Defaulters have the last laugh

Insanity is doing the same thing over and over again and expecting different results, the influential physicist Albert Einstein once said.

And this quote comes to mind when one glances through the Bangladesh Bank's latest policy for defaulters.

Issued on May 16, the notice is an extended version of the generosity it had handed out to large loan defaulters in 2015 -- which yielded no results.

Eleven large business groups got their loans of nearly Tk 15,000 crore restructured then at discounted interest rates (cost of fund plus one percent) and longer repayment period. For loans amounting to more than Tk 1,000 crore, the down payment was just 1 percent.

After a year's grace period the loans were due in September 2016. But most of them failed to pay even their first instalment and half of them even applied to get their loans restructured -- again.

In the absence of any repayment, the restructured loans under the policy have now ballooned to Tk 17,103 crore, according to the central bank's latest policy.

Despite this experience, the BB came up with bigger and better offers for defaulters.

Until August 16, defaulters have the opportunity to reschedule their loans by giving only 2 percent down payment of their outstanding amount -- down from 10 percent to 50 percent in the existing policy.

They will get 10 years to pay back their loans, including a year's grace period.

The interest rate would be the bank's cost of fund plus 3 percent but in no way can it exceed 9 percent.

What is more incredulous is that banks can waive the interest accrued on defaulted loans -- as if the defaulters' transgressions have no consequence.

Not only that, the defaulters can get fresh loans.

And, this set of instructions comes after the central bank bended a couple more rules in the past one month in favour of defaulters.

Earlier on April 22, the central bank relaxed the rules for loan classification.

Banks will now treat term loans as sub-standard if no instalments were made for nine straight months, up from three months at present.

The term loans will come with a six-month grace period, meaning non-payment of instalments, which tend to be monthly or quarterly, for six months would not land the accounts in the overdue category.

Previously, skipping one instalment would send the account to the overdue territory, the repercussion of which is that the borrowers would face difficulty in getting loans from another bank.

This was followed by relaxation of the loan write-off policy.

Repetitive rescheduling of loans without analysing the root causes of default would not yield any benefit, said analysts.

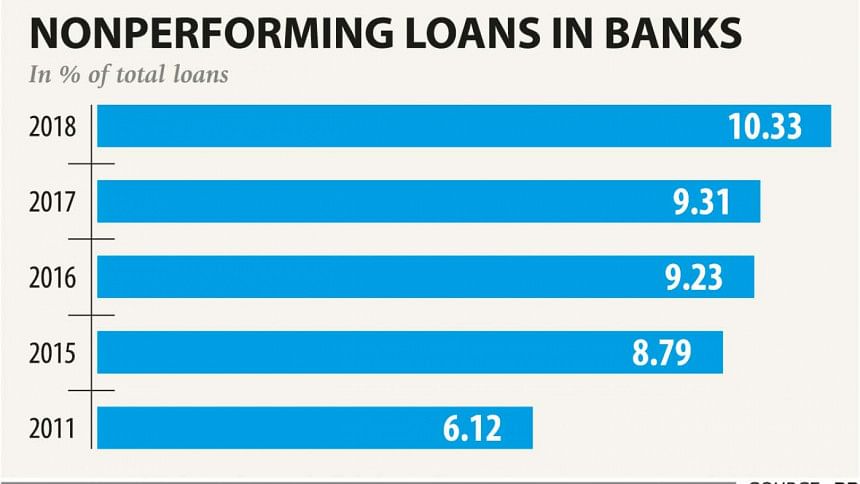

At the end of last year, default loans in the banking sector stood at 10.33 percent of all outstanding loans. And if the rescheduled and written-off loans are taken into account, the amount would be about 20 percent, according to industry insiders.

Bafflingly, the government has not come up with any measures to punish the wilful defaulters and improve the governance system in banks.

Even the men who led the looting of state banks, particularly BASIC Bank, were not brought to the book.

More strikingly, the present government that took power in January for the third consecutive term has been working to show the default loans to be lower than what they are.

"Rescheduling loans of habitual defaulters at 9 percent or less is an incentive for them. Other borrowers who pay regularly will also get encouraged not to pay back banks," said a managing director of a private bank.

However, he doubts whether the banks would be able to reschedule the loans as per the BB's latest notice given the tight liquidity situation.

Banks are now facing severe liquidity crisis and around a dozen banks have been hunting deposits at double digit interest rate.

The interest rate on lending rates hover between 12 to 16 percent depending on the types of loans and clients.

"We cannot charge a defaulter less than our cost of funds," said another bank's chief.

Plus, allowing such lengthy grace periods for term loans will lead to build-up of overdue loans and the liquidity scenario will be tightened further.

"This is a very sad move to save habitual defaulters," he added.

The malaise of default loans is not just limited to Bangladesh. Though the symptom, diagnosis and prescription may vary from country to country, the damage caused to the economy by default loans is similar.

A rise in default loans tightens banks' liquidity, eats up profitability, increases cost of funds, reduces investment capacity and disturbs the transmission mechanism of monetary policy and overall macroeconomic stability.

Different studies show default loans can also lead to banking and financial crisis.

So, how did other countries manage their default loan problem to avoid any adverse effect on the economy?

In 1998, both Indonesia and Thailand had default loan ratios of upwards of 40 percent, which came down to only 3 percent in 2016.

Vietnam is another example that brought down its default loan ratio to only 2.34 percent in 2017 from 17.2 percent five years earlier. South Korea also faced the menace, but tackled the situation deftly.

The trick most used was to form an asset management company (AMC) with government funds. The AMCs' task was to manage the distressed assets to clean up the banks.

Among others, special laws were enacted to empower AMCs such that they could acquire and dispose of default loans faster. They also restructured troubled banks and strengthened measures to protect depositors.

China though went one step further, enforcing wholesale austerity on the part of defaulters.

It barred nearly 10 million loan defaulters from travelling by plane, purchasing bullet train tickets, staying at luxury hotels, enrolling their children at expensive schools, applying for fresh loans and credit cards or even from getting promotions at work.

The Chinese government took the initiatives after its default loans hit a 10-year high of just 1.89 percent at the end of last year, after quadrupling in four years.

Analysts and bankers said forming an AMC like in the Southeast Asian nations could be the best option to deal with Bangladesh's default loan situation before it gets worse.

The writer is the Business Editor of The Daily Star.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments