Withdrawals put BASIC Bank in liquidity crisis

BASIC Bank is experiencing a deep liquidity crunch as depositors have been withdrawing money for weeks following news that the state-run lender is going to be acquired by a private commercial bank.

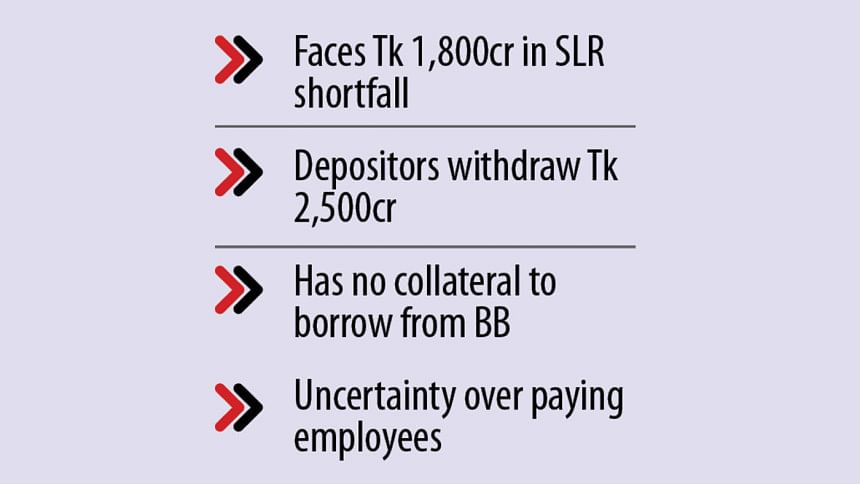

A commercial bank has to maintain 13 percent of its deposits as the Statutory Liquidity Ratio, which is the reserve requirement that banks are expected to keep to be able to offer loans. BASIC currently falls short of meeting the requirement by Tk 1,800 crore.

Amid the crisis, BASIC's management wrote to the Financial Institutions Division of the finance ministry on May 7, requesting that government agencies be ordered to deposit money with the bank at low interest rates.

In a letter, the management also requested that the government clarify its position on the decision to merge BASIC with City Bank.

BASIC had previously incurred losses due to high levels of bad loans and high interest-bearing deposits, but it had never faced an SLR shortfall, said the letter.

Since the decision to merge the two banks was made in early April, BASIC has been facing an unusually high withdrawal of deposits, six officials of the bank told The Daily Star.

As of Thursday, depositors had withdrawn around Tk 2,500 crore, according to data from the bank.

Government institutions like Bangladesh Power Development Board, different agencies under the power ministry, Bangladesh Chemical Industries Corporation, Shahjalal Fertilizer Company Limited, Jamuna Fertilizer Company Limited, and Titas Gas Transmission and Distribution Company deposit money with the bank, officials say.

The bank can no longer borrow from the central bank as it lacks the required securities, reads the letter.

If the situation persists, there is a risk that the bank will fail to give money to the depositors, in which case, the clients will lose confidence in the bank.

BASIC's employees even fear that they may not get paid because of the crisis, adds the letter signed by Anisur Rahman, the managing director.

Anisur neither responded to text messages nor answered his phone as this correspondent tried to reach him.

Abul Hashem, the chairman, refused to make comments on the matter.

After the merger decision was made public, Abu Md Mofazzal, the deputy managing director, said several government institutions and other entities were withdrawing their funds.

The bank on April 17 wrote to the finance ministry seeking advice on how to cope with the situation.

The merger was decided at a meeting between the central bank governor and the managing directors and the chairman of City Bank.

The central bank claimed the merger was voluntary, but BASIC Bank managers said the decision was forced.

BASIC was once a reputed state-run bank. In 2014, an investigation found the involvement of its chairman Sheikh Abdul Hye Bacchu in the embezzlement of Tk 4,500 crore. The bank's condition has been going downhill since.

As of December 2023, the bank's bad loans stood at Tk 8,204 crore, accounting for 64 percent of its total loans disbursed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments