Austerity steps okay but more belt-tightening needed: Experts

The government in Bangladesh has already begun enforcing energy and power rationing to contain the surging import cost of gas and fuel oil and turned to austerity measures to save US dollars.

The initiatives have won support from economists, who said yesterday that there is little room for the country other than taking the measures to stabilise the economy and avert any crisis.

The steps to ration energy supply will slow the pace of the economy but the growth should not be a priority for now, they also said.

In order to overcome the challenge, analysts recommended allowing the take to depreciate further, cutting revenue expenditures, curbing wastages, leakages and the cost-overrun of development projects, and improving governance.

"It is vital to tackle the current situation. There is no alternative to keep the economy stable," said Ahsan H Mansur, executive director of the Policy Research Institute (PRI) of Bangladesh.

"For this, we all will have to take the pain. There will be no harm even if the economic growth slows."

He supported the government's steps but said they are not adequate.

"It has to think seriously about how it can reduce expenditure. The government has to tighten its belts in the areas when it comes to spending from the state coffer."

His other advices included suspending new hiring and ensuring an adequate supply of essential commodities.

"We must reduce the import costs," said the former economist of the International Monetary Fund (IMF).

Mansur urges the government to focus more on implementing projects that are backed by foreign aid, instead of those being implemented by domestic resources.

Zahid Hussain, a former lead economist of the World Bank Bangladesh, said maintaining macroeconomic stability has become a big challenge.

"If more cracks develop, there will be little to do other than taking harsh actions," he said, suggesting the authorities allow the exchange rate to float freely.

Owing to the blistering import bills, Bangladesh has roughly four months of reserves to clear import bills, according to the central bank.

"Since you do not have enough reserves to defend the taka persistently, you have no option but to let the taka float against the dollar," Hussain said.

The increased cost of the American greenback will discourage imports and leisure trips abroad, attract remittances and make exports competitive in foreign markets. However, the depreciation of the taka will raise the cost of imported commodities, thus fanning inflation.

"For the rich, inflation is an annoyance. It erodes the savings of the middle class. But for the lower-income groups, it is a livelihood problem," Hussain said.

He suggested the government resume direct cash transfer and provide cash to poor households through the school stipend programme and other cash transfer schemes.

In the second half of 2020, the government provided Tk 2,500 to nearly 35 lakh families each through mobile financial services and bank accounts to partly cover the income losses of the poor resulting from the coronavirus pandemic.

"It worked although it had faced some setback initially," Hussain said.

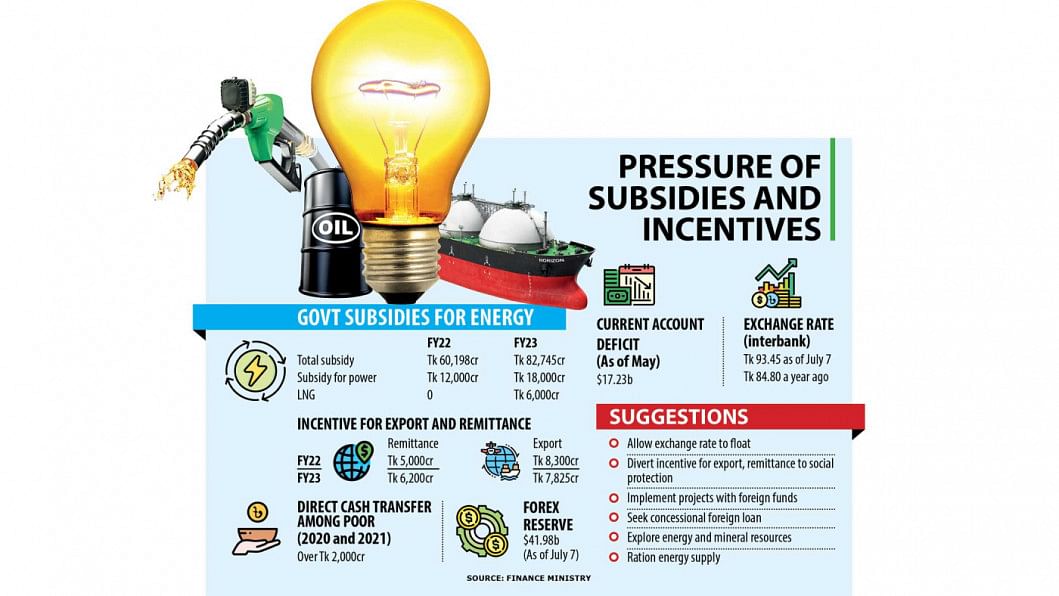

According to Hussain, by allowing the taka to float against foreign currencies, the government can transfer the Tk 6,200 crore kept aside as incentives for remitters to the social protection schemes.

The depreciation will allow the country to free up the Tk 8,300 crore that has been allocated to exporters as incentives.

In order to lessen the impacts of inflation, the government may hike the prices of petroleum and electricity in phases as it stokes inflation, Hussain said.

The economist suggested mobilising concessional foreign loans in the form of budgetary support.

"For this, it will have to carry out structural reforms. An injection of foreign funds will help stabilise the exchange rate and contain inflation."

The government has already begun the process to secure foreign finances.

"We have got the opportunity to receive $8 billion. But the government is primarily considering to take up $4 billion to $4.5 billion," said a finance ministry official.

An IMF mission is scheduled to visit Dhaka this month.

The government is also likely to get $500 million this year from the World Bank and $1 billion from the Asian Development Bank and other multilateral agencies.

State Minister for Planning Shamsul Alam agreed that the devaluation of the taka is an incentive to exporters and remitters. But the economic decision cannot be taken instantly since one is connected to the other.

"The issue of withdrawing incentives for remittances and exporters is under consideration. We may reconsider it if the taka weakens further," he said.

Prof Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, said revenue collection can be increased through proper management and governance.

"There are a lot of anomalies. The loopholes should be identified and plugged in. This is the time to show zero-tolerance."

At the same time, it is possible to reduce costs by eliminating wastages, leakages and corruption and ensuring timely implementation of development projects, he added.

The CPD earlier estimated that public expenditures increased by Tk 30,000 crore just because of the revision of development projects.

Selim Raihan, a professor of the economics department at the University of Dhaka, thinks it appears that there had not been preparation related to overall energy policy on the government's part to face this sort of situation.

"Steps should have been taken to explore energy and mineral resources."

Prof Raihan said the increased import costs of energy will widen the subsidy pressure.

"Import growth has been unprecedented and it has to be managed."

Between July and May, imports went up by 39 per cent to $75.4 billion.

"There are many projects having unnecessary and inflated expenditures. These have to be cut," said Prof Raihan.

"The next six months will be crucial in economic management."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments