BB keeps key policy rate unchanged but signals further tightening

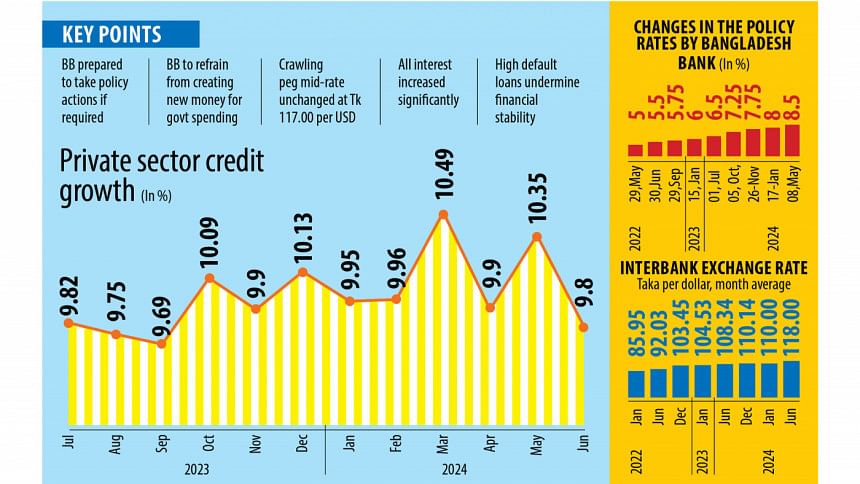

Despite suggestions for a policy rate hike from the International Monetary Fund (IMF) and economists, the central bank of Bangladesh has kept unchanged the major tool of its monetary policy at 8.5 percent although inflation is running high.

The Bangladesh Bank yesterday unveiled the monetary policy statement (MPS) for July-December of 2024-25. It said that the current tightening monetary policy stance would be maintained, and it will help ease the inflationary pressure.

"However, BB remains prepared to take necessary policy actions if required," it said.

"The major policy reforms that the central bank took on May 8 came into effect, and we see the outcome to tackle economic challenges, including higher inflation and the forex crisis," Md Habibur Rahman, a deputy governor, told The Daily Star.

Also the head of the monetary policy department of the central bank, Rahman said as the previous policy stance is producing expected outcome, the policy rate and the crawling peg exchange rate system have not been changed.

In May, the banking watchdog took three bold measures in line with the IMF's $4.7 billion loan programme. It allowed banks to fix the interest rate, brought flexibility to the exchange rate by introducing the crawling peg system, and hiked the policy rate by 50 basis points to 8.5 percent, the ninth straight increase in the span of less than two years.

Yesterday, the BB said that the economy has begun to respond to these policies.

It, however, said while the upward trend in inflation has moderated recently, it remains stubbornly high owing to food price inflation. The BB aims to bring down inflation to 6.5 percent at the end of FY25.

Annual inflation rose to 9.73 percent in 2023-24, the highest since 2011-12, overshooting the government's target of containing it to 7.5 percent, according to the Bangladesh Bureau of Statistics (BBS). This was the second year in a row, inflation in the country stayed above 9 percent.

On the other hand, most countries, including the US, India and even cash-strapped Sri Lanka, have succeeded in bringing down inflation from their record levels.

As a result, inflation control has remained a top priority for the BB.

The BB has maintained a contractionary monetary policy for over a year, significantly increasing the policy rate and avoiding new high-powered money issuance for government spending.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, thinks that the central bank was on the right

track, but it made a mistake by keeping the policy rate unchanged.

"The policy rate should have been hiked by at least one percentage point to 9.50 percent."

He welcomed the central bank decision to refrain from creating new money for government spending. However, at the same time, the BB would have to suspend liquidity support to weak banks.

"If it continues to support weak banks, inflation will not come under control."

Mansur said that the higher government borrowing from the banking sector will narrow the scope for loans for the private sector.

Ashikur Rahman, principal economist at the PRI, said the central bank had missed the opportunity to correct the policy rate.

"As things stand, it is visible that Bangladesh Bank remains committed to a contractionary monetary policy to tame inflationary pressure."

The economist said by keeping the policy rate at 8.5 percent, the central bank is allowing commercial banks to borrow at 8.5 percent from the central bank and buy treasury bills that are promising a 12 percent return.

"This is prolonging the liquidity crisis in the money market as funds are diverted from businesses to treasury bills. Consequently, this scope for arbitrage must be addressed by raising the policy rate to 10 percent."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments