Dhaka Bank turns 30, looks to a digital horizon

Dhaka Bank has weathered many highs and lows since its inception, and its founding Chairman Abdul Hai Sarker credits the lender's resilience to a foundation built on good intentions.

In an interview with The Daily Star ahead of the bank's 30th anniversary tomorrow, Sarker said the focus is now firmly on digital transformation and reducing reliance on paper.

"We have endured many ups and downs over the past 30 years, and it is because our intentions were good that we have managed to survive well," he said, reflecting on the journey.

Dhaka Bank launched its banking operations on July 5, 1995. However, the path to that milestone was long.

The chairman recalled that the initial application to set up the bank was submitted in 1984, along with around 40 others. The proposal did not receive approval at the time. It was eventually greenlit in 1991.

In addition to leading Dhaka Bank, Sarker is also the chairman and CEO of Purbani Group—one of the country's oldest textile conglomerates—and heads the Bangladesh Association of Banks (BAB), an industry trade body of private banks.

The seasoned banker and businessman described Dhaka Bank as a fully service-oriented bank for customers. "The bank always tries to serve the customer."

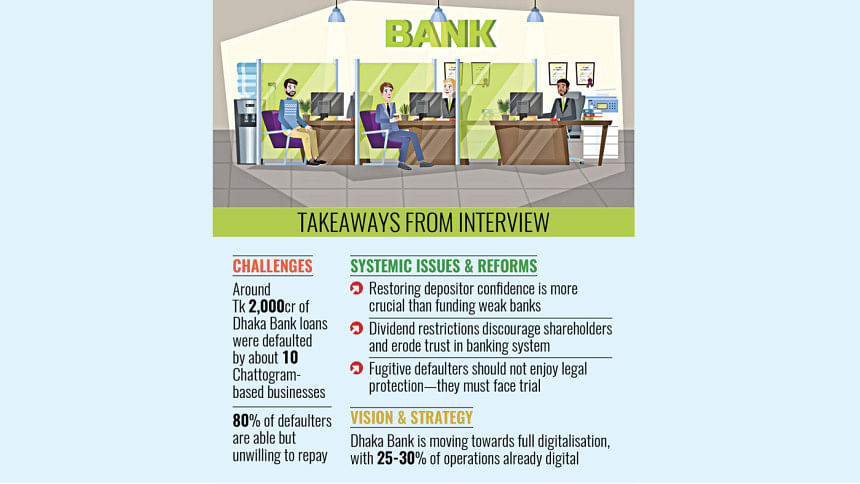

However, he admitted past missteps. "Like many banks, we were overly enthusiastic about lending to some Chattogram-based parties," he said. "We are now suffering the consequences of that craziness."

"Around 10 Chattogram-based borrowers, including Habib Group and SA Oil, are now fugitives who defaulted on loans from our bank worth around Tk 2,000 crore," Sarker informed.

Aiming for complete digitalisation

As it steps into its 31st year, Dhaka Bank is focusing on digitalisation and paperless operations. "Many of our neighbouring countries have already achieved this. India, Dubai, Abu Dhabi, Thailand, Finland, and Malaysia have all modernised significantly," said Sarker.

He noted that around 25–30 percent of the bank's operations are currently digitised.

Beyond lending, Sarker believes banks should guide customers in growing their businesses. "A bank's job is not just to give loans—it's also to guide customers in the right direction."

"A bank's job is not just to give loans—it's also to guide customers in the right direction," said the Dhaka Bank chairman, adding, "Banks should also advise on how to improve a business. That's the direction we want to move in."

Merger good, but customer confidence the key

Turning to the broader state of the banking sector, Sarker emphasised that depositor confidence is key. "It is very difficult to restore confidence once it is lost," he said.

He opined that Bangladesh Bank is on the right track to merge some weak banks—a significant move taken by the interim government to reform the banking sector.

However, he expressed concerns about the feasibility of these mergers.

"Funding weak banks would not bring any positive outcomes unless depositor confidence is restored," he stated, adding, "Depositors' confidence comes first; otherwise, you cannot survive."

Sarker also criticised the central bank's restrictive dividend policy, stating that it discourages shareholders and prompts them to sell shares. "Shareholders need some form of return," he said. "If the banking regulator continues with the policy, then both depositors and shareholders will lose trust in banks," he warned.

80% of defaulters not willing to repay

On the issue of non-performing loans (NPLs), Sarker pointed to an alarming trend. As of March 2025, NPLs in Bangladesh hit a record Tk 420,335 crore—representing 24.13 percent of total loans in the sector, which stood at Tk 17,41,992 crore.

Sarker opined that about 80 percent of defaulters are not willing to repay despite having the ability to clear the loans.

"When the banks go to auction their mortgaged assets, these defaulters send their representatives to the court, and the High Court also takes their words into consideration. We can't recover the money when the court imposes a stay order on the default status of the client," he said.

"But fugitive defaulters should not be allowed to enjoy such legal rights," he added.

Calling for an immediate stop to such practices, he demanded that the defaulters return to the country and attend court hearings to protect their property.

"The authorities will have to establish more money loan courts (Artho Rin Adalat) and strengthen them to clear the logjam of cases in the financial sector and recover the money from the defaulters," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments