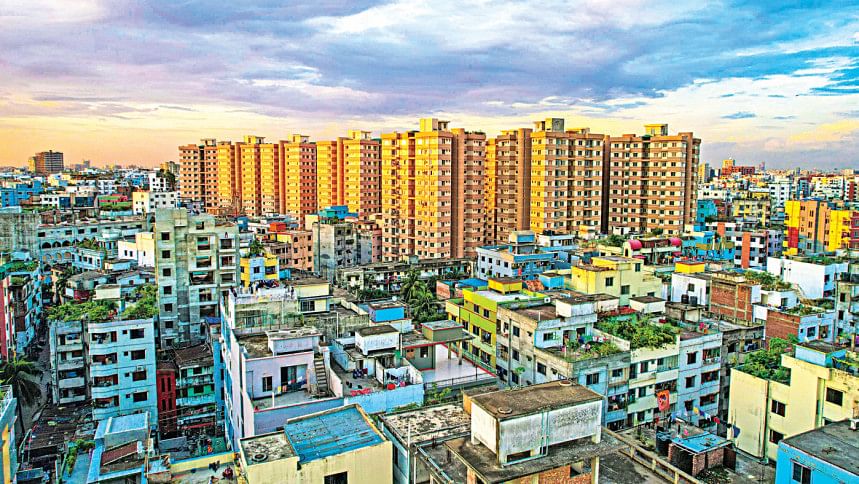

Demand for luxury flats intact despite economic woes

The demand for luxury apartments has remained unchanged while the sales of regular properties and initiation of new housing projects are in the slow lane amid the ongoing economic crisis, according to market players.

Sustained inflationary pressure stemming from global crises, such as the Russia-Ukraine war, has driven up apartment prices by increasing the cost of raw materials.

As such, construction costs have gone up by Tk 1,500 to Tk 12,000 per square foot depending on the size and location of the property, as per an assessment by the Real Estate and Housing Association of Bangladesh (REHAB).

Officials of building technology and ideas ltd (bti), one of the top realtors in the country, say the approval of new housing projects has come down to one-third of normal levels due to the new Detailed Area Plan (DAP).

For example, the Rajdhani Unnayan Kartripakkha (Rajuk) would approve an average of 100 building plans per month before the new DAP took effect. Now, it approves 33 plans per month.

The 20-year master plan was approved last July with the aim of making Dhaka a liveable and modern mega city by 2035.

Despite these constraints, the demand for luxury apartments remains constant as the target customers are of an economic stratum, which has been less affected by economic crises compared to the general public.

"Our target customers can afford to buy apartments as they are premium customers, so the economic crises have not hit them as immensely as the general people," said FR Khan, managing director of bti.

"Even the rate of apartment booking has stayed the same for us as we did not increase prices. We have compromised with profit margins."

Khan then said bti has 72 ongoing construction projects in different parts of Dhaka.

However, he did acknowledge that fresh bookings have declined significantly as property prices have gone out of reach for many due to price hikes amid the inflationary pressure.

Tanvir Ahmed, managing director of Sheltech Group, another realtor in Bangladesh, said his company's sales have slowed as people are holding onto their finances and observing the situation.

Besides, many developers have slowed the construction of new projects under mutual agreements with landowners as raw material prices have been on the rise.

Even opening letters of credit (LCs) to import materials has become very challenging for companies owing to a US dollar shortage.

Ahmed went on to say that this is because banks are more willing to work with companies with export exposure as they can bring in foreign currencies.

"So, opening an LC with 100 per cent advance payment can be a daunting task for now," he said, adding that the import of mechanical items such as elevators and generators is being delayed.

According to Ahmed, landowners are taking more time to settle their agreements considering the implications of the new DAP. So, rolling out new projects is on the decline as well.

"I think there are ups and downs in every business cycle. First came the Covid-19 pandemic. Then the Russia-Ukraine war broke out. Now, a global economic slowdown caused by the war is affecting us all," he added.

Realtors are worried about the slowdown in sales as they were forced to adjust apartment prices in line with the price hike of construction materials.

Also, there is the impact of the new DAP to consider, said Kamal Mahmud, first vice-president of the REHAB, and managing director of Skiros Builders Ltd.

He pointed out that while realtors received a good response from customers during the REHAB Fair in December owing to various offers, those sales do not represent the year-round business situation.

Around 10,000 apartments were sold in 2021 as some customers were able to shrug off the pandemic's fallout while the government extended amnesty for the investment of untaxed income in the housing sector.

However, apartment bookings came down to about 6,000 units in 2022 due to the ongoing economic crisis stemming from the war.

"There are no ready apartments available in the market as realtors are cautious about new ventures and are only constructing previously approved projects," said Mahmud.

However, a senior official of Brac Bank who deals with home loans says the demand for financing apartment purchases has stayed the same despite the economic crisis.

Regarding the reduced number of new projects, he said realtors that took permission in advance for high-rise buildings are completing the construction in phases as they know the Rajuk will not provide such approval in the near future.

"Customers who are buying apartments, both luxury and regular, are those who have the ability to make such large purchases. So, the price hike does not matter much to them."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments