BB asks 5 Shariah banks to resolve liquidity crisis

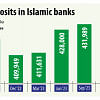

Bangladesh Bank has directed five Shariah-based banks to resolve their current liquidity crisis while three of them were asked to bring down their advance-deposit ratio (ADR) within the regulatory limit as soon as possible.

The five are Islami Bank Bangladesh, First Security Islami Bank, Social Islami Bank, Union Bank and Global Islami Bank.

The ADR measures loans (advances) as a percentage of deposits. A ratio of 100 percent or less shows that the bank is funding all its loans from deposits rather than relying on wholesale funding (from capital markets or other banks).

When a bank crosses the ADR limit, it is in a risky zone, as per industry insiders.

The BB's directive came in a meeting with the managing directors of the five at the central bank headquarters on Wednesday.

BB Deputy Governor AKM Sajedur Rahman Khan presided over the meeting while other high officials of the central bank's off-site supervision department were present.

Bangladesh Bank Executive Director and Spokesperson Md Mezbaul Haque declined to comment on the matter.

However, a senior official of the central bank, seeking anonymity, said three of the banks had crossed their ADR limit which was why the BB had passed the directives.

He also said the banks faced a shortfall in their cash reserve ratio (CRR) and statutory liquidity ratio (SLR) for undergoing liquidity crisis over the last couple of months and the BB had directed them to improve their financial health.

The CRR determines the portion of customer deposits that banks must keep as a reserve with the central bank. The SLR is a minimum percentage of deposits that banks have to maintain in the form of cash, gold or other securities. Both ratios have to be maintained on each working day.

Both traditional and Islamic banks have to maintain a CRR of 4 percent, as per the central bank rules. However, traditional banks have to maintain an SLR of 13 percent while Islamic banks only 5.5 per cent.

Contacted, Social Islami Bank Managing Director and CEO Zafar Alam said the BB met with them to know about their current financial status.

"We also informed the regulator of our present developments as we continue to make progress from the previous situation," he said.

The three that crossed their ADR limit are Global Islami Bank, First Security Islami Bank and Union Bank.

The ADR is 87 percent for conventional banks and 92 percent for Islamic banks, as per the central bank regulations.

This means conventional banks will be able to disburse Tk 87 as loans against every Tk 100 deposit while Shariah-based banks Tk 92.

As of June 30, Global Islami Bank's deposits stood at Tk 11,774 crore while advances or investments Tk 12,084 crore. As a result, the lender's ADR stood at 99.53 percent, according to the BB data.

First Security Islami Bank's deposits stood at Tk 45,091 crore while advances or investments Tk 53,634 crore, meaning its ADR stood at 108.53 percent.

Union Bank's deposits stood at Tk 18,616 crore while advances Tk 23,400 crore. The bank's ADR stood at 101.87 percent.

Global Islami Bank's Managing Director Syed Habib Hasnat said the BB had asked them to bring down the ADR within the regulatory limit.

"We discussed how we can improve our financial health. However, we have already met the CRR and SLR shortfall," he said.

Islami Bank Bangladesh, First Security Islami Bank and Union Bank were yet to respond to phone calls and SMS sent from The Daily Star as of 9:00pm yesterday.

The five banks faced cash withdrawal pressure when loan irregularities of Islami Bank came to light after media reports last year.

The bank had approved Tk 7,246 crore in loans to nine companies that exist only on paper, as per the reports.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments