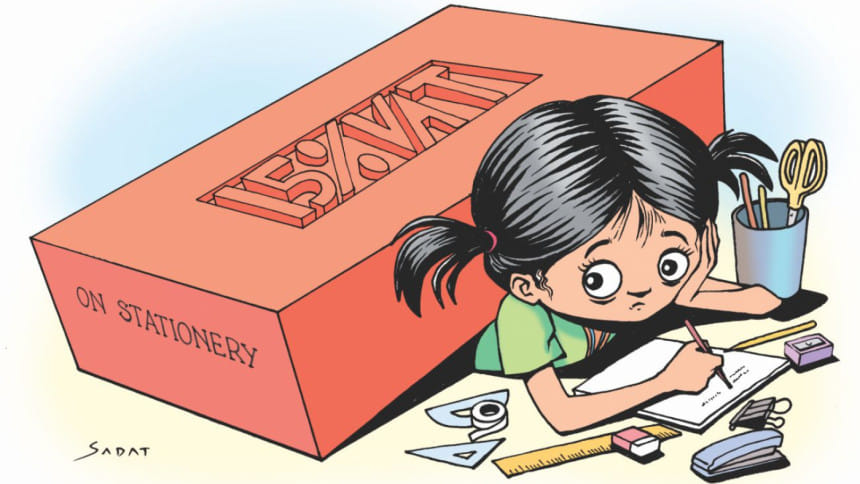

No thanks to 15pc VAT

Ezaharul Haque has been upset since he learned about the government's decision to impose a uniform 15 percent VAT this July. The thought of more money going out of his pockets to purchase necessary goods and services concerned him.

But last week when he heard that education materials like exercise books, ballpoint pens and pencils would also be within the purview of the new VAT system, he sat down to do a math to know how much more he would have to spend on the stuff for his two children.

An employee of a private firm in Jessore, Ezaharul has already been spending nearly half of his monthly salary of Tk 12,000 on the education of eighth grader daughter Atri and sixth grader son Beer.

Both the children study in public schools in Jessore town. Atri requires 17 exercise books and Beer needs 15, while they both use a dozen of pens and pencils every two months.

Ezaharul also buys colour pencils so that his children can participate in art class. The total expenditure on the items comes to around Tk 1,300 every two months. But from the next month, he will have to count an additional cost of Tk 200 as the new VAT and Supplementary Duty Act 2012 takes effect.

"I never thought these [items] would come under Value Added Tax. It will be an extra pressure on middle class families like us," he said.

Like him, other parents will see their spending go up from the next month on exercise books and other learning materials.

The guardians whose children attend English medium schools will receive a double blow as the 15 percent VAT will be applicable to education services at these institutions.

The cost of English medium education has already multiplied three to four times in the last few years. "It [new VAT] means my children's educational expenses will certainly go up further," said Samir whose son studies at Sunnydale School in the capital.

Ziaul Kabir Dulu, president of Obhibhabok Oikya Forum, a platform of guardians, said levying the tax would be a setback for the expansion of education in the country.

The new tax law seeks to impose a single and uniform VAT rate, instead of multiple rates now applicable to more than 100 goods and services, including paper and exercise books. Ballpoint pens and pencils have been exempted from VAT as of now.

Fifteen percent VAT is slapped on educational materials at a time when the government has been providing students from class one to class ten with free textbooks.

Currently, 3.69 crore students are studying at more than 1.67 lakh institutions of primary to university levels in the country.

The government has offered VAT exemption on a total of 1,043 items and services that do not include exercise books, ballpoint pens, pencils and English medium education. Many of the exempted materials are not needed in daily life.

With 15 percent VAT, the price of a 100-page exercise book will increase by Tk 3 to Tk 33, said Choudhury Atiur Rasul, director (accounts) of Pran-RFL Group that operates in diversified areas from processed food, plastic items to educational materials and stationery.

The cost of ballpoint pens and pencils will also go up for VAT.

"The price hike of each exercise book may seem small or insignificant. But considering the total amount a learner requires nowadays, the spike is likely to affect low and fixed-income families," Rasul said.

The National Board of Revenue (NBR) now collects Tk 3,750 and Tk 4,500 as VAT on per tonne of exercise books and commonly used writing and printing papers, said paper industry insiders.

The VAT is charged based on tariff value or minimum value set at Tk 25,000 per tonne and Tk 31,625 per tonne.

Under the new law, 15 percent VAT will be imposed on the market price of writing paper, which now stands at Tk 65,000-Tk 75,000 per tonne.

There will be a big impact on the prices of paper for VAT, said MM Nurun Nabi, general manager of Partex Paper Mills Ltd.

Bangladesh annually requires up to 60,000 tonnes of exercise books and note books, part of its total annual demand for paper of 10-12 lakh tonnes, said Mustafizur Rahman, spokesperson of Bangladesh Paper Mills Association.

The demand for exercise books is rising as students are shifting from buying unstitched paper sheets, said Mustafizur, also deputy managing director of Bashundhara Group that has paper mills.

Eighty percent of the yearly use of pens -- some 60 crore pieces -- are by students since the increasing use of computers has reduced the need for pens in public and private offices, market insiders said.

Alok Karmakar, who runs a stationery store at Tikatuli in Dhaka, said the prices of exercise books and paper remained steady for nearly a year. "If prices go up, customers misunderstand us. They will not be interested in finding out the reason.”

According to eminent educationist Prof Siddiqur Rahman, VAT on education materials is not logical and justifiable.

“When the government provides textbooks for free to encourage education and reduce pressure on guardians, the VAT on education materials will increase burden on many low income families,” said Siddiqur, a former teacher of the Institute of Education and Research at the University of Dhaka.

“VAT should not be imposed in the interest of spreading education and for the next generations.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments