Can we learn anything from Sri Lanka?

Sri Lanka's worst economic crisis since its independence began in 2019. Experts attribute a plethora of reasons behind the crisis. First, after the end of the civil war in 2009, the country emphasised providing goods for the local market instead of trade, a decision that led to a continued trade deficit of more than $3 billion each year. Along with trade policies, tax cuts in 2019 led to a loss of government revenue of over $1.4 billion a year.

To tackle the reduction in foreign currency reserves, the country decided to ban imports of chemical fertilisers, which backfired because crop failures caused Sri Lanka to supplement food stocks by importing them.

In early 2022, Sri Lanka started facing shortages of fuel, power cuts, discontinuity of essential transportation services, and a ban in the sale of petrol and diesel for non-essentials. Offices and schools needed to remain shut down as a measure to conserve electricity.

In May 2022, Sri Lanka failed to make an interest payment on its foreign debt, the first in the country's history. All these factors led to protests, nationwide emergency and ultimately. a regime change.

At the onset of the crisis and the nation defaulting, the new Sri Lankan government took several courses of corrective measures. The country opted to restructure its loans with bilateral creditors i.e., India and China. This allowed it more time to repay loans owed to the countries.

Support was also received from the World Bank. With much of the reform commitment, the International Monetary Fund agreed to provide a $3 billion loan on top of a $600 million loan from the World Bank.

Sri Lanka raised taxes for higher earners from 12.5 percent to above 36 percent and on fuel and food and reduced public spending by better targeting social protection and restructuring state-owned enterprises.

The recent economic indicators of Sri Lanka show signs of recovery. From December 2022, tourism and remittances have started to rebound gradually, raising expectations of improvement in external balances.

In the first quarter of the financial year of 2023, there was a primary surplus for the first time since 2018. Interest rates and inflation are stabilising. Policy rates were cut twice -- in June and July 2023 -- by a total of 450 basis points in response to faster-than-expected easing of inflation.

The Lankan rupee is also showing recovery with a sharp appreciation of 12.1 percent in 2023 thanks to a continuous improvement in foreign currency reserves.

Moreover, Sri Lanka is expecting infrastructure-based foreign direct investment of $2 billion in 2023. However, the country's domestic and external debt situation is still under the cloud and it needs to work on these fronts by increasing domestic revenue and foreign currency earnings through tourism and expatriate remittances.

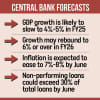

While the economic condition in Bangladesh is nowhere near defaulting, given the depletion of forex reserves, the depreciation of the local currency and the increase in repayment of foreign loans starting in 2025, things are not looking good.

The country has taken steps to stabilise foreign currency reserves with policy measures restricting imports. Steps are also being taken to enhance revenue collection with the improvement in policy implementation. However, FDI inflows, the low rate of repatriation, and avoiding tax in the form of over- and under-invoicing are pertinent issues.

Improvement in government spending is another aspect that may be re-looked. Proper economic and social benefits of public investments must be ensured and state-owned enterprises can be restructured and made more efficient.

There must also be a constant focus on the necessary optimisation of the size of the government, the exchange rate stabilisation, and the quickening of the state-owned asset turnover.

The author is an economic analyst

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments