Deficit financing to be expensive

The government has resorted to deficit financing, largely through bank borrowing and sale of high-cost savings certificates, increasing the interest payment burden on its shoulders and fuelling inflation.

Increased borrowing from the banking industry, which is already in a liquidity crisis, will create a fresh crowding out situation for the private sector.

Budget documents show the borrowing goal from foreign sources has been set at Tk 68,017 crore, around 44 percent higher than the revised target for the outgoing year, meaning that more taxpayers' money will be spent to pay off external lenders.

Now Bangladesh has to pay 2 percent in interest for loans from World Bank and Asian Development Bank, up from the 0.75 percent availed before the transition to a lower middle-income country.

Loans from Japan, Bangladesh's largest bilateral development partner, cost 1 percent, which is almost 7 times higher than what was two years ago.

However, the budget deficit target remains at 5 percent of the GDP for the outgoing fiscal year.

Of the Tk 145,380 crore deficit, Tk 77,363 crore will come from domestic sources: Tk 30,000 crore from savings certificates and other non-banking sources and Tk 47,364 crore from the banking system.

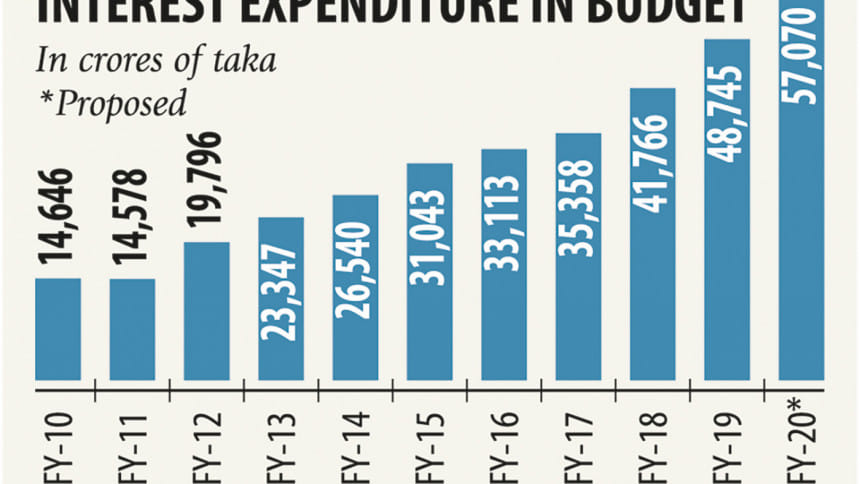

For interest payment, Tk 57,070 crore has been earmarked, which is 10.91 percent of the total allocation and 51 percent higher than the outgoing year's revised allocation of Tk 37,920 crore.

"The size of the budget deficit is not big. But source of financing is important," said Zahid Hussain, lead economist at World Bank's Dhaka office.

He said if the government can manage revenue sources, the repayment would not be a problem.

However, Hussain did not rule out the possibility of inflationary pressure for the bank borrowing "even if the government borrows from Bangladesh Bank instead of commercial banks, as liquidity will increase".

"Domestic loan repayment is not a problem as the government can return it in local currency. But external debt may put pressure on the economy after five to six years when repayment of big and supplier credit loans will start," he said.

According to him, the bank borrowing decision has come amidst the presence of high non-performing loans and a liquidity crisis. Domestic sourcing from commercial banks and national savings certificates will lead to payment of more interest, he said.

Moreover, bank borrowing may affect private investment, which was lagging behind its target of 25.25 percent of the GDP.

If returns are lower than implementation costs, it will definitely create pressure on the economy and the government will have to reduce allocation for education and health and social welfare to make loan repayments, he noted.

Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue, termed the deficit sourcing "expensive", saying the external and local loans would carry high costs.

"…the revenue growth target will not be achieved…the banking system deficit financing will create a crowding out effect and limit access to credit for the private sector, then investment will be stagnant," he said.

If the government is not able to mobilise internal resources, it will create a burden for poor people in the future as the government will have to cut different social welfare expenditure, he said.

Already, the government has started to take expensive loans from China, Russia and other multilateral external sources that will create additional pressure on the economy in coming days, for the repayment amounts will be big, said Moazzem.

He apprehends that if the government continues its bank borrowing, private investments' access to financing might be reduced.

Former caretaker government adviser AB Mirza Azizul Islam said the deficit financing plans remain unfulfilled every year due to a lack of budget implementation efficiency.

Deficit finance repayment is still at a risk free level as external debt is yet to cross the borderline, he said.

He however suggested that the govern-ment avoid non-concessional loans, avail cheaper loans and reduce dependence on national savings certificates.

Risks remain for the government if exports, remittance and revenue do not significantly increase, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments