Budget implementation stays low despite surging allocation

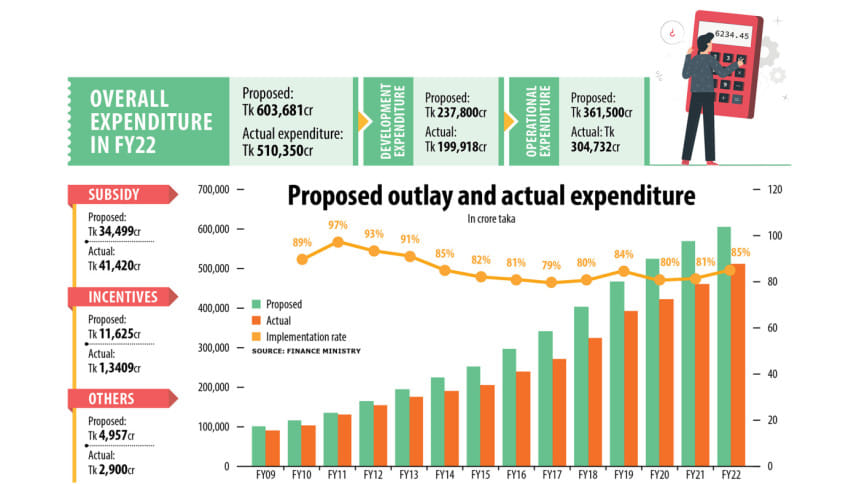

The government managed to implement 85 per cent of the budget in the last fiscal year despite spending a huge amount as subsidies and incentives, raising questions about the trend of unveiling bigger budgets year after year.

The shortfall in the national budget execution is common since the development expenditure target set by the government has remained ambitious amid the lower spending capacity, according to economists.

Since the fiscal year of 2008-09, the government has not been able to implement the budget fully. The execution rate was 97 per cent in 2010-11 and 90 per cent in 2012-13. Since then, it has ranged between 80 per cent and 85 per cent.

For the last fiscal year that ended in June, the government projected that the budget spending would increase significantly as it eyed economic recovery from the Covid-19 pandemic and the Russia-Ukraine war. But the recovery has been hampered for the dragging war.

The shortfall in the national budget execution is common since the development expenditure target set by the government has remained ambitious amid the lower spending capacity, according to economists

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, said: "The government has set an ambitious development expenditure target in every national budget. However, it is apparent that such targets are not implemented fully."

"In the last fiscal year, budget implementation fell short of the target as development expenditure was less than projected."

According to a finance division's report, budget implementation stood at Tk 5,10,350 crore in FY22 against the revised goal of Tk 5,93,500 crore.

In FY22, the government spent Tk 1,99,918 crore as the development budget, which included Tk 1,64,963 crore under the annual development programme (ADP).

The revised development allocation was Tk 2,21,948 crore and Tk 2,09,977 crore was set aside for the ADP, meaning the government had implemented 78 per cent of the programme.

Apart from the ADP, the government's development expenditures also include expenses under the revenue budget, said an official of the finance ministry.

In FY22, Tk 3,66,627 crore was allocated in the revenue budget. Of the sum, ministries and divisions managed to spend Tk 3,04,732 crore, accounting for 83 per cent of the allocation.

The allocation in the revised budget increased significantly in the last fiscal year due to a price hike of energy and fertiliser in the international market, driven by the war, the global energy crisis and supply disruption.

In the original budget for FY22, the government's subsidy allocation was Tk 34,499 crore. It went up by 34 per cent to Tk 46,150 crore in the revised budget. However, the government could spend Tk 41,420 crore in the end.

It set aside Tk 11,625 crore as incentives in the original budget and it was later hiked to Tk 14,625 crore. Finally, Tk 13,409 crore was spent.

In FY22, the government kept aside a significant amount to purchase coronavirus vaccines and manage Covid-19 patients as well.

But a large portion of the special allocation remained unspent because the government received vaccines as donations from various countries and international agencies, said officials of the finance ministry.

"Over the last decade, the budgetary target setting in Bangladesh has emerged primarily as a numbers game, with each year's targets surpassing the previous year's - notwithstanding the extent of actual attainment," said the Centre for Policy Dialogue earlier.

The government also failed to collect revenues as per the target.

It raised Tk 3,37,263 crore as revenue in FY22 whereas the target was Tk 3,89,000 crore. As a result, Bangladesh has continued to be a country with one of the lowest tax-to-GDP ratios in the world, narrowing the government's fiscal capacity.

According to the World Bank, the large gap between budget and execution limits the ability to enforce accountability in public finances, weakens the credibility of the budget and reduces effective implementation of public investment and service delivery, affecting the overall development outcomes of government programmes.

The revised budget for FY22 set a 5.1 per cent budget deficit goal in relative to GDP. It stood at 4.33 per cent finally, putting the government in a comfortable position in meeting the conditions set by the International Monetary Fund (IMF) as the country seeks $4.5 billion in loans from the global lender.

Sources say the IMF may make it mandatory for the government to keep the budget deficit below 5 per cent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments