Not for respite, but for restraints

When reassurance was needed, he exuded panic.

In Finance Minister AHM Mustafa Kamal's fourth budget speech delivered in the backdrop of a cost of living crisis, recovering economy and strained foreign currency reserves, the key takeaway is: that better days are not around the corner for most.

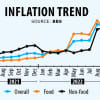

Inflation pops up 29 times in his budget speech, suggesting he is overwhelmed by the possibility of reining in the spiralling price level.

The elevated inflation is mostly imported, meaning there is not much the government can do to stop it. What it could do was help the poor offset the inflationary shock.

Kamal had the scope to engage in some serious redistribution from the rich to the poor in the form of support package for households with cost of living problems. But he held back.

For instance, he increased the excise duty on bank account balances of upwards of Tk 5 crore by just Tk 10,000 to Tk 50,000.

He withdrew the advance income tax on the import of gold, a superfluous purchase for the most, and made importing aircraft and helicopters cheaper.

To encourage import substitution and local manufacturing, he raised the tax incidence on the import of products such as laptops, lifts, mobile batteries and chargers and interactive displays.

At the same time, he brought down the import duty on raw materials for those.

On paper, this looks promising, but in practice, only a select few large conglomerates stand to benefit.

The poor and the vulnerable do not have any cash support to look forward to in the incoming fiscal year beginning July 1 to help them manage the cost of living crisis.

Only Tk 5,000 crore was kept aside for this purpose, which is the same as in this fiscal year, meaning about 35 lakh would stand to get one-off handouts of Tk 2,500.

More than 35 lakh need this support and they need it every month.

For the 40 million middle-class people, there are no glad tidings.

The tax-free income ceiling was not raised from Tk 3 lakh, disregarding the need for inflationary adjustment. Neither was the excise duty lowered on bank balances corresponding to them.

This is particularly a blow to pensioners: the value of their savings has surely eroded in the face of inflation and given the interest rate cap there cannot be an adjustment there.

Admittedly, his scope to offer one-off patches -- be it for moral or political reasons -- is limited by the narrow fiscal space.

But some out-of-the-box thinking and chutzpah could have provided a way out.

While Kamal has allocated a whooping Tk 82,745 crore as subsidy in the budget such that the prices of fuel, gas, electricity and fertiliser do not increase too much at the consumer level, this expenditure would have been better used as targeted support to those who need it the most: the middle-class and below.

The 2.5 percent cash incentive for sending in remittance through the official channel is absolutely not necessary given the Bangladesh Bank's decision to let the taka float, which has effectively brought parity to the official exchange rate for dollar to those in the kerb market.

For the same reason, the cash incentive for exports is no longer necessary.

Austerity could also start at home: the allocation for government employees' pay and allowances could have stayed the same and the slow-moving development projects could have been put on hold.

If Kamal is not one for short-term political fixes, he is not one for effective, long-term policies, either.

He spoke of preparation for Bangladesh's graduation from the least-developed country bracket in 2026 and yet did not provide a roadmap.

He made human resource development one of his priorities and yet, the allocation for education as a share of GDP was down to 1.53 percent in the budget for fiscal 2022-23.

This is lower than this fiscal year's 2.08 percent and lagging far behind Unesco's recommended spending of 4-6 percent of GDP.

When the need for the hour was more allocation to make up for the learning losses for the pandemic and to prepare the youth for the fourth industrial revolution, he went with the shears to this sector.

He earmarked the agriculture sector as another priority and yet did not have a definitive plan to increase its productivity and ensure food security.

When food security is not guaranteed, the logic to provide a 20 percent cash incentive for agricultural exports is rather baffling.

The 20 percent rebate on electricity bill for irrigation pumps and the concessional import facility for combined harvesters and threshers are a step in the right direction.

And so is the proposal to no longer extend tax exemptions on project implementation or maintenance work as it will bring transparency to revenue administration and help manage the budget deficit.

The need to show proof of returns filing to get many services and the snapping of utility connections for failure to pay the government's undisputed revenue are indeed bold strides.

On paper, they would surely widen the tax net and improve tax compliance. Whether it pans out that way in the absence of full automation of the tax administration remains to be seen.

The slash in corporate tax for both listed and non-listed companies in some sectors was a much-needed step to bring parity with Asian peers.

Extending the lower corporate income tax, which has so far been the preserve for garment manufacturers, to the other exporting sectors is a long-sighted move that can go on to expand the country's narrow export basket.

The proposal to increase the applicable duty on the import of some finished products made by the small and medium enterprises, which contribute at least 25 percent to Bangladesh's GDP and generate as much as 90 percent of the private sector jobs, is another significant move.

The slash in import duty from 25 percent to 5 percent on sewage treatment plants can lead to cleaner water bodies, which is much-needed for sustainability.

The push for import substitution for motorcycles and cut in import duty for hot-rolled stainless steel sheets to encourage domestic stainless steel product manufacturing can go on to boost the 'Made in Bangladesh' agenda.

The increased total tax incidence by imposing a supplementary duty on high-end luxury motor vehicles and jeeps along with chandeliers and light fittings at the import stage should bring in easy money to the state coffer.

And yet, there are doubts in Kamal's mind that all his tax measures would not be enough to mobilise adequate revenue.

Which is why, he has proposed to increase the stamp duty that has remained unchanged since 2012.

All said and done, what is absolutely essential is the implementation of whatever is laid out in the budget. This is where the government is found lacking every year. Let's hope next year is different.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments