Can apparel industry weather any storm? 2024 offers clues

For the local apparel industry, 2024 was a year marked by challenges, recoveries and a renewed sense of hope as the global market began to brighten -- proving once again the resilience of Bangladesh's apparel might.

Energy crises, dollar shortages, supply chain disruptions, labour unrest centring pay hikes, political uncertainty and a slack law and order situation: the list of domestic challenges for apparel-makers in 2024 was extensive.

In a positive development, Western buyers began returning to Bangladesh following the fierce nationwide movement and political changeover, as inflationary pressures eased and the world recovered from the pandemic and war fallout.

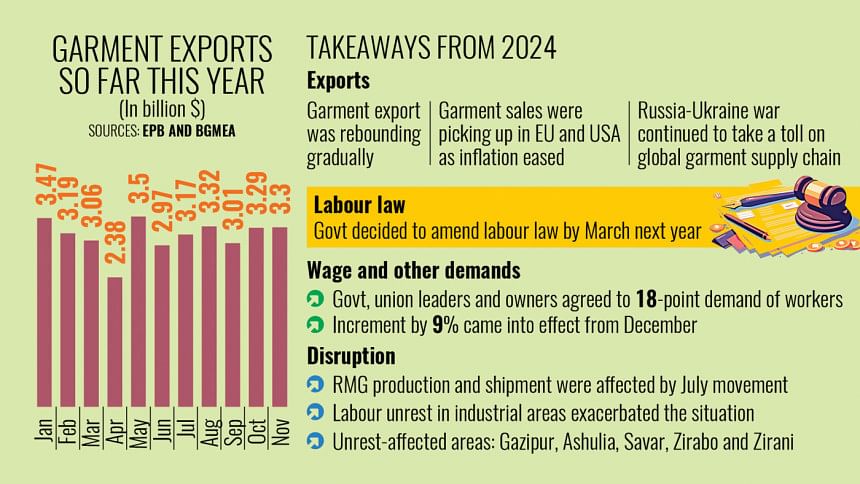

Consequently, Bangladesh's apparel shipments to major export markets like the EU and the USA rebounded. In the July-November period, the country's shipments grew by 16.25 percent year-over-year to $16.11 billion.

"This indicates that the future is brighter now than a few months ago," said MA Jabbar, managing director of DBL Group, whose top clients include Walmart-George, Puma, Esprit, and G-Star.

"I can see a very positive outlook for garment exports," Jabbar added.

The local apparel industry, which fetches the lion's share of the country's export earnings, began 2024 just after emerging from pay hike movements and with increased wages.

Amid the Covid recovery, global markets were then reeling from inflationary woes and the Russia-Ukraine war. There was also the Red Sea crisis and conflict in the Middle East.

Then, in June, the quota reform movement began, blocking apparel shipments to foreign markets.

In July and August, government-imposed internet blackouts and curfews intensified the situation, culminating in a violent political changeover.

This caused deadline delays for apparel-makers, many of whom had to offer discounts to compensate for late shipments.

Amid this struggle, massive labour unrest erupted in major industrial belts on the outskirts of Dhaka in July and continued until October, affecting both production and shipments following the nationwide student movement.

Labourers left production lines, blocked roads and streets and chanted slogans for pay hikes and increments, disrupting the already struggling local apparel manufacturing.

Due to unrest, vandalism and fires, factories in major industrial belts like Gazipur, Savar, Ashulia, Zirani and Zirabo were shut down for several months.

In September, factory owners, labour leaders and workers agreed on a resolution for their 18-point demand.

The minimum wage board increased the annual increment for garment workers to 9 percent from previous 5 -- one of the key labour demands in the 18-point.

The new increment took effect in December and the other demands, except for the amendment of the labour law, have been met too. The government has promised to amend the law by March next year.

For many, the resolution after the unrest meant production resumption, but for a few, it was worse.

For instance, Beximco Group laid off over 40,000 workers from its 16 textile and garment units.

The outgoing year involved correcting export data, as export earnings were previously overstated due to incorrect calculations.

In a final calculation, the central bank said that the garment sector's earnings in fiscal 2023-2024 were $36 billion, rather than the $47 billion calculated by the state-owned Export Promotion Bureau (EPB).

The outgoing year was challenging but also a time for business recovery as work orders rebounded with political stability, said Faruque Hassan, a former president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

Hassan said international retailers and brands are now returning with work orders as sales in the USA and EU have grown with the rebounding of retail sales.

According to BDL Group's Managing Director Jabbar, 2024 was one of the highest-exporting years, as they received massive work orders from international clothing retailers and brands.

"Now we really need to do more for better growth of the sector," Jabbar told The Daily Star over the phone.

He recommended establishing a dedicated EPB-like institution for the garment sector and ramping up investment in man-made fibre and sportswear segments to capture more global markets.

Meanwhile, Rizwan Rahman, a former president of the Dhaka Chamber of Commerce and Industry (DCCI), called for political stability for business growth.

He said the law and order situation has not improved to the expected level and is still affecting the business environment.

According to former BGMEA president Hassan, apart from political and labour unrest, the perennial power and energy crisis severely impacted investment inflow into the sector. As a result, many jobs could not be created in the sector this year.

Hassan also suggested investing more in man-made fibre to get better prices and increase exports, as the demand for specialised garments is increasing worldwide.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments