Pandemic proves a boon for IT freelancers

Like a million others, Ridoy Saha was rendered unemployed within weeks after Bangladesh introduced a nationwide lockdown in March last year to limit the spread of coronavirus.

He returned to his village home as his employer, an ad agency, was closed. But unlike many others, he soon got back to work to make a living as the tasks he specialises in have not lost their demand globally.

He started working at Upwork, an American freelancing platform. What is more, his monthly income surged more than four times compared to the Tk 30,000 he used to take home while working for the ad agency.

"I am doing the same thing that I used to do for the agency -- graphics and animation. The first few weeks of the freelance work were challenging. Then I got some clients who liked my work and started giving me work regularly," Saha said.

Saha is not the lone freelancer who has been able to keep working during the pandemic. Globally, Covid-19 has brought cheers for the freelancers as the crisis has highlighted the comfort of remote work. More companies across the globe are hiring them to cut payroll expenses.

This outsourcing trend has created a gold rush for many, especially youth and the people who lost their jobs due to the pandemic-induced economic slump.

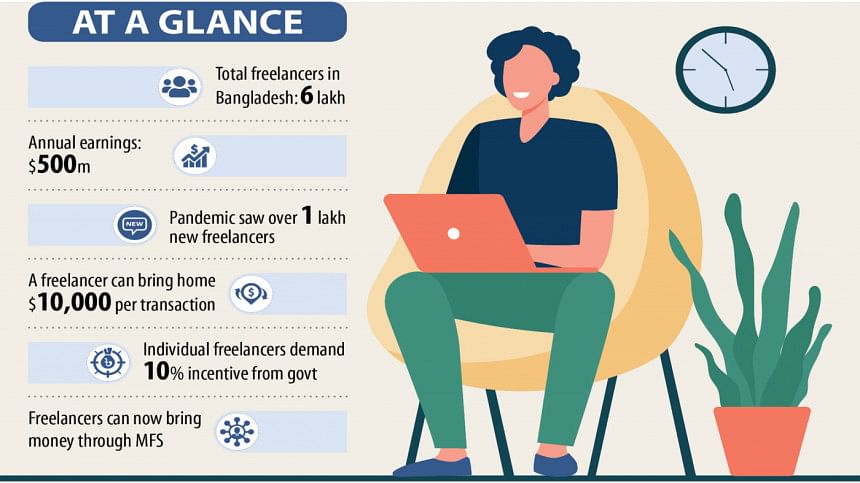

Bangladesh has six lakh IT service exporters or freelancers, and the number of team-based freelancing companies hovers around 1,600. Together they fetch roughly $500 million annually, according to industry people.

Nahid Hasan, a freelancer, said the boom in e-commerce and the demand for online tools had created more business opportunities for freelancers. Besides, global businesses were trying to minimise costs.

He started his journey as a freelancer in 2010. Within a week, he hired one and established Bizcope.

In 2012, Hasan set up his first physical office and moved to a bigger one four years later. His team now consists of a workforce of 27 people.

Bizcope provides services such as search engine optimisation, digital marketing, web design and development, content writing, and digital content production.

"We serve both global and local markets," he said.

Suman Saha, who lives in Dhaka, began freelancing with Upwork while working at a private company in 2012.

At that time, he used to do website development and design and earned $5 per hour. Soon, he moved to projects that develop mobile and software quality assurance.

Now, his hourly income has shot to $25. His income went up by 25 to 30 per cent during the pandemic.

"If I am flooded with extra work, I transfer some of them to juniors working with me in a virtual team."

Freelancers who have not redesigned their services in line with the demand have suffered during the pandemic. For example, the travel and tourism-related IT service providers were hit significantly because of the slump in the sector, according to industry people.

Individual freelancers, however, continue to face difficulties in bringing home payments made by their international employers.

Before 2012, outsourcing income was transferred primarily through illegal channels. Although some of the money came through bank-to-bank wire transfer, it was costly.

That year, the Bangladesh Bank issued a notice, enabling freelancers to receive payments to their bank accounts via online payment gateway service providers (OPGSP)

A few months later, Bank Asia became the first lender in Bangladesh to take initiatives to channel freelancer's income in partnership Paiza Pay, an OPGSP.

Since Paiza has not established good connections with freelancing platforms, independent online workers could not repatriate much.

Later, the bank partnered with Payoneer, the second-largest OPGSP in the world, and launched its service in March 2015.

Bank Asia channels half of the funds that come through formal channels, according to freelancers and a BB official.

Freelancers have fetched $519 million through Bank Asia since 2014, according to Md Zia Arfin, the bank's head of the international division.

The inflow of payments through the private commercial bank increased more than 40 per cent year-on-year to $140 million in 2020.

In 2018, in partnership with the Bangladesh Association of Software and Information Services (BASIS) and Mastercard, Bank Asia announced the launch of the 'Shadhin' card, the first-ever freelancer card in Bangladesh.

The card allows freelancers to receive payments directly from international employers.

Brac Bank, Dutch-Bangla Bank Ltd and Sonali Bank also channel payments for freelancers.

The BB issued a notice in February, making it possible for IT freelancers to bring home small-value earnings through mobile financial services.

"Although there have been many options to bring money, the absence of the largest OPGSP, PayPal, has been a setback for freelancers as many clients prefer the platform," said Mahfuzur Rahman, general secretary of the Bangladesh Freelancers Development Society (BFDS).

INCENTIVE ISSUE

The government has been providing a 10 per cent cash assistance against the export of ICT products or services since 2018. But, only institutional IT and freelancing companies having membership with the BASIS are eligible.

In order to extend the facility to individual freelancers, a meeting was held in February in participation with the BASIS, the BFDS, Bank Asia, the finance ministry, the commerce ministry and the ICT ministry.

However, there has not been any concrete measure so far.

"The annual remittance of freelancers now stands at more than $500 million, and it will soon cross the $1-billion mark. Our foreign exchange earnings will increase if the incentive is given," said State Minister for ICT Zunaid Ahmed Palak.

In June, he wrote a letter to Commerce Minister Tipu Munshi, requesting him to consider the incentive for individual freelancers.

"The incentive will also boost employment for the youth," Palak added.

Last year, he urged the central bank to extend the incentive to individual freelancers.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments