DSE back in top form

The Dhaka bourse is showing good signs of vibrancy, with the turnover crossing the Tk 1,600 crore-mark for the first time in more than five years.

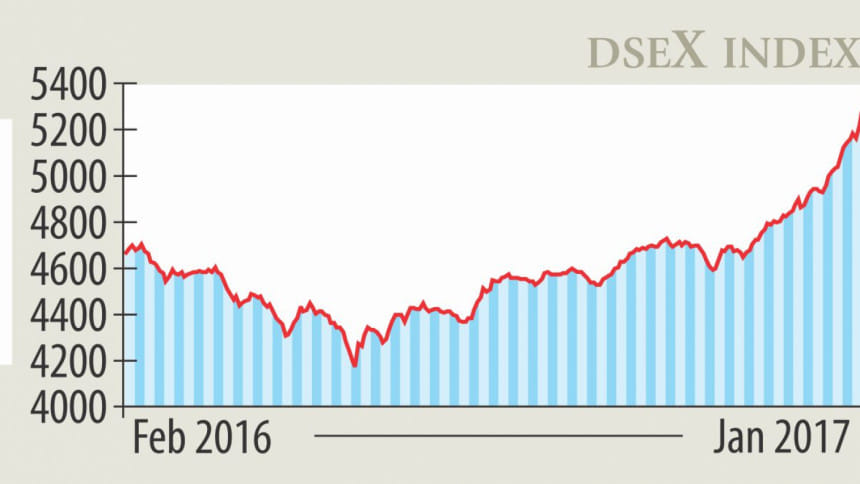

Turnover stood at Tk 1,696.94 crore yesterday, up 36 percent from the previous day. DSEX, the benchmark index of Dhaka Stock Exchange, jumped up 62.78 points, or 1.2 percent, to finish the day at 5,277.39 points.

The rising trend in both the turnover and index, the two most important indicators of the market, suggests a vibrant capital market, which has been sluggish since the market crash of 2011.

It is now being forecasted by many that the market, which passed a decent year in 2016, will go from strength to strength this year, given the promising market fundamentals and increasing investor participation.

The increasing participation of investors is leading the way, as they are quickly shifting from one stock to another to book early profits.

“As an upward trend was continuing in the market for the last few weeks, investors were switching from one stock to another, generating the record high turnover,” said Rakibur Rahman, managing director of Midway Securities, a stockbroker.

But the overall securities prices did not jump up in line with the turnover. “It showed that the market is not performing abnormally or heading toward any volatility.”

He also said the stockmarket is a risky investment place by nature, and the market is not for anyone and everyone to park their funds. “Only those who have excess funds can invest a portion of it in the market,” he suggested.

Investment in the stockmarket by mortgaging properties or taking loans would never be a wise decision, said Rahman, also a former president of the premier bourse.

“We are expecting that the optimistic mood will continue in 2017,” said LankaBangla Securities, a leading stockbroker, in its yearly market review.

Low interest and deposit rates as well as excess liquidity in the banking system will be conducive for stockmarket investment.

“We are expecting increased money flow into the stockmarket in 2017, which will help to keep the market vibrant.”

Moreover, the Bangladesh stockmarket has been getting more and more attention from international investors, who are looking for lucrative investment opportunities in the frontier markets, LankaBangla added.

Net foreign investment in the capital market soared more than seven times year-on-year to Tk 1,340.7 crore in 2016.

The resilient economic growth, stable currency and comparatively higher returns will attract increased foreign investment in the coming years, the stockbroker said.

“The next major resistance level lies at 5,400 points,” it added.

Of the traded issues on the premier bourse yesterday, 218 advanced, 75 declined and 33 remained unchanged.

Beximco dominated the turnover chart with its transactions of 1.94 crore shares worth Tk 64.56 crore, followed by Bangladesh Building Systems, Appollo Ispat Complex, IFAD Autos and LankaBangla Finance.

Among the major sectors, general insurance increased the most -- by 3.96 percent -- in market capitalisation, followed by non-banking financial institutions at 3.32 percent, textiles 2.46 percent, fuel and power 1.66 percent, pharmaceuticals 1.45 percent and banks 0.75 percent.

Conversely, telecommunication declined 0.51 percent.

Paramount Textile was the day's best performer, posting a 9.7 percent gain. Imam Button Industries was the worst loser, plunging 8.94 percent.

Chittagong stocks rose with the bourse's benchmark index, CSCX, increasing 133.39 points, or 1.37 percent, to close at 9,833.88.

Gainers beat losers as 192 advanced and 60 declined, while 17 finished unchanged on the Chittagong Stock Exchange. The port city bourse traded 3.58 crore shares and mutual fund units, generating a turnover of Tk 108.93 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments