Capital machinery imports fall for third year

Bangladesh's imports recovered in fiscal year 2024-25 after two years of downturns, but capital machinery imports fell for the third consecutive year, reflecting a low appetite for investment among entrepreneurs.

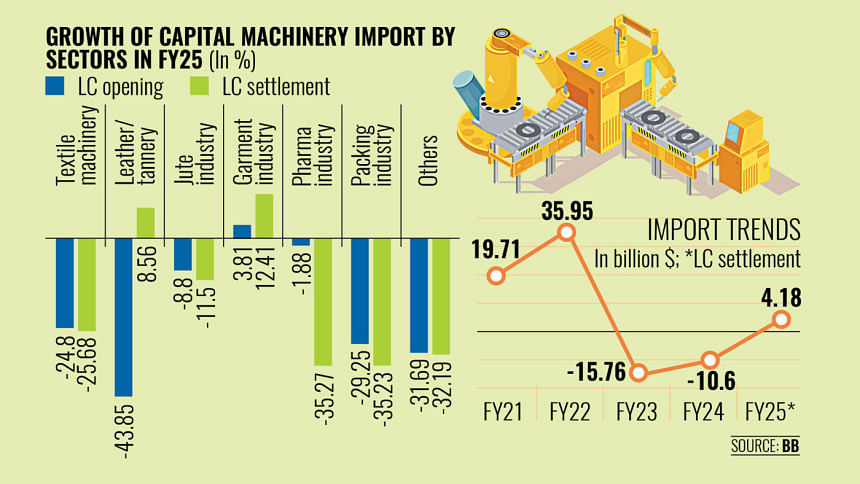

Imports of capital machinery, as reflected by the opening of letters of credit (LCs), dipped by 25 percent year-on-year to $1.74 billion last fiscal year, according to the latest data of Bangladesh Bank (BB).

During the same period, settlement of LCs dropped by 25 percent year-on-year, with analysts and businesses terming the decline a sign of weakened investor confidence and subdued industrial demand.

"This reflects a slowdown in both current and forward-looking investments," said Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD).

The BB says capital machinery imports for the leather industry fell the most, followed by those for the packing, textile, and jute sectors.

Stakeholders said a contractionary monetary policy, now in force, is another major factor discouraging investors.

Private sector credit growth stood at just 7.15 percent in May of FY25 whereas the target was 9.5 percent.

"Uncertainty over policy and ease of doing business is dampening appetite," said Rahman.

Asif Ibrahim, former chairperson of Business Initiative Leading Development (BUILD), said the sharp decline in LC openings was largely a result of mounting pressure on the country's foreign exchange reserves.

"As the trade deficit widened and remittance inflows remained volatile, Bangladesh Bank was compelled to prioritise essential imports—such as food, fuel, and medicine—while restricting non-essential and luxury items to preserve dwindling reserves," he said.

"This prompted tighter administrative measures and more rigorous scrutiny of LC approvals," he added.

Commercial banks, in response, raised LC margin requirements—often demanding 100 percent cash margins—which created major hurdles for importers, particularly small and medium-sized enterprises (SMEs), said Ibrahim.

"The steep depreciation of the taka further inflated import costs, leading many businesses to defer or abandon their import plans," he said.

"Simultaneously, rising domestic inflation and a slowdown in private sector credit growth have dampened both industrial and consumer demand, weakening the overall appetite for imports," he added.

On the supply side, liquidity constraints within the banking sector and growing concerns over the country's creditworthiness have made foreign banks more cautious in confirming LCs, adding to the pressure, said Ibrahim.

"All these factors combined have contributed to a significant drop in LC openings, highlighting the broader strain on both the external and domestic fronts of the economy," he said.

Mohammed Amirul Haque, managing director of Premier Cement Mills, said the declining trend in LC openings signals a negative outlook for fresh investment.

He said the three key reasons for the lack of new investment were—uncertainty surrounding policy support under the interim government, inadequate utility services, and weak governance.

"It appears that entrepreneurs are waiting for political stability and a reduction in the interest rate," said Mohammad Ali, managing director and CEO at Pubali Bank PLC.

"Exports also require a jump to see a rise in capital machinery imports," he said.

Ashraf Ahmed, former president of the Dhaka Chamber of Commerce and Industry, said overall, the increase in imports indicates a slightly better economic performance, but the details expose new weaknesses and threats to domestic industry.

"We are witnessing the positive impact of adopting an orthodox and prudent monetary policy – our trade deficit is lower, we are witnessing robust growth in remittances—supported by market-based pricing, which has helped us reduce the current account deficit," he said.

"This, however, is coming at the cost of lower growth, lower investment, and slow growth in jobs," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments