BB plans to raise exchange rate amid forex volatility

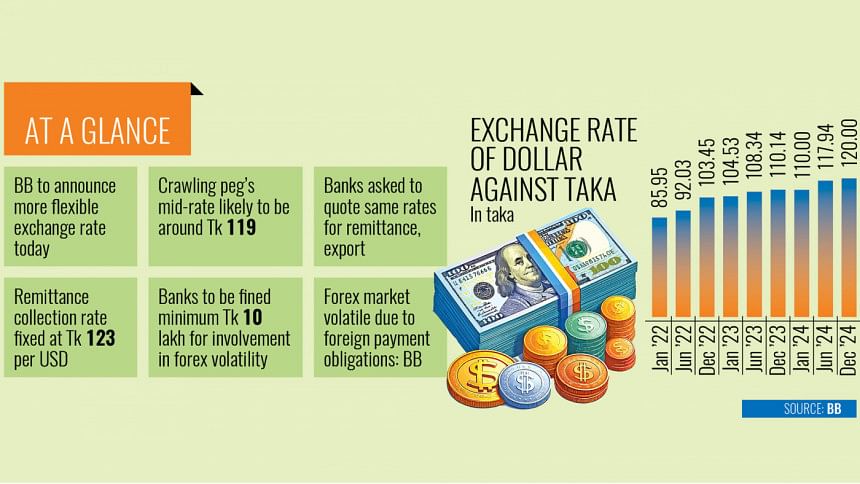

After seven months of implementing a crawling peg exchange rate system in spot purchases and sales of US dollars, the Bangladesh Bank (BB) is now considering increasing the mid-rate to Tk 119 from Tk 117 per greenback, according to central bank officials.

They said a circular will likely be issued today, announcing this upward adjustment amid the recent US dollar volatility, which pushed the exchange rate for remittances to Tk 128.

With the new mid-rate, the exchange rate will be allowed to swing by 1.5 percent to 2 percent from it.

The BB will publish a daily interbank exchange rate based on bank transactions, according to central bank officials. The interbank exchange rate has not been fully operational in recent months.

Besides, the exchange rate for remittance collection will be around Tk 123 per US dollar. Importantly, the exchange rate for remittance collection and export earnings will be the same.

The central bank warned that banks found to be involved in spurring volatility in the foreign exchange market will face financial penalties starting from a minimum of Tk 10 lakh.

These decisions were taken during a meeting between the central bank and chief executives and treasury heads of around 27 banks yesterday.

Bangladesh Bank Governor Ahsan H Mansur chaired the meeting, which was attended by four deputy governors, relevant executive directors and other top officials.

Among others, representatives from various banks, including Janata Bank, Rupali Bank, Sonali Bank, Agrani Bank, Standard Chartered Bangladesh, HSBC Bank Bangladesh, Dhaka Bank, City Bank, Mercantile Bank, Pubali Bank and Mutual Trust Bank, were also present.

At the meeting, central bank officials shared data indicating an improvement in the external position of the foreign exchange market, according to a source who was present.

The foreign exchange reserves recently crossed $21 billion as per the BPM-6 calculation of the International Monetary Fund (IMF) after declining in November due to the clearance of overdue letter of credit (LC) obligations.

The growing trend of remittance and export earnings has contributed to the increase in the US dollar stocks of the country.

The source also mentioned that banks were instructed to operate within a reasonable band on both sides of the mid-rate and to offer the same rate for all inward remittances, whether export or remittance related.

The difference between the buying and selling rates should not be more than Tk 1 per US dollar, the official said.

The banking regulator further directed banks to publish the rates offered to clients and to transact strictly according to the published rates.

"Banks will have to report their transactions to the Bangladesh Bank, which will in turn publish the overall market rates twice a day to enhance transparency and disclosures for both the banking industry and its clients," the official added.

Meanwhile, a senior central bank official said the banking regulator will strictly monitor compliance with the guidelines and set up a complaint cell under senior leadership of the BB.

Therefore, any credible whistleblowing or complaints from the industry or impacted clients will be thoroughly investigated, he added.

"After appropriate engagement with the alleged bank(s), if non-compliance is found, punitive measures will be taken," the official said.

Naser Ezaz Bijoy, CEO of Standard Chartered Bangladesh, welcomed the central bank's initiatives, labelling it "a transition phase towards market-based exchange rate regime".

He told The Daily Star that while the ultimate intention of the central bank is to eventually move to a market-based exchange rate regime, in the interim, the central bank is planning to adopt some measures to ensure transparency and stability of the foreign exchange market.

"Additionally, the BB has floated the ideas of alternative initiatives to garner stability of the exchange rate with participation of banks that have access to forex liquidity. This will contribute to developing a more active and deeper interbank market."

Sources at the meeting said that it was also discussed that many intermediaries and aggregators in overseas locations are responsible for the increase in exchange rates over the last few weeks.

Hence, the banks were asked to be more diligent and ensure the benefits of exchange rates for importers to contain inflation.

In a statement, Bangladesh Bank executive director and spokesperson Husne Ara Shikha yesterday said that the Bangladesh Bank has officially announced a maximum exchange rate of Tk 123 per US dollar for remittance collection in a bid to stabilise exchange rates.

The central bank attributed the ongoing US dollar market volatility to several interconnected factors.

One of the reasons is the increased demand for US dollars at the end of the financial year, which sees a spike in loan repayments and other financial obligations, she said in the statement.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments