Dhaka bourse goes dark after error in adjusting single firm’s rights shares

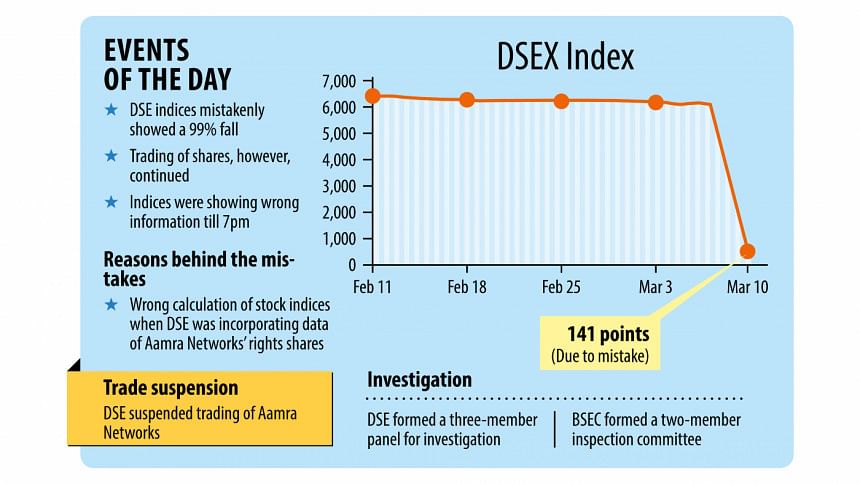

All indices of the Dhaka Stock Exchange (DSE) showed unusual figures yesterday due to an "operational error" that adversely impacted investor confidence, causing turnover to plummet amid huge sales pressure.

The turnover, an indicator of the volume of shares traded, nosedived to Tk 478 crore while it averaged Tk 1,020 crore in the past month.

Just 20 minutes into the day, the DSE, the benchmark index, dropped by an astounding 6,112 points, or 99 percent, to just 0.39 points, according to the website of the country's premier bourse.

Other indices saw similarly peculiar movement with the DSES, an index comprised of shariah-compliant companies, and the DS30, which represents blue-chip stocks, having declined significantly.

The indices receded even though 162 of the 379 stocks traded advanced.

Although the DSE claims that these figures were all incorrect due to an operational issue, a few sources alleged that it was actually caused by a human error.

A mid-level official of the bourse said officials of the bourse had wrongly calculated the stock indices while including 3.09 crore rights shares of Aamra Networks.

The inclusion of a company's rights shares impacts market indices by raising the number of free-floating shares available. However, the adjustment was wrongly calculated, as reflected in the data, he added.

"The indices of the DSE showed unusual figures while taking corporate action for the right share entitlement of Aamra Networks," the country's premier bourse said in a statement.

As a result, the trading of Aamra Networks was suspended for the day considering the greater interest of the capital market and to ensure proper representation of the indices, it added.

On condition of anonymity, a top official of a brokerage house said it was an unprecedented event for the indices to show such disproportionate figures while the share trading was operational.

"This type of inaccurate figures raises suspicions among investors since it did not happen before."

The stockbroker also questioned why it took so long to fix the problem as investors were left in the dark about the market movement throughout the day.

"The DSE's disclosure on Aamra Networks indicates that it was their fault and it stemmed from wrongly inputting the data in index calculations. However, the DSE failed to fix it immediately."

Sajedul Islam, a former vice-president of the DSE Brokers Association, said it is unacceptable to see such wrong data on the website of a stock exchange.

"Due to the wrong presentation of the market scenario, investors panicked, prompting many to sell shares impulsively. The market is already in a bear run after the withdrawal of floor prices."

Ziaur Rahman, an investor, said the fact that the country's premier bourse displayed incorrect figures all day long indicates that its IT team lacks capability.

As the exchange could not fix the issue until 7pm, rumours were going round that it was a move by the regulator to divert investors' attention from the downgrading of many companies to the disreputable "Z" category.

"The DSE should have sorted out the problem fast and disclosed the real reason so that people could understand," Rahman added.

DSE officials said they held a meeting with Nasdaq, the New York-based trading software provider, to resolve the issue. However, it was not solved until 7:00pm yesterday.

At the time, the DSE website was still showing that the DSEX had dropped by 5,971 points, or 97 percent, to 141 points by the end of the trading session.

The DSES fell by 1,304 points, or 97 percent, to 30 points while the DS30 shed 10 points, or 0.50 percent, to 2,083 points.

After 7:00pm, the DSE website displayed the updated figures, showing that the DSEX dropped 37 points, or 0.61 percent, to 6,075 while the DSES and the DS30 fell 10 points.

The bourse has formed a three-member committee to probe the incident. The body, headed by AGM Sattique Ahmed Shah, chief operating officer (in-charge) of the DSE, has been ordered to submit a report within the next three days.

The Bangladesh Securities and Exchange Commission (BSEC) also decided to inspect the IT and indices management operations of the exchange and formed a two-member committee.

Md Sohidul Islam, a deputy director of the commission, and Muhammed Dastagir Hussain, an assistant director, will carry out the inspection and submit a report within the next three working days.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments