Amnesty to black money may continue despite criticism

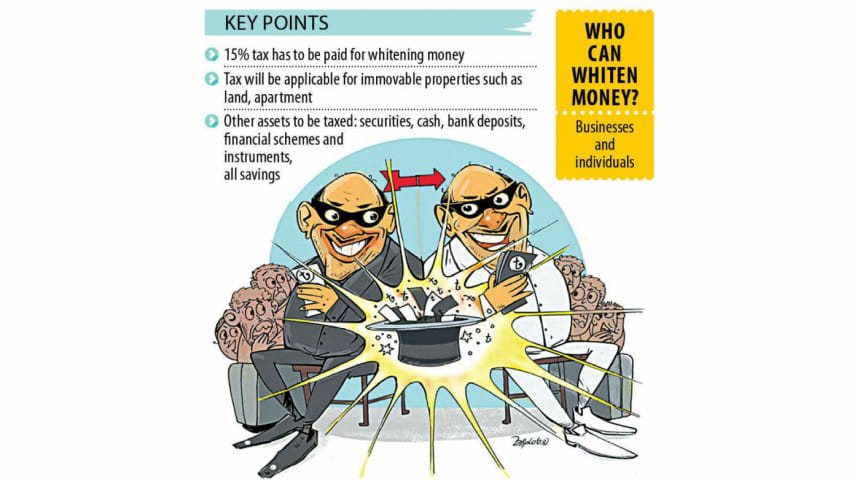

Despite widespread condemnation from economists, watchdogs, businesspeople and even multiple lawmakers, the government is expected to retain the amnesty allowing individuals and businesses to whiten black money without scrutiny by paying a 15 percent tax in the upcoming fiscal year.

In a meeting with the National Board of Revenue (NBR) yesterday, government high-ups gave their consent to keep the provision in the Finance Bill 2024, according to finance ministry officials.

If lawmakers raise no objection, the bill is likely to be passed in parliament on Thursday. Afterwards, individuals and businesses can enjoy the benefit from July 1 this year to June 30 next year.

According to the new provision, no authority can raise any question if a taxpayer pays tax at fixed rates for immovable properties such as flats and land, and 15 percent tax on other assets, including cash, securities, bank deposits, and savings schemes.

Finance Minister Abul Hassan Mahmood Ali placed the provision while unveiling the proposed budget on June 6, aiming to increase the flow of money into the economy.

Consequently, think-tanks, watchdogs, chambers, and several lawmakers criticised the move, labelling it as unethical, unjust and unacceptable.

Independent lawmaker AK Azad from Faridpur-3 constituency said the proposal contradicts the Awami League's election manifesto, which declared zero tolerance for corruption, at the parliament this week.

"It is not comprehensible how the sovereign parliament can legalise the laundering of black money," he said, questioning why the origin of black money cannot be scrutinised.

A group of lawmakers, including Pran Gopal Datta from Cumilla-7, Zahid Maleque from Manikganj-1, former foreign minister AK Abdul Momen, and Jatiya Party lawmaker Nurun Nahar Begum, criticised the provision in the parliament recently, according to media reports.

On June 23, the Federation of Bangladesh Chamber of Commerce and Industry (FBCCI) wrote to the finance minister, calling him to allow the amnesty only to businesses and companies, not to individuals.

The apex trade body said companies should only be eligible for this facility if their income is legal.

"Such measures will protect the transparency and fairness of the tax policy and ensure equal opportunities for all tax-paying entities."

The Transparency International Bangladesh (TIB) has termed the amnesty as an "unethical provision".

"This will foster an environment that is conducive to carrying out corrupt practices."

The Centre for Policy Dialogue, the South Asian Network on Economic Modeling (SANEM), and the Bangladesh Economic Association also lambasted the provision.

The government is also likely to revise the proposal to withdraw the existing tax holiday benefits for investors in private economic zones (EZs) in order to encourage domestic and foreign investments.

"Investors of the private EZs may enjoy the existing facilities but they will have to meet some new conditions," a finance ministry official told The Daily Star yesterday.

Currently, investors in economic zones receive tax breaks ranging from 20 percent to 100 percent in the first ten years of their production. The proposed budget maintains these benefits for state-run EZs but eliminates for private economic zones.

The government is likely to keep the proposal to end the privilege that allows lawmakers to import cars duty-free, a facility they have been enjoying since 1988.

Additionally, the proposed tariff and duty structure for some products may be revised in the final budget proposal.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments