Less tax for well-off, more for commoners

"So unfair!" is what middle-class taxpayers were left mouthing upon seeing the budget for the fiscal year 2019-20.

Save for simplification in getting tax rebate on investment in certain savings tools, there is no good news for individual taxpayers from middle-class households in the new budget. But for the relatively well-off and black money-holders, it is the opposite. Other than some incentives for small investors, there is nothing in the budget for the middle-class to cheer about, said Towfiqul Islam Khan, senior research fellow of the Centre for Policy Dialogue (CPD).

"On the contrary, the rich have been given benefits by increasing the surcharge-free net wealth threshold," he said.

The popular demand for raising the tax-free income tax ceiling to give relief to low- and fixed-income groups was not entertained on the ground that the tax-exempted threshold was mostly on par with or below the per capita income of developing countries.

In Bangladesh, the tax exemption threshold is almost 1.5 times the per capita income.

"Any increase in tax exemption threshold will push a significant number of taxpayers out of the tax net, which will eventually erode the tax base," said Finance Minister AHM Mustafa Kamal in his budget speech.

So, anyone who earns Tk 21,000 a month from July this year will come under the tax net, helping the government expand the overall base further from nearly 40 lakh registered taxpayers.

But, given the rising cost of living, the erosion of purchasing power and the lack of social security benefits, the disposable income of people in the lower income brackets will shrink.

The government has kept the tax-free income threshold unchanged at Tk 250,000 since fiscal year 2015-16.

"The pressure on the middle-class will increase for the tax measures," Khan said, adding that the CPD proposed lowering the income tax rate for the first slab to 7.5 percent from existing 10 percent without changing the taxable income level.

On the other hand, the surcharge-free net wealth ceiling was increased from Tk 2.25 crore to Tk 3 crore, which will give a slight relief to the high-income group.

In its analysis, the private think-tank said a number of rich people will remain out of the surcharge net.

For instance, a taxpayer who owns four 2,000sqft flats in the capital's Gulshan area will remain outside the purview of the surcharge.

The think-tank, however, used the prices put during land/flat registration for its calculations. The prices quoted tend to be lower than the actual transaction amount.

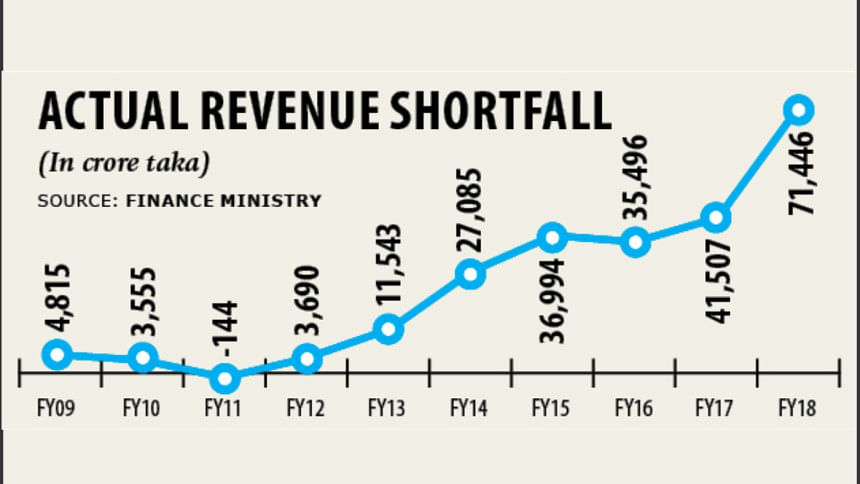

In order to widen tax net and attain the budgetary target of Tk 113,912 crore, up 20 percent from this fiscal year's target, the NBR seeks to make the submission of taxpayer identification number (TIN) mandatory for electricity bill payment in city corporations, cantonment boards, and municipalities.

"Based on the submitted TINs, we will check whether the users submit income tax returns," said an NBR official.

There are 20 lakh electricity connections in Dhaka city and many of them do not pay tax despite having taxable income, he said.

There are four crore people who are included in the middle-income group, but the number of taxpayers is only 21-22 lakh, according to the finance minister.

The total number of taxpayers would be increased to one crore at soon as possible, he said.

To that end, tax offices would be set up in every upazila and reforms in tax department would be made.

AF Nesaruddin, president of the Institute of Chartered Accountants of Bangladesh, welcomed the plan to bring tax administrative reforms.

"Digitalisation of the whole process is a need of the time. The government should focus more on this area."

Programmes must be undertaken to make taxpayers aware of digitalisation, Nesaruddin said.

Steps regarding online return filing and reducing the hassles of taxpayers are missing, CPD's Khan said.

To achieve the higher tax collection target for the next fiscal year, the NBR has sought to raise the withholding tax on the the interest earnings from national saving certificates to 10 percent from 5 percent.

It has also sought to hike the tax at source on cash subsidy on exports to 10 percent from 3 percent and impose advance income tax on imports of various items and purchase of raw materials.

The NBR also wants to treat the advance income tax slapped at the import stage of cement, iron rod and steel products, as the minimum tax.

These measures are expected to bring a chunk of the additional tax the NBR is seeking, according to the NBR official.

There is not much good news for companies either.

Despite calls for cuts in tax rates to attract investment, the finance minister has sought to keep the corporate tax rates unchanged for all.

This means, the reduced tax benefit for the garment and textile sectors, the main export earner, will be carried over to the next fiscal year.

The finance minister has extended the tax holiday benefit on income from investment in infrastructure and 21 types of industries in economically lagging regions for the next five years to encourage private investment and job creation.

Offers are also there for black money-holders: they will be able to invest the undisclosed income without facing any question from taxmen about the source of funds.

Holders of undeclared money will be allowed to invest in establishing factories in economic zones and hi-tech parks by paying only 10 percent tax.

Until now, their investment scope was limited to properties in city corporations and municipalities.

"It shows that privileged persons get more benefits. This is unjust and it will increase inequality in the society," Khan said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments