Govt measures will tame rising inflation

Finance Minister Abul Hassan Mahmood Ali yesterday expressed hope that the government would be able to curb high inflation on the back of budgetary measures and the central bank's steps.

"I would like to remind you that after we assumed power in 2009, inflation was at a high level, but we brought it under control. I want to assert that inflation will fall this time too.

"We have taken several steps to control inflation through the tax structure. For example, duties have been reduced for the import of daily necessities."

The minister was speaking at the post-budget media briefing at the Osmani Memorial Auditorium in Dhaka.

Bangladesh has been seeing more than 9 percent inflation for the past two years. Though many countries have successfully brought it down, Bangladesh is struggling to contain it owing to a lack of adequate measures at the right time.

Mahmood Ali tried to allay fears that higher bank borrowing, targeted for the upcoming fiscal year, will stoke inflation.

"There is nothing to worry about," he said, adding that the government did not go for a bigger budget with an aim to rein in inflation.

"Since controlling inflation is our top priority now, contractionary policy remains the focus for a while. However, we will keep an eye to ensure our growth does not suffer too much from this."

In the budget speech, the finance minister said the goal is to increase government spending gradually in the second half of 2024-25, and this will be possible if the revenue collection increases.

Md Khairuzzaman Mozumder, secretary of the finance division, said there is distortion in the supply chain of essentials and the government is trying to address it.

"The policy rate has been increased to 8.5 percent, and it will take a while to see its impact."

BLACK MONEY DOMINATES BRIEFING

According to the new provision, no authority can raise any question if taxpayers, both individuals and companies, pay tax at fixed rates for immovable properties such as flats and land and 15 percent tax on other assets, including cash and savings instruments.

Abu Hena Md Rahmatul Muneem, chairman of the National Board of Revenue (NBR), defended the amnesty, saying there has been demand from the business community and the public to allow the scope for legalising undeclared money.

He said companies are finding it difficult to come up with an explanation about the source of income or assets when it comes to compliance with the document verification system, a piece of software that aims to prevent unruly firms from submitting falsified or multiple audited financial statements to the NBR.

In reply to a query from a journalist, Abu Hena said there is no scope for Benazir Ahmed, a former inspector general of police, to whiten his alleged ill-gotten money and assets since he is facing an investigation.

Mashiur Rahman, economic affairs adviser to the prime minister, said, "The ACC (Anti-Corruption Commission) is probing the matter. Steps will be taken as per the laws."

Rahmatul Muneem said the NBR does not want to see zero duty on anything.

Responding to the capital gains tax imposed on investors, he said it can't be said the tax cuts alone can revitalise the stock market.

"Various tax cuts had been in place for the stock market for a long time, but the market has not surged proportionately. This means the market faces other challenges.

"We are trying to end tax exemptions gradually in all sectors. It has already been done in many areas."

Education Minister Mohibul Hassan Chowdhury said Bangladesh's rate of food inflation is also at the same level as in many other countries.

RESERVES, SAFETY NET AND NPLS

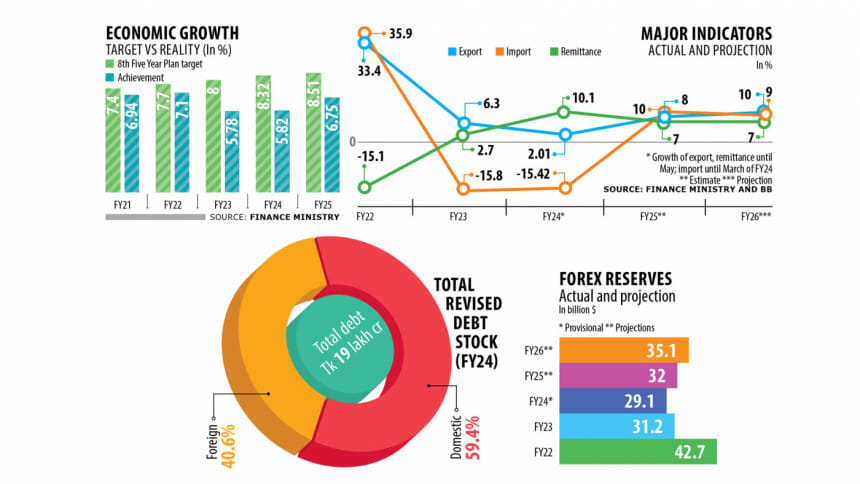

The government has projected that the foreign currency reserves would go up to $29.1 billion at the end of the current fiscal year and $32 billion at the end of FY25.

On Tuesday, it stood at $18.67 billion if calculated in line with the International Monetary Fund's manual.

When asked how the reserves would climb by $13 billion in the span of a year, Waseqa Ayesha Khan, state minister for finance, replied that the target would be attained riding on the crawling peg as well as the offshore banking operations, which will help attract foreign deposits.

Ahasanul Islam Titu, state minister for commerce, said the main challenge for the budget is to contain high inflation.

In order to support the poor and low-income groups, assistance is being given and the size of social safety net programmes will expand in the future, he said.

Mashiur said the current level of non-performing loans (NPLs) has not accumulated in a single day. Rather, they have piled up over the years.

On Thursday, Bangladesh Bank reported that the NPLs amounted to Tk 182,295 crore as of March.

"Our target is to bring down NPLs. There are provisions to set aside funds to cover NPLs. We will ensure compliance," the adviser said.

Questions were asked whether tax justice is ensured when a lawmaker is allowed to import cars by paying 25 percent tax while common people must pay up to 600 percent tax to import a car.

Mashiur said lawmakers were first allowed to import cars duty-free in 1988 during the regime of Hussain Muhammad Ershad.

"When a provision is introduced, it is difficult to change it," he said.

Md Tazul Islam, minister for local government division, and Abdur Rouf Talukder, governor of the central bank, were also present.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments