First Security Islami Bank: Almost 90pc of Tk 2,254cr loan to Sikder Group sours

As much as 89.3 percent of the credit extended by First Security Islami Bank, when controlled by the major Awami League beneficiary S Alam Group, to AL-affiliated Sikder Group by violating banking rules and regulations has become defaulted.

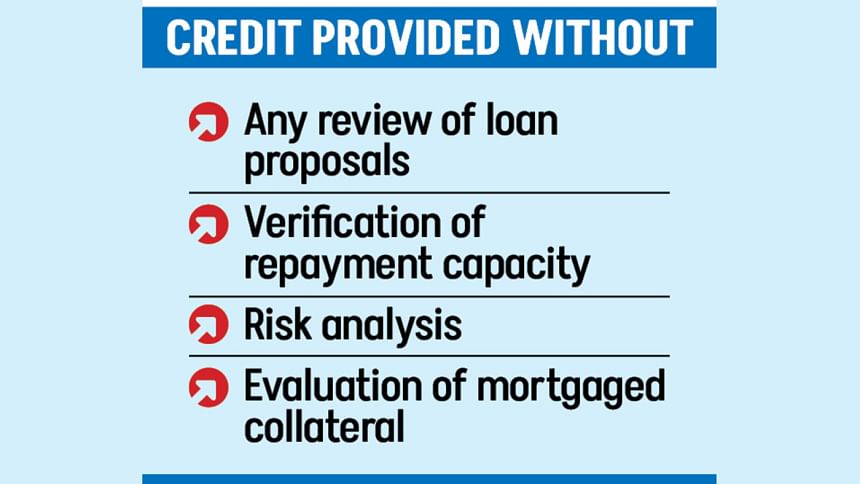

The bank provided the loan facility to the business group without any review of the loan proposals, verification of the client's repayment capacity, risk analysis and evaluation of the client's mortgaged properties or collateral -- all major violations of banking rules and regulation, documents show.

The loans were disbursed by the Senanibash, Dilkusha, Banani, Dhanmondi and Kawran Bazar branches of the Shariah-based lender between 2009 and January this year.

The bank disbursed Tk 1,025.47 crore as funded loans and Tk 167.47 crore as non-funded loans (bank guarantee) against collateral valued at Tk 149.15 crore collateral and Tk 8.69 crore cash.

In the 15 years, FSIB recovered Tk 573.86 crore from the borrower during the 15 years, leaving the total liabilities of the business group at Tk 2,254 crore including interest or profit, documents showed. Of the sum, Tk 2,013 crore has defaulted.

The loan irregularities came out in a recent inspection by the internal control and compliance division of the bank based on the financial statement of October.

The Senanibash branch disbursed Tk 337.24 crore to six companies of the Sikder Group against Tk 83.19 crore collateral. The outstanding amount is Tk 1,099.63 crore.

Besides, the branch issued five bank guarantees worth Tk 13.67 crore to two companies of Sikder Group against only Tk 1 crore as margin. No other collateral was taken against the non-funded loan facility.

The Kawran Bazar branch disbursed Tk 260.27 crore to two companies of the business group without any collateral, with Tk 438.46 crore now outstanding.

The Dhanmondi branch disbursed Tk 174.92 crore without collateral; its outstanding amount is Tk 238.56 crore.

The Dilkusha branch disbursed Tk 103.04 crore against Tk 54.85 crore collateral value; its dues now stand at Tk 228.70 crore, the inspection report showed.

The Banani branch disbursed Tk 150 crore to Sikder Group against Tk 11.11 crore as collateral value; the outstanding amount is Tk 248.73 crore. It issued nine bank guarantees worth Tk 153.80 crore to the group against only Tk 8.69 crore as margin.

As per Credit Risk Management guidelines for banks introduced by the Bangladesh Bank, the bank was supposed to obtain invoices related to the purpose of the loans or investment before disbursing the amount. Besides, the lender must ensure that the loans are being used for the approved purposes.

However, FSIB -- whose board consisted of five members of the S Alam family until September -- did not follow this, as per the report.

A bank can take legal action against borrowers to recover the money as per the central bank circular. In practice, FSIB waived the interest of Sikder Group.

This activity went against depositor interest, the inspection report said.

The inspection found that the loans or investment accounts of the borrower were not properly classified and the lender did not report to the credit information bureau in line with the guidelines of the central bank.

It also found that the loans or investments were disbursed without adequate collateral and in some cases, scheduled properties were not mortgaged against the sanction letter and in some cases, the mortgaged properties accepted by the bank as collateral were overvalued.

The bank issued pay orders in favour of companies of the group for the purchase of Murabaha investment without confirming the actual purchase and sale, which is a violation of Shariah compliance.

It repeatedly extended the tenure of the loans and repayment period and grace period for the client --without following any rules and regulations.

The illegal loan facility to Sikder Group, whose director Parveen Haque Sikder was an AL MP, was provided in exchange for an interest waiver facility to S Alam Group from the National Bank, The Daily Star has learnt from FSIB officials who spoke on the condition of anonymity to speak candidly on the issue.

As many as 169 current and former officials of FSIB were directly involved in the loan's irregularities related to the Sikder Group, according to the inspection report.

In 2021, the ailing National Bank, then controlled by the Sikder family, waived Tk 2,283 crore as interest on the loans of eight companies of the S Alam Group.

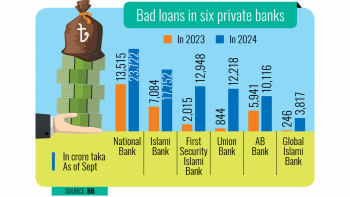

As of September, the total outstanding loans of FSIB stood at Tk 60,272.17 crore. Of the sum, Tk 12,948.13 crore has become defaulted, which is 21.48 percent of its disbursed loans, according to data from the Bangladesh Bank.

The majority loans of were taken out by S Alam Group, whose chairman Mohammad Saiful Alam was also the chairman of FSIB until September.

Mohammad Abdul Mannan, who succeeded Alam as FSIB's chairman in September, declined to comment on the issue.

FSIB Managing Director Syed Waseque Md Ali and Sikder Group directors Parveen Haque Sikder and Rick Haque Sikder could not be reached for comment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments