Banking reform roadmap useless if past failures not understood

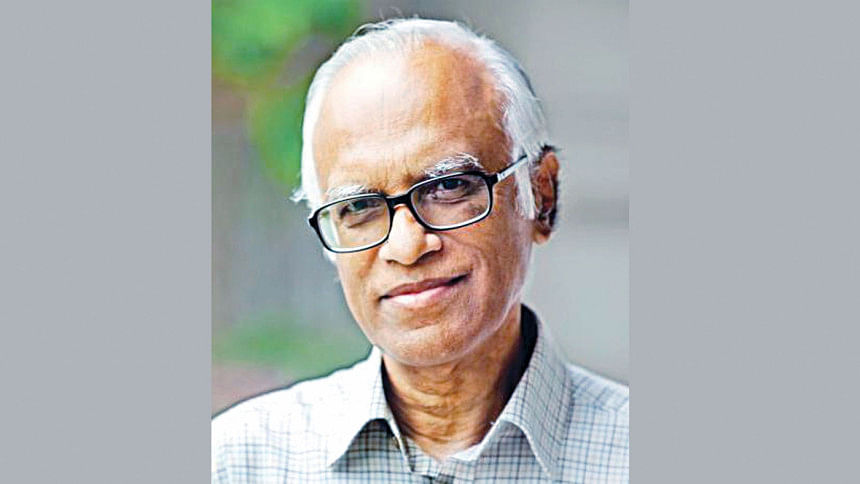

Bangladesh Bank's banking sector reform roadmap of last week will come to no use if the implementation failures of previous roadmaps cannot be understood, said eminent economist Wahiduddin Mahmud yesterday.

"I have previously been involved with two banking sector reform roadmaps, so I am aware of those…Why did we deviate from those roadmaps? ...influential groups prevented their inclusion in the banking law," he said.

"Implementation is difficult when we lack knowledge of the deficiencies of regulations… we have to know the history of the regulations and why the regulations were amended repeatedly," he said.

"The banking sector's present scenario cannot be understood if the history of the regulations remains unknown, such as that over the amount of loan bank sponsors can take from their own banks and the number of family members who can sit in a bank's board," he said.

Mahmud, also a former adviser to a caretaker government, was addressing the launch of the fifth edition of Banking Almanac at National Press Club in Dhaka yesterday.

It is not always wise to follow the recommendations of World Bank and International Monetary Fund (IMF), as the situation in Bangladesh is quite different from that in other countries, he said.

"Maximum limits must be set on interest rates otherwise weak banks will not get deposits and bank loans will be taken by only those groups who are not willing to pay those back," he said.

The banking sector is the heart of the economy yet everyone knows about its "sorry state", added the economist.

Recently the international credit rating of Bangladesh was downgraded, he said, adding that this rating reflects the country's economic condition.

"The evaluation of credit rating agencies is more important now than the certificate of the World Bank and the IMF," said Mahmud.

Regarding the Banking Almanac, he said it contains information regarding default loans in the country but no information about the loans that have been written off.

Written-off loans may be included in a bank's profit and loss account but the defaulter should always be held liable, he said.

"Not only default loans, written-off loans are also an indicator of a bank's bad health," he said.

Nowadays word is going around that small and weak banks will be merged and the authorities have realised that there are too many banks, he said.

"We had said earlier that there was no need for any more banks in the market," he said.

Private banks will not take up the burden of weak banks while forced mergers with state-run banks will not bring about any good, he said.

Reforms taken up by the central bank are very strange, said Salehuddin Ahmed, a former Bangladesh Bank governor.

Once upon a time, borrowers had to pay 30 percent of the total loan to reschedule it but now they have to pay only 2 percent, he said.

He criticised the latest banking sector reform roadmap, saying that it would allow banks to write off bad loans in two years whereas it was three years previously.

"It is a trick to reduce bad loans," he said, adding that banks should be allowed to fail.

Nowadays, data mismatch has become a trend, which is not good for research, said Ahmed, also chairman of the board of editors of the Banking Almanac.

Bangladesh Bank's export data differs from that of the Export Promotion Bureau while the central bank's forex reserve data differs from that of International Monetary Fund calculations, he said.

Mohammed Nurul Amin, chairman of the FAS Finance and Investment and member of the board of editors of the Banking Almanac, gave the welcome speech.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments