Cash recycling machines gaining traction

Cash recycling machines (CRMs), set up by banks in Bangladesh to help clients deposit, withdraw and transfer money instantly, almost doubled in the last financial year.

In 2021-22, banks installed 917 such machines, taking the total to 1,821, up nearly 99 per cent from a year ago, data from the Bangladesh Bank showed.

The new technology was introduced in Bangladesh in 2017.

Since then, banks have been increasingly installing CRMs as it offers a number of core banking services, cutting customers' reliance on branches and giving them more freedom to carry out financial transactions whenever they want since the machines operate round the clock.

A CRM can accept cash, count the notes, authenticate them, and credit the amount to accounts on a real-time basis, helping banks do away with the manual labour needed to provide the service.

It allows users to deposit and transfer funds to other accounts as well.

The rural parts of the country saw a huge increase in the number of CRM installed. Banks set up 159 CRMs outside big cities and towns in FY22, a 120 per cent year-on-year rise from the previous financial year's 133 units.

They installed 745 CRMs in urban centres, raising the total number to 1,529, an increase of almost 95 per cent from the previous year, according to the central bank data.

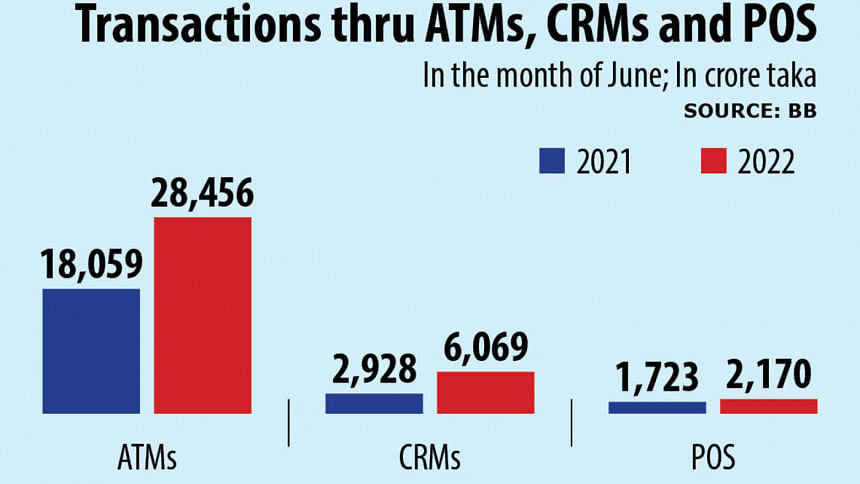

Transactions through CRMs rose to Tk 6,069 crore in June, more than doubling from Tk 2,928 crore in the same month last year.

"The number of CRMs is increasing rapidly as the machine has the facility of both real-time deposit and withdrawal," said Ziaul Karim, head of communications and external affairs at Eastern Bank Ltd.

CRMs cut the necessity for many customers to visit branches, have reduced the pressures on banks, and brought down the frequency of cash loading.

"Therefore, the operating cost is being rationalised. It is also the best source for an instant cash deposit in both cards and accounts," Karim said.

Currently, 16 banks are using CRMs across the country. EBL has set up five CRMs and another 50 will be installed in the next four months.

Amid the growing use of CRMs, cash deposit machines (CDMs), which only allow depositing cash, and automated teller machines (ATMs), which permit fund withdrawals, are going to be outdated gradually, bankers say.

There were 1,699 CDMs across the country at the end of FY22. It stood at 1,664 at the end of FY21, BB data showed.

No new CDM was set up in the rural areas since December when the number of such machines fell to 505.

The number of ATMs increased 6 per cent year-on-year to 13,036 as banks set up 699 new automated teller machines since June last year.

Users used ATMs to transact Tk 28,456 crore in June, a year-on-year increase of 58 per cent. It was Tk 18,059 crore in the same month in 2021.

Karim thinks since ATMs are being used for cash withdrawals only, CRMs will replace them in the next five to seven years.

The number of points of sale (POS) devices, which enable merchants to accept payments through cards, rose 23 per cent year-on-year to 101,341 in June, highlighting the shift to digital transactions. The devices installed hit the one-lakh mark in April.

Transactions through POS devices stood at Tk 2,170 crore in June, up 26 per cent from Tk 1,723 crore a year prior.

As banks are increasingly moving to digital means of providing services and customers are finding them convenient, the number of branches increased by only 2 per cent to 10,980 in the last fiscal year.

Banks set up 192 new branches last financial year, with a majority of them in rural areas.

Some 107 branches were set up in rural areas, raising the total number of outlets beyond cities and towns to 5,243.

The number of total branches in urban areas stood at 5,737 and 85 new branches opened in FY22.

All except one branch provide full-fledged online services.

A central banker says branch-led banking is already on the wane in keeping with the spread of internet banking, which cut the operational costs of financial institutions. Transactions through internet banking more than doubled in the last fiscal year.

Mobile financial services are also expanding.

There were 17.86 crore MFS customers at the end of the last fiscal year, transacting Tk 94,293 crore alone in June, up 19.89 per cent year-on-year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments