Bike sales punctured by duty hike, high registration fees

High registration fees and the government's duty hike have dampened the demand for motorcycles, with marketers posting a 31 percent slump in sales in the first four months of the fiscal year.

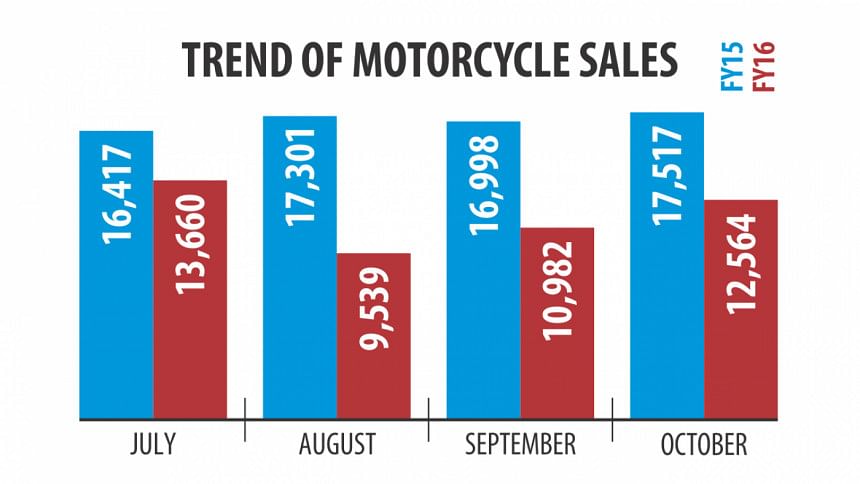

Between July and October, 46,745 units of motorcycles were sold, in contrast to 68,233 units a year earlier, according to data compiled by Bangladesh Honda Private Ltd.

The government this fiscal year raised the supplementary duty on motorcycle components to 45 percent from 30 percent, mainly to encourage local manufacturing.

The hike was not welcomed by Bangladesh Motorcycle Assemblers and Manufacturers Association, which predicted that the move would push up prices and subsequently eat into sales.

“Before July, we requested the government not to raise the supplementary duty, but nobody listened to our pleas,” said Yoichi Mizutani, managing director of Bangladesh Honda, a joint venture between Japan's Honda Motor Company and state-run Bangladesh Steel and Engineering Corporation.

He said the higher supplementary duty will shrink sales to 148,000 units this fiscal year -- the lowest since fiscal 2008-09. Some 1.75 lakh units of motorcycles were sold in fiscal 2014-15, according to data from the association. Apart from the increased duty, the high registration fees along with strict enforcement of registration by authorities have also put a damper on the demand for bikes, according to Mizutani.

The registration fee for a motorcycle with 125 cubic centimetre engine is $273, which is much higher than in India, Pakistan and Sri Lanka, where $53, $27 and $52 is charged respectively, he added.

“The market has been damaged seriously for these two reasons. The customers are not happy. The industry is also not happy.”

To offset the falling sales, the motorcycle assemblers are now reducing the prices, Mizutani said.

Shahdat Hossain, a national sales manager of Uttara Motors that markets Bajaj bikes, echoed the same.

Almost all have cut their prices to see a turnaround in demand, which is not picking up, he said.

Mizutani said the price cuts will not only exhaust the player, it will ultimately destroy the market.

His views come at a time when more brands, such as Bajaj and Hero, are setting up assembling plants in Bangladesh following the lead of Bangladesh Honda, which has been assembling motorcycles in the country since October 2013.

Although the country has a population of about 16 crore and a rising per capita income, the high prices are suppressing Bangladesh's bike market, Mizutani said.

The market in Bangladesh is small compared to neighbouring countries such as India, Pakistan, Vietnam and Cambodia.

He said these factors hold back popular brands from setting up manufacturing plants in Bangladesh, as huge investment is required.

To attract investment, an annual demand for minimum 10 lakh bikes is required, according to Mizutani.

“That's why I request the NBR (the National Board of Revenue) again and again to reduce the taxes and try to expand the market. This is the first step,” he said, adding that the move will also help increase the government's revenues.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments