April food prices cross 10%, highest in five months

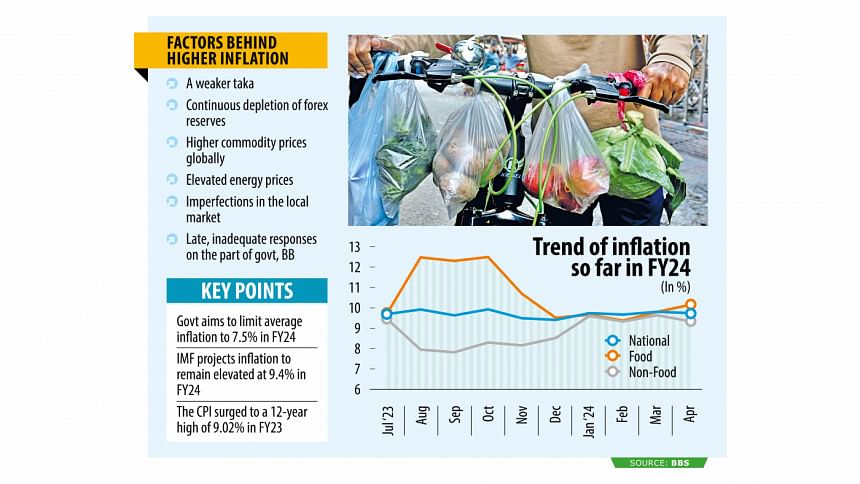

Food inflation in Bangladesh rose to a five-month high in April as the measures of the government and the central bank aimed at reining in elevated consumer prices are yet to take hold, official figures showed yesterday.

This means the struggles for the low-income groups and the poor have continued because of the erosion of purchasing power in the past two years.

According to the Bangladesh Bureau of Statistics (BBS), food inflation jumped 35 basis points to 10.22 percent last month from 9.87 percent in March. This was the first time in five months that food inflation hit double digits.

However, the Consumer Price Index (CPI), a measure of the average change over time in the prices paid by consumers for a market basket of consumer goods and services, fell seven basis points to 9.74 percent in April. It was 9.81 percent in March.

Non-food inflation went down by 30 basis points to 9.34 percent.

Inflation has remained sticky although expectations were high that the government would take appropriate initiatives to tackle it when it took office in January. However, four months have passed since then, but no improvement is in sight.

"We are seeing deficit when it comes to implementation," said Selim Raihan, a professor of economics at the University of Dhaka.

He said higher inflation has been a concern for a while. "However, we are even more concerned about food security of people because higher prices have hit hard poor households since their incomes have not increased in line with price hikes."

"Tackling higher inflation should have been a top priority for the government. However, coordinated efforts are missing."

The economist cited the examples of a sharp spike in egg and meat prices.

In Bangladesh, the inflation surge was initially triggered by supply chain disruptions due to the Covid-19 pandemic and the Russia-Ukraine war.

In 2022, while global commodity prices started to decline, the significant deficits in Bangladesh's current account balance and overall balance of payments led to a sizeable depreciation of the taka.

The pass-through of a sharp depreciation of the local currency accounted for half of the inflation surge in the last financial year of 2022-23, according to the International Monetary Fund (IMF).

Additionally, second-round effects from adjustments in energy prices and imperfections in the commodity market further compounded high inflation, said the Bangladesh Bank in January.

In the past two years, the currency has lost its value by about 35 percent owing largely to a 30 percent decline in the foreign currency reserves.

On Wednesday, the central bank made three major decisions to beef up its fight against inflation. It loosened its age-old grip on the taka as it will now follow the crawling peg, a flexible exchange rate system.

It also made lending rates fully market-based and raised the overnight repurchase agreement rate. The taka has lost its value by 6 percent after the central bank introduced the crawling peg.

Prof Raihan, also the executive director of the South Asian Network on Economic Modeling, said it would take time for the initiatives to take hold.

"We would have benefited had we taken the measures earlier."

The economist said food prices have gone up in global markets, meaning import-dependent nations like Bangladesh have to pay more to buy them. Furthermore, the duties and taxes have not been adjusted adequately to lessen the impacts of the price spiral.

"There are also anomalies in the market. Besides, only a few companies import items, so there is a lack of competition."

Another blow for Bangladesh is coming from the declining foreign exchange reserves. Since the reserves are not improving, the IMF has drastically slashed the net international reserves requirement for the fourth tranche of the $4.7 billion loans.

Commodity prices are projected to experience a slight downturn in 2024 and 2025 but are expected to remain above pre-pandemic levels, according to the World Bank.

Despite the drop in April, the overall inflation has stayed above the government's target for the current financial year, which ends in June. The government has aimed to limit the average inflation to 7.5 percent in FY24.

The CPI surged to a 12-year high of 9.02 percent in FY23.

According to the IMF, inflation is projected to remain elevated at approximately 9.4 percent in FY24 but is anticipated to decline to around 7.2 percent in FY25, on the back of the continued tighter policy mix and projected lower global food and commodity prices.

"Nevertheless, uncertainties surrounding the outlook remain high, with risks predominantly leaning towards the downside."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments