'Bearish market resulted from floor price'

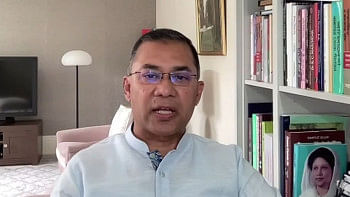

The long-term imposition of the floor price has had a negative impact on the stock market, leading to the current bearish trend, according to Md Ashequr Rahman, managing director of Midway Securities.

Besides, the regulators' constant policy changes have also contributed to the current state of the market, he said in an interview with The Daily Star yesterday.

The Bangladesh Securities and Exchange Commission (BSEC) had first imposed the floor price, which is the lowest price at which a stock can be traded, during the pandemic period and then for a second time in July 2022.

The aim was to halt the freefall of the indices amid uncertainties brought on by the lingering fallouts of the coronavirus pandemic and Russia-Ukraine war.

Last January, it started gradually withdrawing the floor price and after an initial period of recovery, the market has been falling almost continuously.

The prime index has returned to what it was before the imposition of the floor price, meaning the regulator is again faced with what it sought to prevent almost two years ago, said Rahman.

"The long-term imposition of the floor price has had a detrimental impact on market dynamics," he said.

Due to the floor price, only those stocks that account for small amounts in market capitalisation and low paid-up capital and float were consistently traded, he said.

Market capitalisation refers to the value of a company calculated by multiplying the total number of shares by the present share price.

Paid-up capital is the amount of money a company has received from shareholders in exchange for shares of stock.

A stock with a small float means it has few shares available and will generally be more volatile than a stock with a large float.

With the market suffering from a lack of liquidity, whatever money available was logically injected into such stocks, explained Rahman.

"However, since the floor price has now been removed, these stocks, which previously rallied irrationally, are now behaving more rationally," he said.

He said the investor community dislikes uncertainties and all stocks must be allowed to follow the same rules. If there is no clear visibility, the market will go into panic and impact stocks, he said. Moreover, the DSE website recently displayed unusual data while the market was bearish, further undermining market confidence, said Rahman.

All indices of the Dhaka Stock Exchange (DSE) had showed unusual figures for around nine hours till 7:00pm on March 10 due to an "operational error", which adversely impacted investor confidence, causing turnover to plummet amid huge sales pressure.

"Investors rely heavily on this crucial information when the market is active. The unprofessional conduct of the DSE in this regard added to investors' concerns," said the managing director of Midway Securities.

"People are hesitant to invest when they cannot access clear and accurate data," he said.

Rahman said rising interest rates were also a crucial factor.

"Stock markets worldwide are sensitive to interest rates. Investors are gradually shifting a portion of their investments into safer assets."

Brokers were recently allowed to purchase treasury bonds, which has facilitated investors in diversifying their portfolios easily. However, this also means that a certain portion of funds is exiting the equity market, said Rahman.

"To create a resilient capital market, we must acknowledge the aforementioned policy missteps and avoid them in the future," he said.

This will enable smart buyers to begin investing in undervalued stocks. While investors who are currently panicking may lose out, the astute ones will prevail, he added.

Besides, regulators should adopt a hands-off approach for the market, he said.

"Constantly amending rules creates uncertainty. Regulators should focus on fostering free and fair markets and remain vigilant against manipulators," said Rahman.

"Timely punishment of those who manipulate our illiquid markets will encourage long-term investments, which is the true backbone of this industry, to stay," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments