 8 percent. Food prices see upwards pressure in the global markets. The last thing needed now is a run on taka. It's not just the current account deficit that points to an upside risk to inflation. Potentially more important is the projected budget deficit of 5 percent of GDP in FY12. The government intends to finance 2.1 percentage points of that from the domestic banking sector. In FY11, domestic banks financed 2.3 percent of GDP worth of budget deficit. This was accompanied by broad money growing by 20 percent. In FY12, broad money growth is projected to ease to 16 percent. Incidentally, broad money growth has mostly overshot the target over the past five years. That is, there is considerable inconsistency between various monetary and public finance targets in the Budget. One way these inconsistencies can be resolved is through higher inflation than what is projected. Another way is for the deficit to be smaller than anticipated. The deficit can be smaller in two ways: better revenue collection, or worse expenditure, particularly development expenditure. Recent experience suggests that it is the last case that is more likely. Which would be unfortunate. A trend GDP growth rate of 6.25 percent was assumed above. But there is nothing special about that rate. We should be aiming for higher trend rates, which will require more investment, including public investment. That, however, is the subject of a whole different article. Jyoti Rahman is an applied macroeconomist and a member of Drishtipat Writers' Collective.

Copyright

(R) thedailystar.net 2011 |