ICB Islamic Bank struggling to pay back depositors

ICB Islamic Bank, which took shape from the ruins of Oriental Bank in 2008, is now failing to repay the depositors' money due to severe liquidity crisis, indicating a vulnerable situation of the lender.

Abdul Hamid Mahbub, who has a deposit of Tk 1,00,000 at the bank's Moulvibazar branch, was sent back without any money when he visited the bank last week.

"On Tuesday, I went to the bank with a cheque of Tk 55,000, but the branch manager said they had no money at the time," Mahbub told The Daily Star on Friday.

About 15 other depositors at the same Moulvibazar branch had the same experience, he said.

"Two days later, I was able to withdraw only Tk 20,000 from the branch with the help of local journalists."

Depositors are also flocking to Dhaka's Paltan and Karwan Bazar branches to withdraw money, only to be sent back empty-handed.

Zakir Hossain has a Tk 2,00,000 deposit with the bank's Naya Paltan branch. On Thursday, he failed to encash a cheque due to liquidity crisis.

"The branch manager assured me that I would be able to withdraw the money…. But I think the bank's vault is empty," he said.

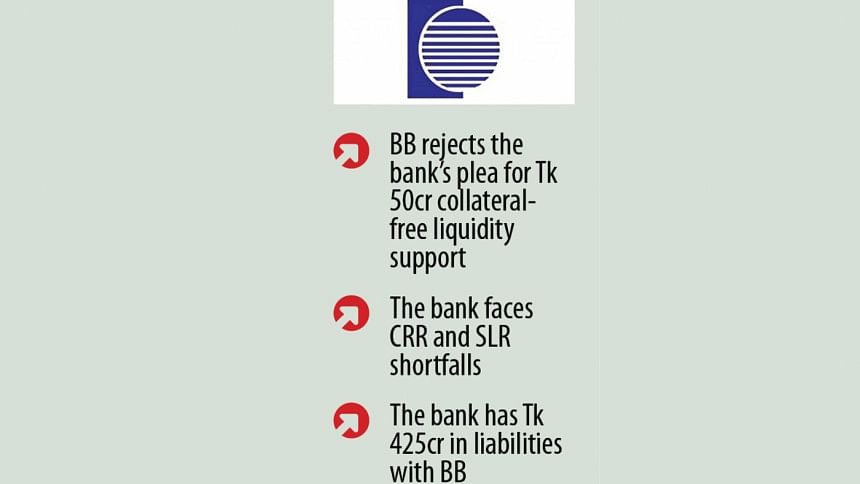

After facing a severe liquidity crisis, the lender on January 31 requested Bangladesh Bank to provide it with Tk 50 crore in collateral-free liquidity support.

The plea was turned down two weeks later as the bank already has Tk 425 crore in liabilities with the central bank.

The Off-site Supervision Department of the BB requested the Banking Regulation and Policy Department to take corrective measures against the bank as it is practically out of operation due to the liquidity crunch.

"The bank is now in a systemic risk due to its frozen deposits, capital shortfall, high defaulted loans and liquidity crisis," said a BB official.

The situation is so dire that the bank has no securities against which it could borrow money from other Islamic banks and the central bank, and is paying its employees in phases, The Daily Star has learnt from BB officials familiar with the developments.

"We are aware of the current situation of the bank," Md Mezbaul Haque, executive director and spokesperson of Bangladesh Bank, told this newspaper on Friday.

He said a large portion of the bank's fund is stuck with some leasing companies, which caused the liquidity crisis.

"We asked the Malaysian shareholder of the bank to inject fresh funds," he added.

Some legal complexities related to its previous owning company (Orion Group) also mean that there are some ambiguities over the current ownership of the bank, the BB spokesperson said.

Currently, a case related to its ownership is pending before a court.

"We will ensure that the depositors get their money back, but currently the bank is facing a sudden crisis," Mezbaul said.

About rejecting ICB's plea for liquidity support, he said the bank has no quality securities, which is why the BB did not entertain the request.

At the end of 2023, the bank faced a capital shortfall of Tk 1,823 crore and 87 percent of its total loans of Tk 790.4 crore turned bad, according to BB data.

Presently, the bank has 350 employees in 33 branches, ICB officials say.

According to a number of ICB officials, the bank is struggling to even pay its employees in full for quite some time.

Muhammad Shafiq Bin Abdullah, managing director of the bank, said they did not face such a crisis before.

"All the depositors are arriving at the same time, which is why we are struggling to pay them. This year, we repaid our depositors Tk 50 crore," added Shafiq, a Malaysian national.

"We had sought liquidity support from the central bank, but are yet to get the support as we have no liquid assets as collateral …. I hope the crisis will be over this month," he added.

At the end of 2022, the bank had Tk 1,212 crore in deposits. Of the sum, Tk 444 crore was frozen deposit, meaning the deposit from the erstwhile Oriental Bank that were blocked by the central bank.

The bank's origin can be traced back to 1987 when it was operating under the moniker Al-Baraka Bank.

In 1994, it became a "problematic bank" and the central bank introduced the practice of appointing observers to errant banks to bring in discipline.

In 2004, it started operating as a scheduled commercial bank under a new name, Oriental Bank.

In June 2006, the central bank dissolved the board of directors of Oriental Bank after detecting massive irregularities.

In 2008, the bank was renamed as ICB Islamic Bank, with the majority share of the bank held by Swiss ICB Group, whose majority shares are owned by Malaysian investors.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments