Deposit growth rises, loan growth falls

The deposit growth in the banking sector of Bangladesh rose in the first quarter of 2023 from a quarter ago as businesses prefer to park funds with lenders instead of making investments amid the ongoing economic slowdown and uncertainty.

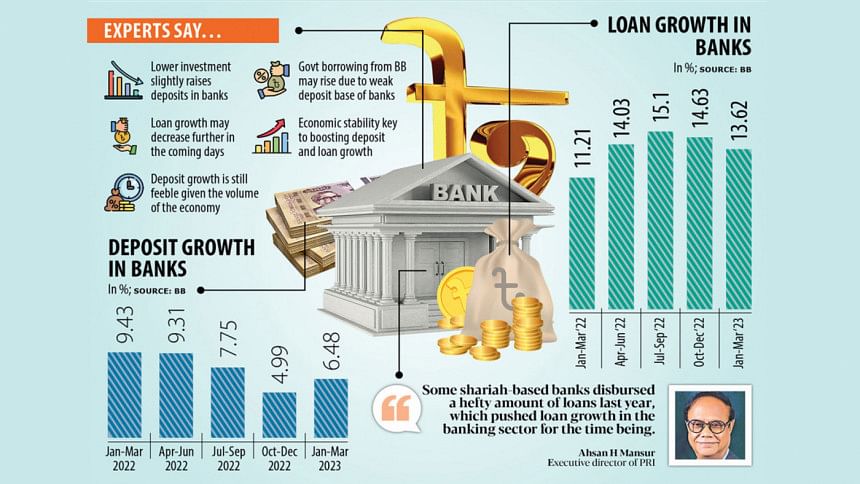

The deposit growth stood at 6.48 per cent in March, up from 4.99 per cent three months ago. It, was, however down from 9.43 per cent from a year ago, data from the Bangladesh Bank showed.

Deposits in the banking sector stood at Tk 16,13,062 crore at the end of third month of the year.

Amid a liquidity crunch and higher consumer prices driven by deep economic uncertainty and the foreign exchange volatility brought on by the Russia-Ukraine war, the deposit growth suffered a steep decline from March to December last year as the capacity of individual savers as well as businesses was squeezed.

Scams at a number of banks also forced some savers to withdraw funds as their confidence was dented. The deposit growth, however, broke the falling trend in March this year after the central bank stepped in to restore their confidence.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, says that the broadening of the deposit growth is good for the economy.

"It gives an indication that the liquidity base in the banking sector has widened to some extent."

He, however, thinks that some businesses might have kept their funds in banks instead of investing.

In addition, the central bank provided liquidity support to a number of cash-strapped banks in the first quarter, boosting deposits, he said.

The lower investment made by businesses has adversely hit the loan growth, which stood at 13.62 per cent in March, down from 14.63 per cent three months earlier. It was 11.21 per cent a year ago.

The loan growth increased between March and September last year before starting to fall steeply from March this year as the economic woes showed no signs of disappearing amid the persisting global and national crises.

Banks collectively disbursed Tk 14,05,084 crore in loans as of March this year.

Mutual Trust Bank's Rahman thinks that investment is facing sluggishness across the globe and the same situation exists in Bangladesh as well.

"The purchasing power of the common people has decreased in the country, which has discouraged businesses from going for expansion."

Inflation has stayed at an elevated level in the past one year, owing to both external and internal factors, hurting the pockets of fixed-income groups and the poor.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, says some shariah-based banks disbursed a hefty amount of loans last year, pushing up the loan growth.

Although the deposit growth increased a bit in the first quarter of 2023, the improvement is still weak given the size of the economy, he said.

"If the deposit growth does not reach the expected level, the loan growth will fall further, which will slow down investment."

The lower deposit growth will compel the government to continue borrowing heavily from the central bank to manage its deficit financing. The large volume of government borrowing from the central bank has already brought a negative effect for the economy as it has fueled inflation.

Inflation escalated to an 11-year high of 9.94 per cent in May. May's figure takes the average inflation to 8.95 per cent, way above the revised budgetary target of 7.5 per cent for the financial year ending on June 30.

Mansur urged the government to avoid higher borrowing from the central bank to keep the macroeconomy stable.

Between July 1 and May 24, the government took loans to the tune of Tk 85,024 crore from the banking sector. Of the sum, Tk 69,208 crore came from the BB.

If deposits in banks increase, the government can take a portion of its required funds from commercial banks along with the central bank, a central banker said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments