Desperate, banks ignore own rates for collecting remittance

In a desperate attempt at collecting the greenback to meet immediate requirements, a good number of banks are ignoring directives of two lenders' organisations to not offer over Tk 107 for each US dollar coming in as remittance.

The directive was a part of a consensus reached between Bangladesh Foreign Exchange Dealers' Association (BAFEDA) and the Association of Bankers Bangladesh (ABB) in September to follow multiple exchange rates.

Documents seen by The Daily Star showed that three banks were ignoring the directive, offering up to Tk 110 for each dollar availed from foreign exchange houses.

But senior bankers, on condition of anonymity, say that at least 15 to 20 banks were offering higher rates.

Economists say that these incidents reveal the volatility the still persists in the foreign exchange market and which would deepen further if appropriate policy measures were not immediately taken.

The market should be allowed to determine the exchange rate between the taka and the dollar, otherwise the volatility will not subside, they said.

The banks offering high rates are now getting more remittance than others, creating an uneven competition in the banking sector, said the bankers.

Although some banks have a strong network of agent outlets in rural areas, they are now getting lesser remittance than those offering the higher rates.

"Our remittance inflow is decreasing as we are following the BAFEDA's instruction," said an official of a bank having such a strong agent outlet network.

Contacted, Md Mezbaul Haque, spokesperson of Bangladesh Bank, said the central bank can hardly do anything to this end as the BAFEDA had fixed the rate.

The BAFEDA is an organisation of banks whose priorities include implementing foreign exchange-related policies.

Haque thinks that the organisation should take steps against the errant banks as the central bank had not set the rate.

He, however, said the central bank may talk to the BAFEDA about the matter.

A managing director of a bank said the BAFEDA does not have any authority to take steps against a bank.

Rather the central bank should identify steps that should be taken, he said.

Punitive measures against the errant banks will not be the solution, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

"The dollar-strapped banks ignore the rate as they have to meet their immediate requirements for making import payments," he said.

The central bank should take measures to withdraw the multiple exchange rates with a view to restoring discipline in the foreign exchange market, he said.

As per the policy of the BAFEDA and ABB, exporters are allowed to get Tk 102 for each US dollar. Importers buy the greenback based on the weighted average exchange rate plus Tk 1. The average rate will be decided based on the rates paid to exporters and exchange houses.

The two organisations took the decision to halt further depreciation of the local currency against the dollar.

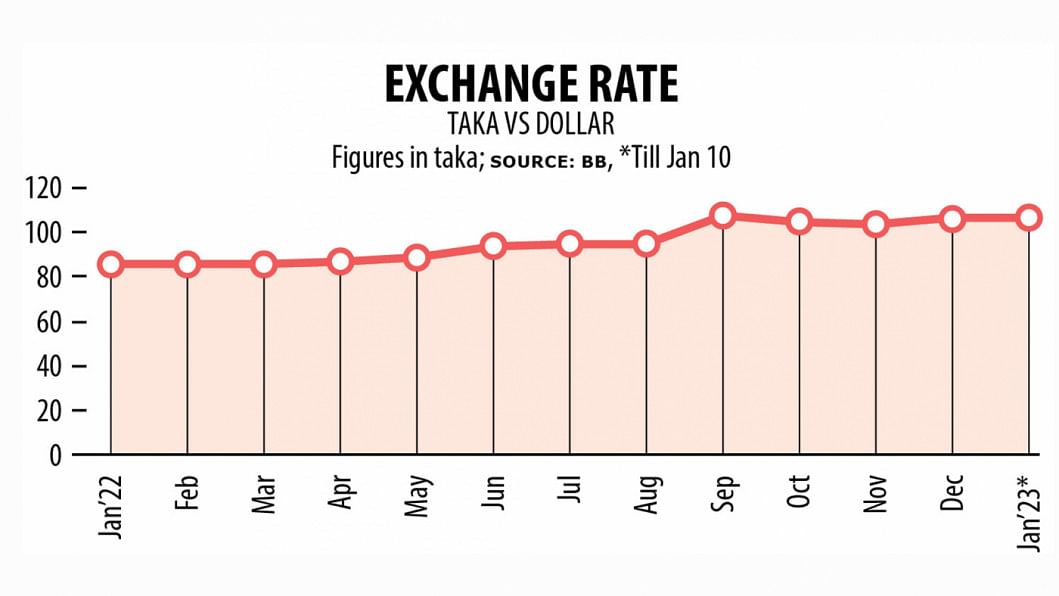

The interbank exchange rate of the dollar stood at Tk 107 on January 10, which was 24 per cent higher year-on-year.

If the market determines the rates, there will be no distortion, said Mansur.

The country's foreign exchange reserves are still going down, which is not good for the economy. It had slipped to less than $33 billion on January 9 after the central bank cleared international import bills.

The BB paid $1.12 billion to clear payments for the country's imports from member states of Asian Clearing Union (ACU), an arrangement to settle payments for intra-regional transactions among member countries, including Bangladesh.

Volatility in the market was expected to subside had the import payments reduced, said Mansur, also a former high official of International Monetary Fund.

"But this has not happened. Required policy measures should be taken immediately, or else the reserves will decrease further," he said.

Multiple exchange rates can not be followed for long, said Monzur Hossain, research director of the Bangladesh Institute of Development Studies.

The exchange rates should be aligned with the market rate gradually and the central bank should closely monitor the market, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments