Loan rescheduling hits peak

Banks have rescheduled a record amount of default loans last year, fuelling further fears of the sector's health.

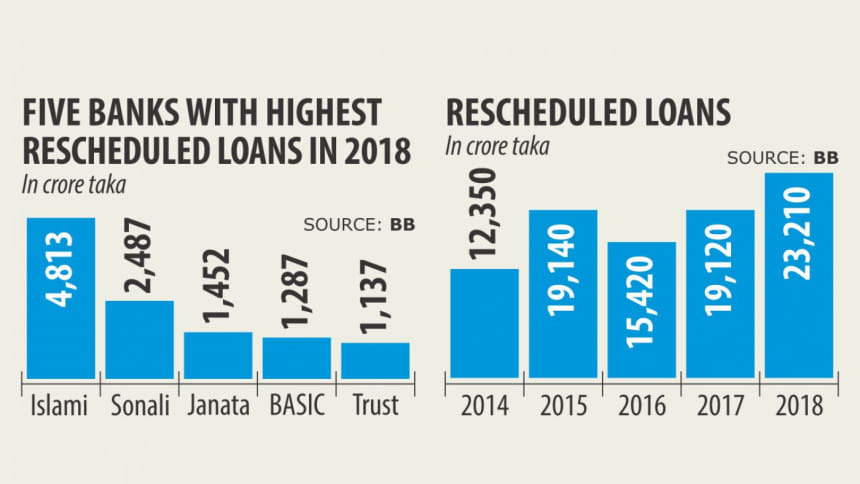

In 2018 non-performing loans amounting to Tk 23,210 crore were rescheduled, up 22 percent from a year earlier, according to data from the central bank. Curiously, last year saw both the default and rescheduled loans hit their peaks.

At the end of September 2018, banks' NPL grazed Tk 1 lakh crore -- it stood at Tk 99,370 crore -- the largest yet in Bangladesh's history. It came down to Tk 93,911 crore towards the end of the year.

"This has cast a pall of gloom over the entire financial sector," said Ahsan H Mansur, executive director of Policy Research Institute, a private think-tank.

A major portion of the loans was rescheduled by taking special approval from the central bank on a case-to-case basis, meaning the applications would not have held water were they put through the standards for the Bangladesh Bank's rescheduling policy.

Furthermore, the majority of the lenders rescheduled their default loans on a wholesale basis without verifying the cash flow of the borrowers or without securing the required down payment, analysts said.

And the motive for such wheeling and dealing was to avoid keeping provisioning against the toxic loans and show hefty net profits.

In the long run this will not bring any good as it artificially showed a lower amount of default loans, said Mansur, a former economist of International Monetary Fund.

"It is just window dressing to make the statistics look better than what they are."

The real problem is that both the central bank and the government are yet to address the problem head-on; they are showing a nonchalant attitude towards it.

The central bank should not permit defaulters to reschedule their classified loans on a discretionary basis as it creates a moral hazard, he said. "If the central bank's ongoing policy continues, the default culture will remain and prop up habitual defaulters," Mansur added.

Of the banks, Islami Bank Bangladesh rescheduled the highest amount of default loans: Tk 4,814 crore, which is 21 percent of the total rescheduled loans in 2018.

The central bank gave about 200 special approvals -- bypassing its own policy -- to Islami Bank's loan rescheduling applications, said a BB official requesting anonymity due to the confidential nature of the matter. Default loans at the bank, which is the largest in Bangladesh in terms of deposits, also increased 31 percent year-on-year to Tk 3,317 crore last year.

Banks have been extending the rescheduling facility for years and yet it could hardly bring any positive impact on the NPL amount.

In 2014 loans amounting to Tk 12,350 crore were rescheduled and over the next four years the sum ballooned 87.94 percent.

"Rescheduling is not a bad thing, but lenders will have to follow a cautious policy to regularise the loans," said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of private banks' chief executives.

The rescheduled loans will become default ones if it is done just with the intent of showing lower NPLs.

"Rescheduling should be done on the basis of the borrowers' cash flow," said Rahman, also the managing director of Dhaka Bank.

The central bank's financial stability reports for 2016 and 2017 also expressed concerns about the growing tendency of loan rescheduling.

Poor due diligence, influenced lending, and fraud and negligence in compliance with risk management practices could be the reasons for the rise in rescheduled loans, the reports said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments