Banks sell dollar at more than Tk 118 as pressure mounts

Most banks in Bangladesh are quoting more than Tk 118 per US dollar, which is above the official exchange rate as per the crawling peg system, said bankers and businesspeople.

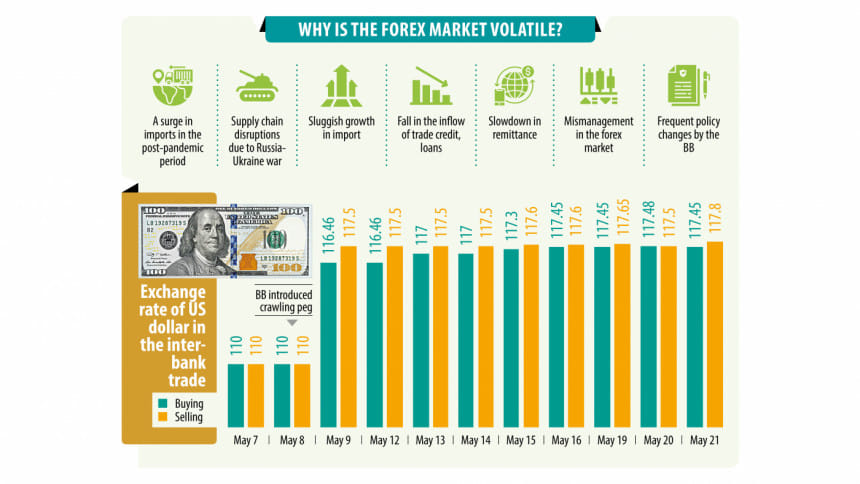

The Bangladesh Bank introduced the new system to manage exchange rates on May 8 in line with the conditions set by the International Monetary Fund (IMF) with its $4.7 billion loan programme.

Under the system, a crawling peg mid-rate was set at Tk 117 per US dollar. However, banks are quoting up to Tk 120 per US dollar to open letters of credit. The exchange rate is more than Tk 118 per dollar in the case of collecting remittance and export bills.

The chief executives of at least three private commercial banks told The Daily Star that the BB had verbally allowed them to quote Tk 1 more than the exchange rate to collect US dollars amid the ongoing forex crunch.

As such, banks are unofficially quoting at least Tk 118 per greenback, thereby raising the interbank exchange rate.

The official interbank exchange rate stood at Tk 117.80 on Tuesday, up from Tk 117.50 a week earlier, central bank data showed. The rate was Tk 110 on May 8.

"No US dollars are available in the market at less than Tk 119 to Tk 120," said a senior official of PHP Group, a conglomerate based in Chattogram, adding banks are quoting their previous rates for LCs.

Before the launch of the crawling peg, banks quoted Tk 118 to Tk 122 per US dollar even though the official exchange rate was Tk 110.

A crawling peg is a system of exchange rate adjustments in which a currency with a fixed exchange rate is allowed to fluctuate within a band of rates.

The official also said the BB is ignoring the violation since the banking regulator has unofficially permitted banks to quote a higher rate as forex holdings with banks continue to decline.

At the end of April, the gross foreign exchange held by commercial banks in the country stood at $5.04 billion, down 8.19 percent year-on-year, as per the latest data of the central bank.

April's figure was 7.21 percent lower compared to the previous month, when banks collectively held foreign currencies amounting to $5.43 billion.

The treasury head of a private commercial bank said most banks have adopted forward selling for US dollars, where the rate is comparatively high.

Forward selling is the practice of selling something at a fixed price to be given to the buyer in the future.

The treasury head also said most banks are now quoting Tk 118.50 to Tk 120 per US dollar in the case of opening LCs and that the banking regulator was aware of the matter.

Even some Shariah-based banks are offering higher rates when collecting remittances and selling them to importers, he added.

A senior official of the BB said the banking regulator now wants to give a boost to the forex reserves, so it is giving banks some freedom in dealing with foreign currencies.

Bangladesh's forex market became volatile in 2022 as supply chain disruptions caused by the Russia-Ukraine war led to a hike in commodity prices globally.

The mismanagement in the forex market, frequent policy changes by the central bank, and the gap between the official exchange rate and the unofficial one are also to blame.

The reserves have fallen by $24 billion since August 2021. On Wednesday, the gross international reserves stood at $18.42 billion, enough to pay for imports for over three and a half months.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments