Anontex Loans: Janata in deep trouble as BB digs up scams

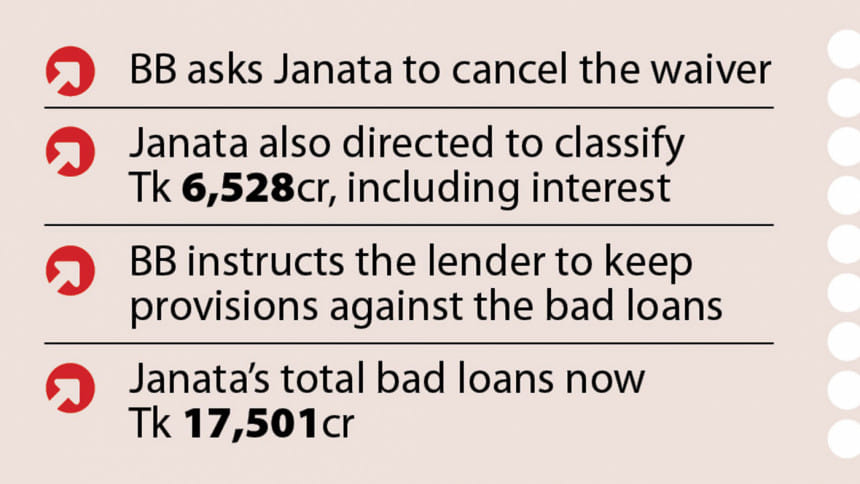

Bangladesh Bank has ordered Janata Bank to cancel the Tk 3,359 crore interest waiver facility the lender had allowed to AnonTex Group, after an audit found forgeries and scams involving the loans.

Scam-hit Janata will also have to classify Tk 6,528 crore AnonTex owes to the state-run bank as defaulted loans in line with the BB order given on April 1.

It will take Janata's total bad loans to over Tk 23,000 crore, putting it in deeper trouble, said a senior Janata Bank official on condition of anonymity.

According to the findings of a recently-completed functional audit, Janata approved the Tk 3,359 crore interest waiver facility for the company and recorded the company's loans as regular in June 2022. The audit also unearthed forgeries and scams involving the principal loans approved over a decade ago.

As per central bank regulations, loans sanctioned through irregularities and scams cannot be rescheduled and their interest cannot be waived.

By recording the AnonTex loans as regular borrowing, Janata essentially reduced its defaulted loans artificially, although it will now have to reverse the decision in line with the BB instruction.

In its April 1 letter to the Janata Bank managing director, the regulator also asked the lender to classify the loans and keep appropriate provisions against it, and then report back to the Credit Information Bureau (CIB) of Bangladesh Bank. Janata has also been asked to take steps to recover the loans.

Janata will have to keep 100 percent provision against the Tk 6,528 crore, although the bank's board has yet to approve it, a senior Janata Bank official said.

Contacted, Bangladesh Bank Executive Director and Spokesperson Md Mezbaul Haque said the BB gave the instructions after a functional audit found the loans were approved through forgeries.

After five years of insistence from the central bank, Janata Bank in July last year appointed audit firm Ahsan Kamal Sadeq & CO to look into the alleged loan scam.

Janata Bank Managing Director and CEO Md Abdul Jabbar declined to comment on the BB instruction to cancel the interest waiver.

But talking to The Daily Star at his Motijheel office yesterday, he said, "AnonTex has yet to repay the loan even after the interest waiver facility."

He said he is worried that the bank's bad loans will now soar further.

At the moment, the bank is not approving large loans and is trying to recover the previous loans, he added.

Janata Bank disbursed around Tk 3,527.9 crore in loans among 22 companies of AnonTex Group between 2010 and 2015. Including the interest, the amount stood at Tk 6,528 crore in December 2022.

The amount exceeds 25 percent of the lender's capital base, and violates the Single Borrower Exposure Limit set by the Bank Company Act 1991.

After a central bank probe unearthed large-scale irregularities in loan approvals by Janata, the regulator in 2018 had ordered the lender to conduct a functional audit and take legal action against those involved in the scandal. But Janata has yet to take any legal action against anyone.

JANATA'S FINANCIAL HEALTH

Janata was once one of the most reputed banks in Bangladesh, but its financial health started to slide downhill thanks to a series of loan scams involving AnonTex and Crescent Group.

In 2017, its bad loans stood at Tk 5,818 crore, which skyrocketed to Tk 17,501.44 crore in December last year, which is 19.2 percent of its total disbursed loans.

BB data show the bank had a capital shortfall of Tk 2,189 crore till June last year.

A recent central bank report shows 75 percent of the bank's total loans are concentrated in five branches, which is highly risky.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments