Money in Swiss Banks: Bangladeshis' deposits drop

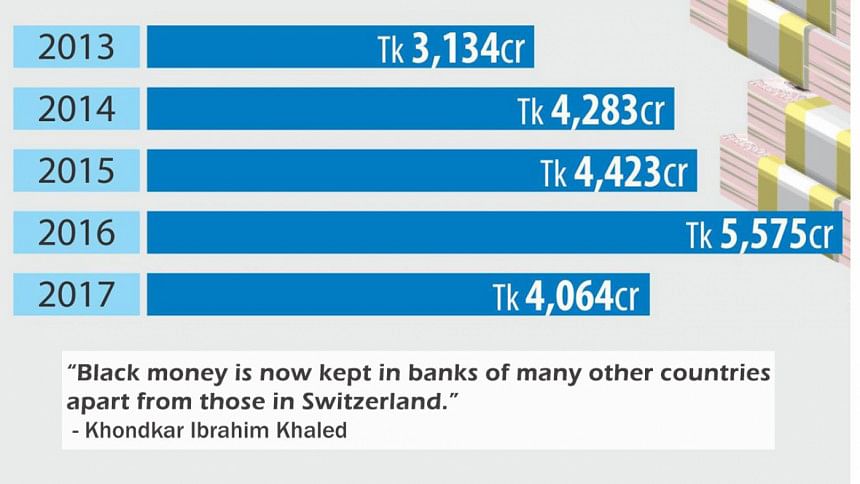

Bangladeshi nationals' deposits in Swiss banks dropped 27 percent year-on-year in 2017 to 481.32 million Swiss francs or Tk 4,064 crore.

The Swiss National Bank (SNB) came up with the data in its annual report titled “Banks in Switzerland 2017”.

The amount was Tk 5,575 crore in 2016 and Tk 4,423 crore in 2015, according to the report.

The fall in deposits comes amid an ongoing global clampdown on the famed secrecy wall of Swiss banking system.

Zaid Bakht, ex-research director of Bangladesh Institute of Development Studies (BIDS), said many people are cautious about depositing money with Swiss banks possibly because of this clampdown. Money may have been deposited elsewhere, leading to a drop in the deposits in Swiss banks.

The SNB report, however, does not shed light on the alleged black money held by Bangladeshis.

Talking to this newspaper, ex-Bangladesh Bank deputy governor Khondkar Ibrahim Khaled said black money is now kept in banks of many other countries apart from those in Switzerland.

At present, Swiss banks are not the best place for depositing black money, he pointed out.

Khaled said the decline in Bangladeshi nationals' deposits in Swiss banks does not prove that corruption has decreased in the country.

Zahid Hussain, lead economist at the World Bank's Dhaka office, said, “The decrease in amounts held by Bangladeshis in the Swiss Bank is indeed good news. Perhaps, the initiatives taken by the government against money laundering are beginning to yield some results.

“What would be important is to understand better what caused the decline -- is it because of overall decline in the size of capital flight or is it a diversion of laundered money to safer havens?”

Seeking anonymity, a Bangladesh Bank official said the Bangladeshi nationals' deposits in Swiss banks don't mean that the money was sent there only from here or those were illegally earned or laundered.

Bangladeshis living abroad also keep their money in Swiss banks, noted the banker.

Bangladeshi businesspeople, who make transactions with firms or individuals in European countries for business purposes, may have also kept money in Swiss banks, added the official.

According to the SNB report, the deposits of Indian nationals in Swiss banks rose to 999 million francs last year from 664 million francs in 2016.

However, the deposits dropped by almost half in 2016 compared to that in 2015.

Indian nationals deposited 1.2 billion francs in Swiss banks in 2015.

The report also shows that Pakistani nationals' deposits in Swiss banks fell to 1.1 billion francs last year from 1.38 billion francs in the previous year. Their deposits also dropped in 2016 compared to that in the previous year.

Over the last several decades, Switzerland has provided wealthy families around the globe with a convenient and safe place to stash their money.

The country's political neutrality, stability and tradition of bank secrecy have kept their fortunes beyond the reach of national governments and even the most determined tax collectors.

Offshore accounts are not illegal, but many people use those to hide cash from the tax authorities, say experts.

Swiss banks have come under global pressure in recent times, as a number of countries, including India, are stepping up efforts to crack down on black money. A Europe-led clampdown has also been launched on tax evasion and corruption.

Experts, however, say data from the Global Financial Integrity (GFI), a Washington-based research organisation, gives a comprehensive picture about money laundered out of a country.

Bangladesh lost between $6 billion and $9 billion to illegal money outflows in 2014, according to a GFI report.

However, the GFI has not yet published any report this year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments