A banker with extraordinary leadership retires

After more than eight years at the helm, Helal Ahmed Chowdhury retired as the managing director of Pubali Bank yesterday, having led the bank on to an enviable solid footing.

His banking career spanned 38 years -- all spent at the same private commercial bank. He crossed the mandatory retirement age of 65 years set for all chief executives in the banking sector.

"Helal Ahmed Chowdhury has done very well, and under his leadership the bank has progressed and expanded its reach," said Khondkar Ibrahim Khaled, one of the most respected bankers in the country, and the predecessor of Chowdhury.

"The bank is well-operated. Over the years, he has maintained ethical standard. As a result, the bank has been able to keep itself away from irregularities," the former deputy governor of Bangladesh Bank told The Daily Star yesterday.

When Chowdhury took over from Ibrahim Khaled in 2006, Pubali Bank was still struggling to shake off its 'problem bank' image.

But in the last eight years, he has not only led the country's largest private commercial bank to make a turnaround, but also put the lender on a sound footing and kept it away from any financial scam.

Since Chowdhury's takeover as CEO, the bank grew to greater strengths to be among the few banks that did not need to reschedule loans from fear of defaults, even when the central bank offered a relaxed loan rescheduling policy to keep the sector buoyant.

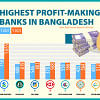

Pubali's deposits, profits, loans and total assets all grew substantially during his time. The lender's deposits quadrupled to Tk 17,787.82 crore in 2013 from eight years ago.

During the same period, profits rose to Tk 755.98 crore from Tk 181 crore and the total assets grew to Tk 22,853 crore from Tk 5,840 crore. Lending trebled to Tk 13,694 crore.

"Pubali Bank is a role model for a government turned private bank of the relentless effort of the chairmen, board members, shareholders and staff," Chowdhury said, attributing the bank's success to compliance to Bangladesh Bank rules and regulations.

Chowdhury's ties with the bank date back to 1977 when he joined the bank as a probationary senior officer. He never left. That earned him a record in the banking sector: as the first banker to start his career with the same bank and later to become its chief executive.

Pubali Bank was launched as Eastern Mercantile Bank in 1959 in Chittagong. It was nationalised in 1972 and renamed Pubali Bank. The bank was denationalised in 1983.

But privatisation did not make the bank sustainable, and it turned into a problem bank in 1990 because of the unrealised loans lent to state-run entities and lack of good governance, prompting the central bank to appoint an observer.

As the board of the bank gained experience, coupled with support from the central bank, Pubali shed the stigma of a problem bank in 2005. It came out of the early warning system two years later.

"I have seen the trouble the board had to go through to bring the bank to this stage," Chowdhury said.

At the heart of the bank's transformation into a mature financial institution has been innovation. Now the bank's 427 branches are totally automated, making it the largest real time online bank.

The bank has introduced SMS and internet banking. It provides hands-on training to its officials in its own lab. It also has a modern disaster recovery centre in Uttara.

The bank organises special trainings on audit and IT for its officials to help them fight financial crimes through IT platform.

"We are trying to develop a totally IT smart population," said Chowdhury.

Chowdhury gives immense credit to the board members of the bank for the current strong position. "During my tenure as the managing director, I was never under pressure from them."

He admitted that a small number of irregularities took place in his bank, but they were not close to any of the major scams that hit the country's banking sector in recent times.

The bank has been always generous when it comes to giving back to the society, prioritising health and education for its corporate social responsibility spending.

Chowdhury said he has been always loyal to the institution and is proud to be a part of the bank's journey to the top.

"The bank has gone through a huge transformation. I am really proud to be part of it," said Chowdhury, who is an MA, a diplomaed associate of the Institute of Bankers, Bangladesh and has additional professional education at top universities like Cambridge, Oxford, Columbia and the University of California Berkeley.

The father of two acknowledged he does not know how successful he has been in running the bank. "But I have tried my best, maintaining due diligence, and I always tried to work in a team."

He thanked the government, the finance ministry, the central bank, the National Board of Revenue and the Bangladesh Securities and Exchange Commission for their cooperation. Following his retirement, Chowdhury, whose wife is a teacher, plans to impart the knowledge he has acquired over the years to the next generation of bankers through teaching.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments