Tax burden to get heavier, life even harder

The tax measures unveiled yesterday for 2024-25 are not going to provide any relief to taxpayers.

It became apparent after the finance minister placed his proposals in parliament on income tax, value-added tax (VAT), and customs tariffs for the fiscal year beginning on July 1.

Let's consider the example of a young couple who have just started their conjugal life with a monthly income of Tk 43,800.

As the tax-free income threshold remains unchanged for FY25, the breadwinner of the two-member family will need to pay personal income tax, which will reduce their disposable income.

Now if the couple want to buy a refrigerator, they are likely to count more to get the home appliance, a necessity nowadays.

The National Board of Revenue (NBR) will also collect higher taxes from each Tk 100 recharge on mobile phones, making phone calls and data usage costlier. The ultimate result will be reduced use of phones and internet, not only for the couple but also for all in Bangladesh, regardless of their incomes.

The higher tax burden comes at a time when people are desperately looking for a cushion from persistently higher consumer prices and preventing the erosion of living standards.

In May, inflation, a measure of the increase in the prices of a basket of commodities and services, edged up to 9.89 percent from 9.74 percent a month ago, according to the Bangladesh Bureau of Statistics.

There is some good news for individuals, however.

For example, there will be no spike in the amount of minimum tax for FY25. The minimum tax applicable to individual taxpayers in Dhaka North, Dhaka South and Chittagong city corporations will be Tk 5,000. For other cities, it will be Tk 4,000.

For areas outside city corporations, a taxpayer will have to pay Tk 3,000 in tax if their total tax liability stands below the amount.

There will be some breathing space for taxpayers who earn between Tk 11 lakh and Tk 21 lakh.

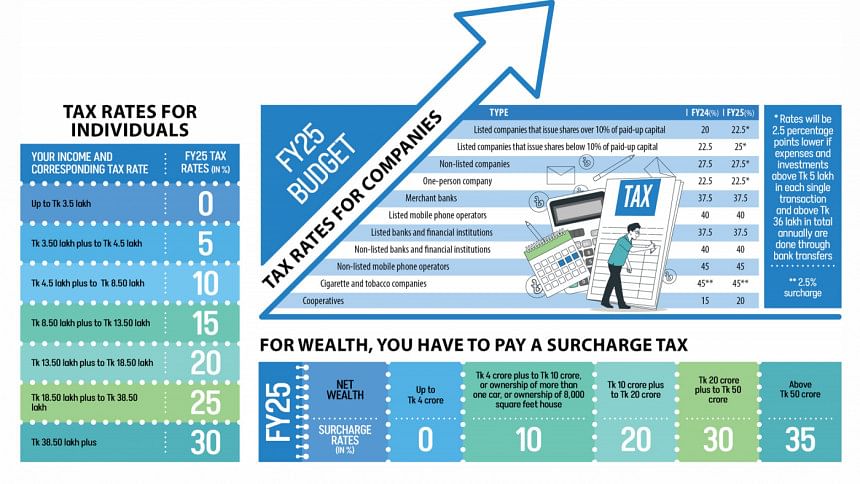

The wealthy will need to pay higher taxes on their incomes since the NBR seeks to reinstate a 30 percent tax rate on high-income earners after a gap of four years.

Those taking home more than Tk 43 lakh annually will face a 30 percent tax.

However, the rich will also receive some relief since they will not have to pay any additional surcharge on their wealth. The rate of the surcharge tax remains unchanged.

There is also good news for the holders of undeclared wealth, both individuals and corporates. They are again going to enjoy full amnesty and no government agencies will raise any questions about the sources of their wealth.

However, they will have to pay a 15 percent tax on cash, bank deposits, financial securities, or any other forms of wealth. Furthermore, they will have to count a specific tax on properties -- land, buildings, flats, or commercial spaces -- to whiten their wealth.

The amnesty will undoubtedly discourage compliant taxpayers.

Except for the firms that have already taken the initiative to carry out transactions through banks, there is no good news for listed corporate taxpayers.

A firm will qualify for a reduced tax rate if it uses the banking system while receiving funds and making expenses and investments above Tk 5 lakh in each transaction. Bank transfers are mandatory if annual transactions go past Tk 36 lakh.

The rule stays despite calls from firms to relax it. The NBR did not entertain the proposal because it wants to promote cashless transactions, formalise the economy, and collect more taxes. Roughly, half of the economy of Bangladesh is still informal.

As such, the tax authority wants to make it mandatory for hotels, restaurants, motels, hospitals, clinics, and diagnostic centres to furnish it with the proof of submission of returns, known as PSR, in order to obtain and renew licences.

They will face a penalty, which will be no less than Tk 20,000, if they fail to display the PSR in a prominent place within public view.

The good news for individual and corporate taxpayers is that the new tax rates will remain effective for two years, giving some predictability they have long demanded.

The NBR says it wants to retain the proposed tax rates for the years to facilitate the expansion of trade, improve investor confidence in the country's tax system, and encourage local and foreign investments.

The tax administration has termed it as a prospective tax system, saying it will enable taxpayers to do proper tax planning and ensure higher compliance, crucial to raising revenue collections and cutting the government's reliance on loans.

The NBR is going to bring back the 27.5 percent tax rate for the incomes generated by provident, gratuity, superannuation, and pension funds. It is 15 percent presently.

Cooperatives will bear a 20 percent tax rate on their incomes.

For FY25, the NBR has been given the task of collecting Tk 4.80 lakh crore through direct and indirect taxes. This is 11 percent higher than the original target set for FY24 and 17 percent more than the revised target for the outgoing financial year.

As usual, it will rely on indirect taxes such as VAT and supplementary duty, to reach the goal. Of course, the bid to increase SD on cigarettes and tobacco products is a laudable initiative in view of the health risks they pose.

In order to pull off the collection target, the administration has trimmed the list of exemptions.

For instance, visitors to amusement parks will face a 15 percent VAT in FY25, double the amount they are subjected to in FY24.

And if the new couple plan to buy a holiday package from a tour operator, they will have to accept higher costs because the VAT exemption for the tour operators' service is coming to an end. This means holidaymakers will have to count a 15 percent VAT.

If the couple shelve the plan of holidaymaking and choose instead to take a short ride on the metro rail, a new attraction, they will face higher ticket fares as the NBR is set to lift the VAT exemption on ticket prices, making commuting less cheerful from July 1.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments