Credit growth beats expectations

Private sector credit growth continues to beat expectations in 2016, suggesting borrowers are eager to take advantage of the low interest rates.

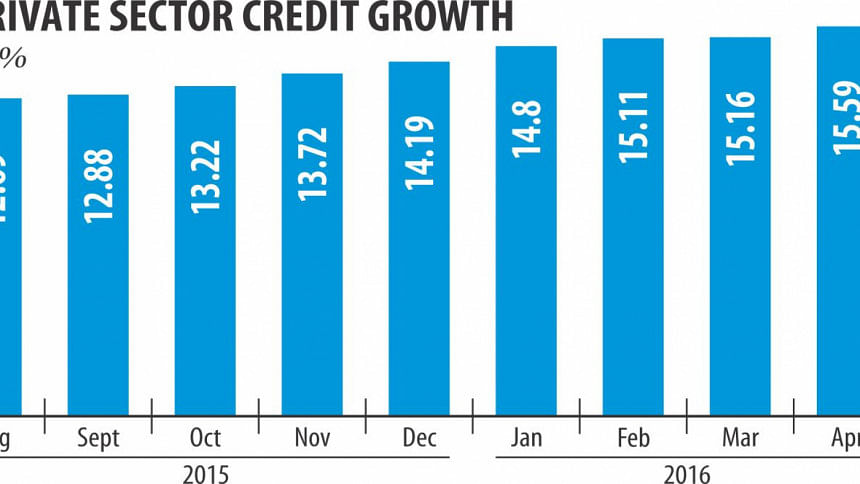

In April, private sector lending, which includes home, personal and business loans, rose 15.59 percent year-on-year, according to Bangladesh Bank data. It stood at 15.16 percent in March and 15.11 percent in February.

However, credit growth in the first ten months of the fiscal year stood at 12.21 percent, much lower than the target of 14.8 percent.

Lenders attributed the recent spike in private credit growth to the turnaround in economic activities after a gap of three years.

Mega projects floated by the government and declining cost of funds are also pushing the credit growth up, they said. A rise in import ahead of Ramadan also helped.

“We are seeing higher demand for loans from some sectors, such as transport, steel, garments and textiles and so on in recent months,” said Ahmed Kamal Khan Chowdhury, managing director of Prime Bank.

A decline in foreign currency loan, for which the cost has started to creep up, is also creating a demand for local loans, he said.

Private sector credit growth was subdued for three years since January 2013, when it stood at 14.4 percent.

Volatile political situation and violent activities had forced the private sector to shelve their investment plans, which brought down the credit growth to as low as 8-9 percent.

High interest rates in the local market also compelled many entrepreneurs to take low-cost foreign currency loans, which brought down loan disbursement by local lenders, according to bankers.

This pushed the lending rate down to 10.91 percent in February compared to 12.23 percent a year earlier. Deposit rate also saw a sharp fall as banks are still awash with excess liquidity. The interest rate on deposit came down to 6.1 percent in February from 7.19 percent a year earlier.

“We see more demand for loans for import of capital machinery, which is an encouraging factor for the economy,” said Anis A Khan, managing director of Mutual Trust Bank.

Khan, also the chairman of Association of Bankers Bangladesh, a forum of banks' managing directors, found that entrepreneurs are also taking loans for expanding their garment factories.

“Import of essential commodities ahead of Ramadan also created fresh demand for loans,” he added.

Abdul Halim Chowdhury, managing director of Pubali Bank, the largest private bank in terms of branch network, said his bank is feeling the rising demand for loans in recent months.

Pubali's loan-deposit ratio reached 78 this month from 74 percent the previous month, meaning that the bank can lend Tk 78 percent now out of every Tk 100 of deposit.

Chowdhury too said the imports of essential items ahead of Ramadan and new and costly machinery by the garment sector have boosted Pubali's credit growth. “Rising economic activities in the northern part of the country is also creating new avenues for fresh loans,” he said.

Bankers hope that this positive trend will continue in the days to come. “We expect the business environment will remain buoyant and consequently, the private credit growth,” Khan said. Yet, he sees rising traffic congestion posing a threat to the growth in economic activities.

Chowdhury detected classified loan as a major risk for steady economic growth.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments