60pc of women SME entrepreneurs struggle to get loans: survey

Over 60.2 percent of the women SME entrepreneurs' demand for finance remains unmet as banks and non-bank financial institutions do not want to lend to women, a survey found.

The unmet demand for financing was estimated at Tk 6,007 crore for fiscal 2014-15, according to the report of the International Finance Corporation, an arm of the World Bank Group.

The survey was conducted among 500 women SME entrepreneurs in 12 districts, including seven divisional headquarters.

Additionally, 40 qualitative interviews were conducted with government agencies, financial institutions, women business associations and other stakeholders in the entrepreneurial ecosystem.

The report titled “Mapping the market potential and accelerating finance for women SME entrepreneurs in Bangladesh” will be unveiled at a programme in Dhaka today.

Only 31 percent of the women SME entrepreneurs were able to finance most of their entire business requirements, the report found. On a regional basis, enterprises in Rajshahi had the widest gap in financing, averaging Tk 10.67 lakh per enterprise, followed by Khulna. The lowest average financing gap was seen in Barisal.

Though women-owned businesses are viewed as the new economic agents of change in Bangladesh, limited access to finance coupled with socio-cultural barriers restricts their participation in economic activities. Even different initiatives taken by the government and the Bangladesh Bank have failed to inspire lenders to extend loans to women entrepreneurs.

As per BB's 'Small and Medium Enterprise Credit Policies and Programmes', the interest rate for women SME entrepreneurs should not be higher than 10 percent.

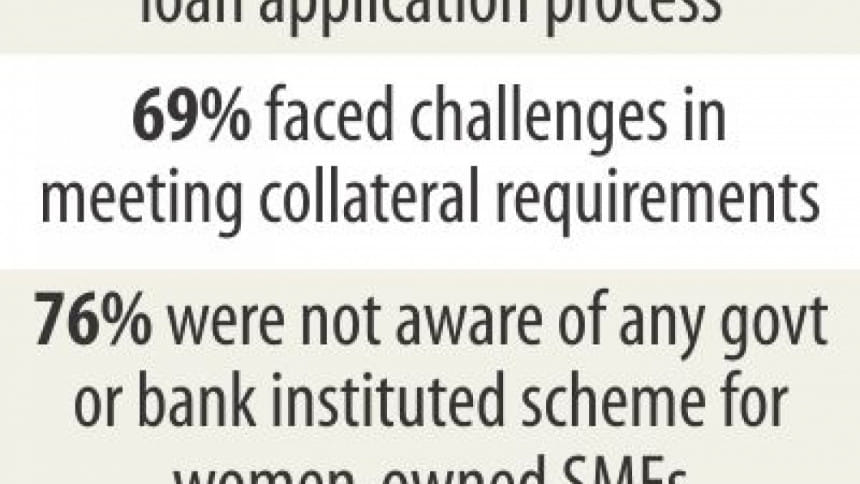

Loans of up to Tk 25 lakh ($32,000) can be sanctioned against personal guarantee to them, it said. Banks are encouraged to set up dedicated desks for women entrepreneurs, as per the BB initiative. The survey found that 76 percent of women SME entrepreneurs were not aware of any government or bank instituted scheme for women SME entrepreneurs in Bangladesh.

“However, for various reasons, these initiatives have been unable to make the intended impact on women SME entrepreneurs' access to finance,” it said.

Many women entrepreneurs want to expand their business, but banks do not lend them to support their growth, Ananya Wahid Kader, senior financial sector specialist of the World Bank Group, who led the survey, told The Daily Star.

Bankers said that they do not have information, be it turnover or nonperforming loans, on women entrepreneurs.

Nearly 70 percent of the women entrepreneurs in Bangladesh are in micro and rural enterprises, so they often tend to be small, with limited access to markets and information. The overall demand for finance among women-owned SMEs is estimated to be approximately Tk 9,975 crore ($1.29 billion), according to the findings of the survey.

Of the sum, 49 percent or Tk 4,851 crore is required to meet working capital for day-to-day operations. Nearly two-thirds of the surveyed women SME entrepreneurs were unable to finance more than 75 percent of their entire business requirements.

Lending to women-owned enterprises as a proportion of the total SME portfolio has hovered around 3 to 4 percent over the past five years (2010-14).

Around 88 percent of women SME entrepreneurs expressed dissatisfaction with the loan application process.

On average, women SME entrepreneurs made nearly 13 visits to the bank to get their loan approved.

High turnaround time for loan sanctions proved to be an expensive challenge to women, with sanctioning time averaging 137 days, according to the report.

The women business owners surveyed during the study were growth-oriented, generating an average annual turnover of Tk 16 lakh and earning marginal profits of Tk 2.7 lakh.

Further, nearly 80 percent of the women SME entrepreneurs surveyed sought formal credit for expanding their business.

The highest average profit per enterprise was noted for those enterprises engaged in agro and food services, followed by those in the healthcare and pharmaceutical industry. The IFC report has also come up with some recommendations to boost access to finance for women SME entrepreneurs.

The focus of the recommendations is on improving the capacity of banks in Bangladesh to better serve the women SME entrepreneurs by employing responsible finance practices.

The study sketches out a framework for developing specially designed products for women, outlining specific aspects that are necessary to reach women SMEs.

Educating women entrepreneurs is also vital, according to the report.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments