Bangladesh Bank expands inflation battle with rate hike

The central bank raised the key policy rate by 50 basis points to 10 percent yesterday, making borrowing costlier for the 11th consecutive time to tame inflation as spiralling prices remain a headache for the interim government.

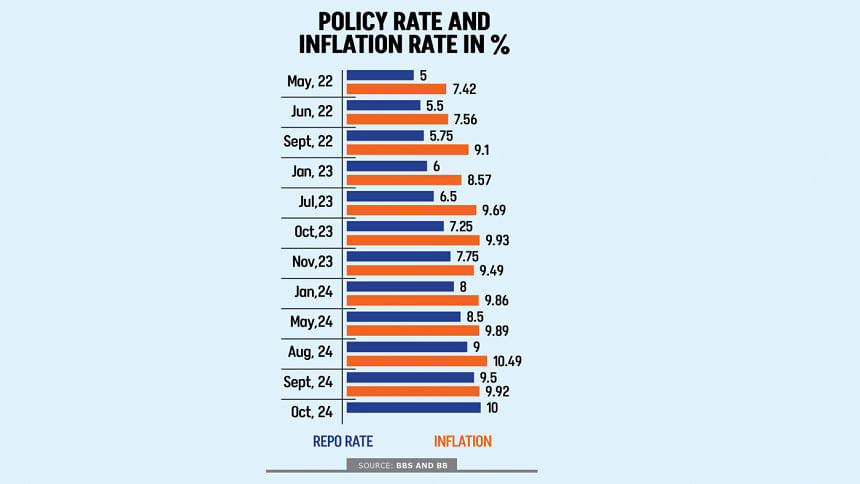

The overnight repurchase agreement (repo) rate has exceeded the inflation rate for the first time in many years in Bangladesh in one of the most significant steps taken since Ahsan H Mansur took over as governor in August.

This is the third repo rate hike after Mansur's appointment. Even before taking up the role of governor, Mansur emphasised that the policy rate must be increased to a double-digit figure to control inflationary pressure by effectively tightening the money flow.

As Bangladesh Bank has remained firm on its contractionary monetary policy, analysts say higher borrowing costs can help reduce inflation by cooling down demand in the economy.

Banks will face higher costs while borrowing from the central bank, a possible scenario that typically leads to higher interest rates on loans for businesses and consumers.

While the rate hike is necessary to reduce the overall money supply in the economy to rein in runaway consumer prices, businesses may delay or reduce investments, and consumers may cut back on spending. This can slow down economic growth in the short term.

Bangladesh has been hiking the policy rate since May 2022, stepping up efforts to curb inflationary pressure, but the real policy rate, adjusted for inflation, remained negative.

The central bank in its latest move also raised the standing lending facility rate by 50 basis points to 11.50 percent and the standing deposit facility rate to 8.50 percent from 8 percent. The new rates will be effective from October 27.

Despite a slight ease in consumer prices to 9.92 percent in September from 10.49 percent in August, inflation remains a significant concern, particularly for lower- and fixed-income households.

A recent report by Bangladesh Bank indicates that domestic products are the primary drivers of inflation, accounting for 74 percent of the overall inflation rate in September.

This is a notable increase from 61 percent in June, highlighting the growing influence of local factors on price levels.

The contribution of import-dependent items to inflation has declined from 39 percent in June to 26 percent in September.

NOT THE ONLY SOLUTION

Experts said that while raising policy rates is a critical tool in controlling inflation, it is not the only solution. Other factors must be addressed concurrently for effective alleviation of inflationary pressure.

They also observed that comprehensive strategies, which deal with supply chain dynamics, production costs, and domestic market conditions, are essential for a holistic approach to managing inflation.

"Monetary policy alone is not enough to curb inflation," said Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD). "Because other factors are working in our country. Fiscal policy is very important here. Different costs of the mega projects such as operational costs and administrative costs are examples of overspending. We have to prioritise those things."

Ashikur Rahman, principal economist at the Policy Research Institute, said, "If we revisit how India and Sri Lanka have controlled inflation over the last two years, it is evident that they followed an orthodox monetary policy that relied on increasing policy rate to control their inflationary pressure – and it has worked."

"If we remain committed to a tight monetary policy and also parallelly commit to addressing disruptions in the supply chain of essential commodities, then I am cautiously optimistic that inflation will come down in the current fiscal year.

"This should also create conducive conditions for broader macroeconomic stabilisation, which will benefit everyone in the medium term," Ashikur said.

Monzur Hossain, research director at the Bangladesh Institute of Development Studies, said: "I think it's going to be an ultra-tightened monetary policy. It will increase interest rates further, making investments costlier."

Solving demand-supply gaps, and reducing transportation costs and market mismanagement would also be needed to ease inflation, he said.

"If other measures are not taken together, raising policy rates or interest rates would not be effective, rather it would hurt growth momentum in the medium to long run," he added.

Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development, said that although inflation was not decreasing much, there was no option but to increase the policy rate.

"Not only has the policy rate been increased, but fiscal policy adjustments have also been made. ADP spending has been cut. The central bank doesn't print money or give loans to the government," he said.

The researcher thinks it will take some time to get the outcome of these measures.

He believes normalcy in the supply chain of essential commodities should be prioritised while keeping the policy rate high.

Recently, the government has lowered the import duty for some daily essential items, such as rice, wheat, and egg, and started selling some key commodities at subsidised rates.

CPD's Fahmida called for lower tariffs on the import of other essential commodities and measures to increase the supply of local products, stressing the need to curb market manipulation.

The effectiveness of the Competition Commission must be enhanced along with the readjustment of trade policy, according to her.

She also emphasised accurate data on supply and demand, which she said is crucial for understanding market dynamics.

Selim Raihan, executive director of the South Asian Network on Economic Modeling, said that the previous government did not raise the policy rate when it was crucial, contributing to prolonged high inflation.

He argued that simply increasing the policy rate will not suffice; it will take time to reduce inflation through this measure alone.

To effectively tackle inflation, he said, ensuring a steady supply of essential commodities is critical.

Raihan also said action should be taken to stop anti-competitive practices in the market.

"If the Bangladesh Bank, commerce, finance and food ministries, and the National Board of Revenue collaborate on a unified platform to tackle inflation, their efforts will be more impactful.

"Without this coordinated approach, combating inflation will remain a challenge," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments