Challenge lies in implementation

A look at the revised budget for the outgoing financial year and its state of implementation up to the month of March reconfirm the main weakness of our financial management, namely, the persistently low revenue mobilisation that routinely misses its target. It appears from the budget speech that the strategy for the upcoming budget will be to substantially improve revenue collection by initiating a campaign against tax evasion and not by hurting the common people through increases in the tax rates. That is indeed a noble goal and, even if partially successful, such a campaign can begin to make a real difference in our fiscal management. Admittedly, a change in the culture of tax evasion will not be easy, but the campaign should have started much earlier.

In spite of the visibly good intentions to allocate more funds for public social spending on health, education and the safety nets, the low rates of revenue mobilisation remain the most formidable constraint, on top of the problem of poor service delivery.

While the new VAT law will now finally be implemented, its effects on prices and business incentives remain unclear for a lack of articulation. It is not clear what principles have been followed in applying VAT at different rates instead of the initially-proposed single rate. The VAT rates may vary according to stages of the supply chains from import and production to wholesale and retail trade, which are similar to the existing truncated rates and are justified by the lack of capacity of businesses to claim credits for VAT paid at the earlier stages. But the VAT rates may justifiably vary according to whether the products or services are essentials or luxuries. The resulting implied protection provided to domestic production may be another consideration, although VAT in principle should be neutral to incentives for import or domestic production. It is not clear whether the outcome of these various considerations create more distortions or bring discipline in the VAT system. Negotiating with the business communities is useful since their cooperation is essential for the effective implementation of the VAT law, but there is no substitute for independent analysis. Most of all, if tax evasion remains rampant, analysing the effects of VAT rates on paper is a non-starter.

In bringing any changes to the tax structure, policymakers are obviously keen to improve the business environment and investment incentives. However, an overlooked fact is that making the truant businesses tax compliant and preventing the malpractices in import-export businesses are effective ways to encourage honest entrepreneurs -- even more effective than providing tax incentives or outright subsidies.

The budget proposes to provide a subsidy to attract transfer of remittances to the banking system away from the illegal channels. The cost of such subsidies will need to be weighed against the intended benefits through monitoring.

There seems to be a proposal to increase the existing Supplementary Duty, over and above the VAT, on services related to mobile telephony. This will work towards making the indirect tax system even more regressive, since such services are now considered necessary even for the poor. As it is, the mobile phone companies are already paying the lion's share of indirect taxes. In general, the fiscal authorities should exercise self-restraint against temptation to go for the low-hanging fruits irrespective of the equity aspect of taxation.

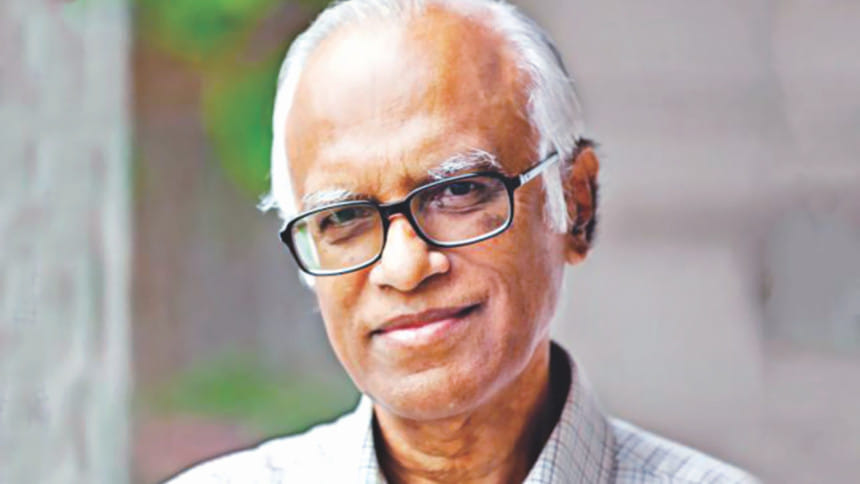

[The writer in an economist and former adviser to a caretaker government.]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments