Balance of payments deficit to go thru the roof this fiscal year

Bangladesh's balance of payments (BoP) deficit would widen massively in the current fiscal year than the central bank had earlier projected owing to escalated imports, lower remittances and export receipts, and higher accumulation of debts.

The BoP summarises the economic transactions of an economy with the rest of the world. These transactions include exports and imports of goods, services and financial assets, along with transfer payments such as foreign aid.

In June when the Bangladesh Bank unveiled the monetary policy statement for the entire fiscal year of 2022-23, it was projected that the deficit would stand at $150 million.

But on Sunday the BB said the BoP deficit would be $5.08 billion in FY23, according to the MPS for January-June.

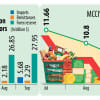

The balance turned negative in 2021-22 when it shot up to $5.38 billion from a surplus of $9.27 billion in 2020-21.

"The BoP deficit was on account of a higher amount of import payments as compared to the total amount of export receipts and inward remittances, and a significant repayment of trade credit," said the BB.

Import growth is projected to contract by 9 per cent at the end of FY23 from an expansion of 12 per cent forecast earlier.

The central bank has already taken measures to discourage the imports of luxury and non-essential commodities by enhancing the requirements of letters of credit (LCs) margin and restricting all sorts of foreign tours by officials of banks, non-bank financial institutions, and the BB.

It has also enhanced the interest on non-resident foreign currency deposits and on loans from the Export Development Fund.

The import growth surged to 35.9 per cent in FY22 and 19.7 per cent in FY21, driven by a pickup in demand following the recovery from the coronavirus pandemic.

Export is projected to grow at 10 per cent in FY23, down from 13 per cent stated earlier. Bangladesh posted a 33.4 per cent and a 14.9 per cent growth in FY22 and FY21, respectively.

Between July and December last year, exports fetched $27.31 billion, up 10.58 per cent year-on-year.

The remittance flow is projected to display a paltry growth of 4 per cent in the ongoing financial year, way down from the 15 per cent the BB had anticipated in June.

In the six months to December, money transferred by migrant workers living abroad posted a growth of 2.48 per cent. It declined 14 per cent in FY22.

The central bank, however, called the projected BoP deficit to be moderate, well supported by a befitting performance of the financial account.

The financial account covers claims on or liabilities to foreigners concerning financial assets and includes direct investment, portfolio investment, and reserve assets.

The financial accounts would be $28 billion in surplus at the end of FY23, way higher than the $16.02 billion projected at the start of the financial year.

The deficit in the trade balance is forecast to fall to $20.9 billion from $36.71 billion.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said: "The economic outlook of Bangladesh has changed for the worse."

In June, there were expectations that the dollar crisis would be over by September and then the outlook was changed and it was said that it would disappear by January.

"Now, the government is not saying anything. I think the dollar crisis would not be over by the current fiscal year. It may not even go away by 2023," said Mansur.

Under the current circumstances, the outlook of an overall BoP deficit of $5 billion is optimistic, he said.

Pointing to the financial account part of the BoP, the former economist of the International Monetary Fund said it turned negative in the first five months of the current fiscal year.

"It has never turned negative in recent times."

The financial account was a surplus of $13.77 billion in FY22 and $14.07 billion in FY21, BB data showed.

"This is the portion where the problem lies. This means funds are not flowing to Bangladesh now," Mansur said.

The BB has projected that it would $2.8 billion at the end of the fiscal year in June.

"Whatever the BoP situation of Bangladesh, the payments situation is worsening," said Mansur.

Importers are already struggling to settle LCs owing to the dollar shortage. There are media reports that large groups are not being able to offload goods from the port owing since they have not been able to make the payments against the LCs.

"If large groups face such a grim situation, it can be easily understood what others are going through," said Mansur.

"The situation is serious. Foreigners know this so they are not willing to lend money to us because Bangladesh is facing higher risks and difficulty to make repayments."

According to Mansur, the third factor is the repayment of the short-term credits, which have been taken in the previous years, has become overdue or are becoming overdue.

"We are not being able to repay the debts and they are being rolled over."

"So, the overall BoP deficit of $5.5 billion would be a suboptimal outcome because it will be the results of suppressed imports, a hike in debts and accumulation of forced debts."

Higher export and remittance receipts can emerge as saviours for the economy, according to the economist.

"The remittance will make a comeback if we can curb money laundering. But it would be next to impossible to curb money laundering in an election year."

A contraction of imports could provide another relief but it would not bode well for the economy, he warned.

"The moment Bangladesh removes import restrictions or makes US dollars available, the imports will rocket."

Mansur said that the exchange rate may depreciate sharply amid the current build-up of pressures in the foreign exchange rate regime.

"That risk is very much there because the current exchange rate can't be maintained at some point. This is because we are not allowing a market-based exchange rate."

"Bangladesh faces very difficult choices and they are not something that are pleasant and easily doable."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments