Six private banks’ bad loans soar 55pc in nine months

Bad loans in six private banks increased by about 55 percent in the first nine months of the year, raising further alarms about the health of the banking sector.

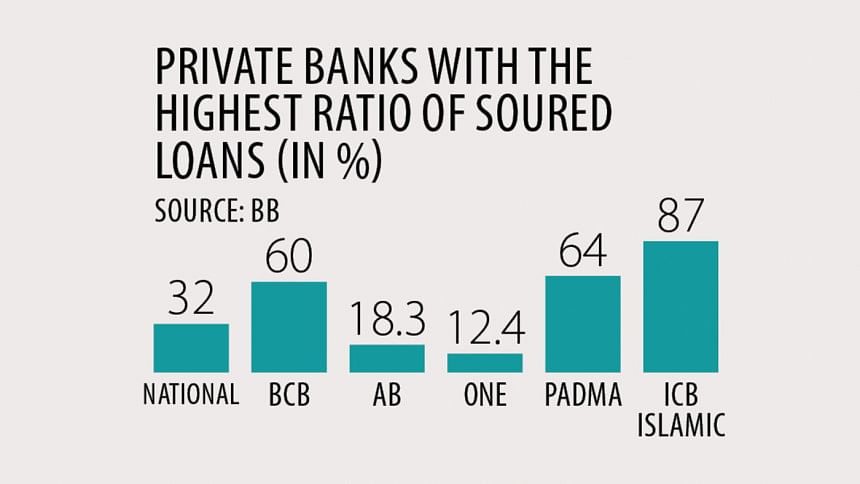

At the end of September, the soured loans of National Bank, One Bank, AB Bank, Bangladesh Commerce Bank (BCB), Padma Bank and ICB Islamic Bank together stood at Tk 27,931 crore, according to data from the Bangladesh Bank.

The six lenders together accounted for 34.25 percent of the total defaulted loans of the 43 private banks at the end of the third quarter of 2023.

Of the six banks, cash-strapped National Bank's defaulted loans rose the most between January and September of this year: it stood at Tk 13,514.6 crore, up from Tk 6,658.5 crore.

Md Mehmood Husain, the managing director of National Bank, pinned the blame for the doubling of the defaulted loans in just nine months to a move away from the manual system for loan classification to an automated one.

"In recent months, we have recovered a good portion of the defaulted loans, so our bad loan figure will be less in the last quarter of the year."

Thanks to the high volume of defaulted loans, which accounts for 32 percent of its total outstanding credit, the 40-year-old bank continues to face a staggering provisioning shortfall of Tk 1,3797.5 crore as well as liquidity shortage.

Husain blamed the drying up of government deposits for the liquidity shortage.

"We need more time to fix our problems," he added.

AB Bank, another first-generation private bank, saw the next big jump in defaulted loans in the first nine months of the year: by 48.6 percent to Tk 5,941 crore.

Tarique Afzal, the MD of AB Bank, could not be reached for comment.

The defaulted loans of BCB, where Chattogram-based conglomerate S Alam Group has a stake, increased 38.8 percent during the period to Tk 1,374 crore.

The increase in BCB's defaulted loans, which accounts for 60 percent of its total outstanding credit, was due to vacating the writs that were filed by the errant borrowers, said Md Tajul Islam, its MD and chief executive officer.

"On paper, our bad loans increased much. But in reality, it is not so high," he said, while citing BCB's spirited loan recovery in recent times.

Thanks to the high bad loans, the bank logged in provisioning shortfall of Tk 542 crore.

The bad loans of One Bank, which last year saw the appointment of a coordinator by the central bank to improve its financial health, increased 21.8 percent to Tk 2,741 crore at the end of September.

One Bank is now focusing on loan recovery rather than disbursing new loans, said its MD Md Monzur Mofiz.

"Now, we are not issuing new loans because the liquidity situation in the market is not good," he added.

While Padma Bank's defaulted loans increased 7.3 percent in the first nine months of the year to Tk 3,672.74 crore, it now accounts for 63.7 percent of its total outstanding credit as of September.

Tarek Reaz Khan, the MD and CEO of Padma Bank, acknowledged that the lender had suppressed the actual amount of soured loans in the closing quarter of 2022 in its books.

The defaulted loans shot up after the central bank audit, he said.

"It would not be possible to shrink bad loans overnight but we are taking various legal steps to bring down the volume."

Padma Bank has signed a performance agreement with the central bank which stipulates a 20 percent cut in bad loans by 2025, Khan added.

The defaulted loans of ICB Islamic Bank, which was born out of the scam-riddled defunct Oriental Bank, stood at Tk 687.95 crore at the end of September, up from Tk 686.1 crore at the end of the last year.

"Those loans were disbursed by Oriental Bank -- and not us," said its MD Muhammad Shafiq Bin Abdullah, adding that the bank is trying to recover the defaulted loans.

The above-average increase in the six banks' defaulted loan amount is nothing unusual, said Ahsan H Mansur, a former chairman of Brac Bank.

"Bad loans are increasing in all kinds of banks -- the overall situation in the banking sector is not good at all."

In the first nine months of the year, the total defaulted loans of private banks increased 44.5 percent to Tk 81,538 crore.

The health of the banking sector would not improve with the existing governance structure, said Mansur, also the executive director of the Policy Research Institute.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments