Bad loans, forex volatility main challenges

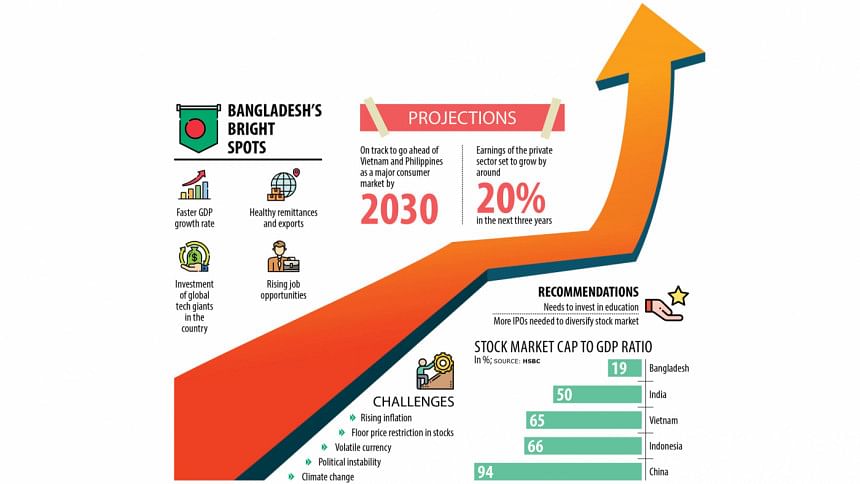

Bangladesh should get more attention from investors considering its economic potential but the country faces challenges in bad loans, an illiquid stock market, exchange rate volatility and an unstable political landscape, according to HSBC Global Research.

The global research wing of London-based universal bank and financial services group HSBC Holdings PLC yesterday released a report on Bangladesh, styled "The Flying Dutchman".

The report starts by saying that it is true that the stock market in Bangladesh is small and illiquid.

"But as was the case in India two decades ago or Vietnam one decade ago, it [the stock market in Bangladesh] offers prospects for significant long-term capital appreciation driven by earnings growth."

The country's GDP growth averaged 6.4 percent in the past decade -- faster than most of Asia -- and its GDP per capita ratio recently surpassed that of India, the report said.

One of the most startling projections for Bangladesh is that it is on track to become a major consumer market by 2030 ahead of Vietnam and the Philippines, as per HSBC estimates.

Besides, that comes on top of the country's rising foreign investments, not just from garment makers, but also from Indian conglomerates, global tech giants such as Samsung Electronics, and Chinese firms.

Plus, domestic employment is rising and there are healthy remittances and good exports, it added.

Another upside for the country is that the earnings of its private sector are set to grow by around 20 percent in the next three years.

However, risks include rising inflation and the existing floor price mechanism on stocks, which is denting investor confidence, while exchange rate volatility and an unstable political situation are also concerns.

Additionally, climate change is a key risk for the country's development, the report said.

HSBC suggests that as more than 50 percent of the population is under 25 years old, Bangladesh should invest in education that better equips its people for skill-intensive jobs so that they do not fall behind by focusing on low-tech garment work.

THE EQUITY STORY

Previously, HSBC Global Research termed Bangladesh's stock market as a "hidden gem" considering its potential for growth.

But in its latest report, HSBC said the floor prices on stocks are a major overhang for the market and are one of the reasons for its recent unimpressive performance.

"The process of price discovery and the amount of liquidity is a key risk for Bangladesh's stocks," it said.

The Bangladesh Securities and Exchange Commission launched the floor price mechanism for the first time in March 2020 and a second time in July of 2021 with the aim of halting the freefall of market indices.

With floor price restrictions, prices cannot fall below a certain level and this impedes price discovery and dents investor confidence. So, it is no wonder trading volumes have fallen significantly from their highs in 2021.

"But with a market cap-to-GDP ratio of only 19 percent, down from around 41 percent in 2010, we think Bangladesh deserves more attention than it gets," HSBC said.

"Yes, the market is small, illiquid, and not that easy to access, but so was Vietnam's five years ago. The two markets were similar in size until 2015, but Vietnam's is now four times larger than what it was back then," it added.

An attractive point is that Bangladesh is less correlated with global macro and equity themes compared to Vietnam and also receives far less attention from analysts, creating opportunities for fund managers looking for diversification and "hidden gems".

HSBC Global Research pointed out that another issue holding back the market is that few companies have listed in Bangladesh since 2020, raising a combined $96 million.

BANKING SECTOR DYNAMICS

The banking sector is currently facing a double challenge of slowing deposit and credit growth coupled with rising non-performing loans.

"But looking beyond this, we expect banks to benefit from rising credit growth fuelled by high infrastructure spending, investment in the power sector and higher capital expenditure by companies setting up manufacturing units," HSBC said.

DYNAMIC DEMOGRAPHICS

Bangladesh is expected to be the ninth-largest consumer market by 2030 ahead of Germany and the UK, and most of this is powered by its demographic dividend.

With this backdrop, the report said investments in areas like health, education and skills could make the best use of this "demographic window of opportunity".

MACRO BACKDROP

A decade high inflation rate and volatile food and energy prices are the key drags on the economy of Bangladesh while rising exports and foreign direct investment, along with moving up the value chain in terms of goods exported, are key growth catalysts.

Also, the country remains the preferred location for many labour-intensive manufacturers given its cheap labour and strategic location in Asia, HSBC added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments