Farmers Bank hits controversy

Rubel Brothers and Apollo Multipurpose Agro Industries are loan defaulters of state-owned BASIC and Janata banks respectively and yet had no trouble getting fresh loans from the Farmers Bank.

The bank itself managed fake credit information bureau reports for the two clients to enable them to qualify for loans, Bangladesh Bank said in a report.

This is part of a long list of irregularities that the newly-established bank indulged in. The bad lending practices have now come out in the open after a central bank study.

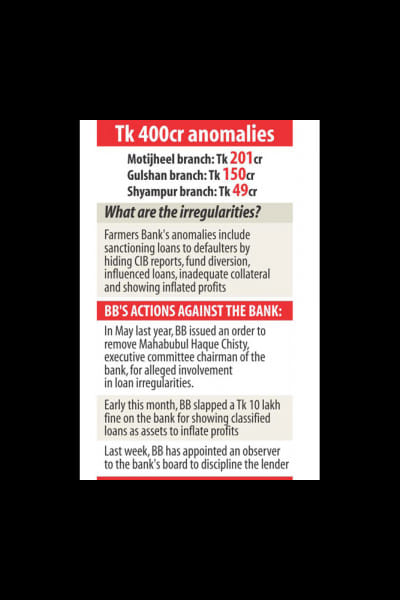

The BB carried out special inspections into the bank's Gulshan, Motijheel and Shyampur branches between September and November last year and found irregularities in sanctioning loans that amount to Tk 400 crore.

The central bank had warned the bank's directors, including Muhiuddin Khan Alamgir, chairman of the lender's board and a senior leader of the ruling Awami League, on these irregularities. The BB also asked the bank to punish the corrupt officials, but they did not pay heed to the advice.

Depositors are at risk as the bank has failed to follow the rules and regulations in sanctioning and disbursing loans, SK Sur Chowdhury, deputy governor of the BB, said yesterday.

The investigation found that the bank had concealed its classified loans to inflate profits and resorted to irregularities in recruitment.

For example, the bank disbursed loans of Tk 38.26 crore to six companies -- EBL Securities, International Securities, Prime Islami Securities, Kazi Equities, BD Securities and Union Capital -- but marked them as investment.

This is a punishable offence.

Its Motijheel branch disbursed about Tk 27 crore loans to three companies, including non-existent Anamika Enterprise, without taking proper collateral.

Rubel Brothers, which had defaulted on Tk 48 crore loans from BASIC Bank, borrowed Tk 4 crore from the Motijheel branch of Farmers Bank in May 2014 by way of fake credit reports.

In July 2014, the bank sanctioned Tk 13.5 crore for Apollo Group although its sister concern Apollo Multipurpose Agro Industries is a defaulted client of Janata Bank.

The client, after taking the loan, paid Tk 3.2 crore to Janata Bank to regularise the loan defaults of Apollo Multipurpose Agro Industries, according to the BB report.

The branch also issued loans of Tk 1.81 crore to Adurey Housing concealing the fact that the company was a loan defaulter.

The central bank also detected anomalies in Tk 143 crore loans given by the bank's Gulshan branch between 2014 and 2015.

The branch increased the cash credit limit of little-known Rom and Hus Enterprise to Tk 45 crore from Tk 10 crore between February 26 and June 6, 2015.

Influenced by Mahabubul Haque Chisty, chairman of the bank's executive committee, the lender sanctioned Tk 20 crore to MS International that had assets worth only Tk 1.15 crore and equity of Tk 69.56 lakh.

Chisty also gave Tk 17 crore to Emerald Foods against collateral of Tk 3.51 crore.

Shyampur branch of the bank disbursed Tk 30 crore to Laila Bonospoti taking Tk 8.15 crore as collateral securities and Tk 30 crore to Global Trading Corporation without adequate mortgage.

The branch disbursed Tk 17 crore to Al-Ferdous Re-Rolling Mills and Sami Enterprise violating the banking rules, the report said.

The companies repaid the non-performing loans of Tk 2.3 crore to Sonali Bank from the credit and diverted a big amount of the fund to other projects, said the report.

The branch sanctioned Tk 19 crore for Barek Ware Industries and Engineering Works, over Tk 10 crore to East Way Fashion and Tk 3 crore to Safa Community Centre without following due diligence.

On the irregularities, Muhiuddin Khan Alamgir, chairman of the Farmers Bank, said: "We are examining the BB reports. We have time until the 12th of next month to take actions against the officials responsible for the irregularities."

He said it is not just his bank that is under the BB scanner: a total of 17 banks were investigated.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments