Digital transactions – the new normal

The Covid-19 pandemic has turned out to be a global issue of shared human vulnerability. Except for a few islands in the south Pacific, no country has been spared from the invisible virus. The woes continue to batter the economy and threaten sustainability.

While scientists have succeeded in developing a vaccine, governments in most countries are still battling this biological turbulence by enforcing lockdowns, social distancing, closure of educational institutions, tourism and travel. They are in a dilemma in chalking out a balance between economy and health.

While tomorrow looks uncertain, the pandemic has brought us to a turning point wherein we need to redesign our policies in economic, social, educational, and administrative areas. We need to redefine and reactivate our policies and practices in all fields with due stress on protection, inclusivity and sustainability. That is a massive job that needs colossal resources, prudential thinking, a global approach and stronger faith in science and technology.

Although the Covid-19 is a health crisis, it has a direct arterial impact on the economy. The catastrophe has caused a profound drop in growth, a rise in unemployment, widened inequality and increased poverty. The economic decline can adversely impact the health sector. When money circulation goes downhill, there will be lower tax returns. Moreover, as announced by several governments, the weight of the stimulus packages will be heavier to have a recovery in the balance sheet.

However, technological developments over the last few decades have saved humans and the economy from being totally crushed. Notably, there has been unprecedented development in digital technology, which enables people to access information and facilities even from a remote location.

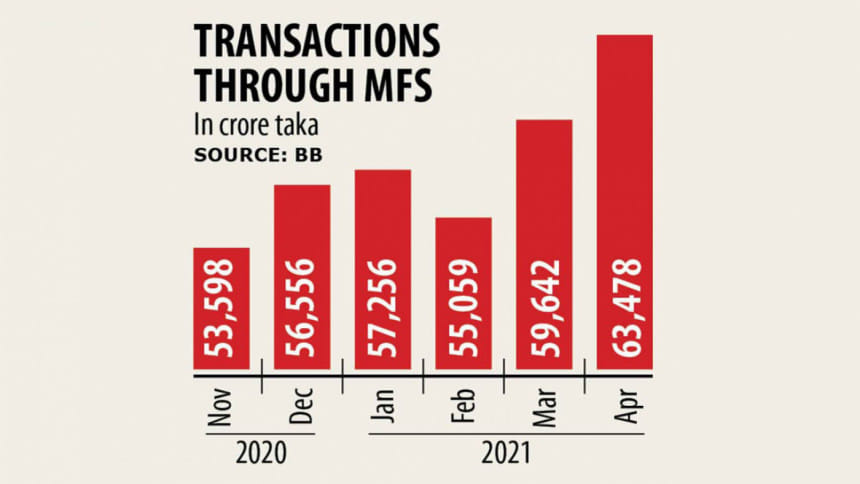

The pandemic has further accelerated the digitalisation of the economies. As all deterrent measures like lockdowns and social distancing were in place, digital transactions have become a daily necessity.

The World Bank estimates that globally about 1.7 billion adults still do not have any bank account. However, digital payments through a mobile device are getting popular, and hopefully, it would soon help widen the aspect of financial inclusion.

In Bangladesh, there are 59 scheduled banks with more than 10,000 branches. Yet 40 per cent of the population is still unbanked – a situation has given rise to the mobile financial service (MFS).

Set up by Brac Bank, bKash has shown the MFS way in Bangladesh. Since its operation in the middle of 2011, it has made such a strong impact in the financial ecosystem that even global institutions such as the International Finance Corporation, the Bill & Melinda Gates Foundation, and Alibaba have become shareholders. Today, bKash owns the majority of the market share, followed by Bangladesh Bank-regulated services like Rocket and Upay.

The usefulness of MFS was best felt during the pandemic. To comply with the new health standards and restrictions and ensure personal safety, more and more people opted for financial transactions through mobile phones. On the back of its wide network, bKash has acquired a huge number of users. Since March 2020, it has added 14,420,370 new customers. Other MFS providers have also had significant customer acquisition.

This financial technology has been highly beneficial in reaching out the government's initial stimulus package of Tk 5,000 crore to the workers of export-oriented garments industries last year.

About 45 per cent of it was channelled through bKash, 29 per cent through Rocket, and the rest by other MFS providers.

Besides, the stimulus packages for the beneficiaries in other sectors such as education, fisheries and livestock, agriculture and sports were also disbursed through the MFS providers.

The MFS has also become a favourite platform for migrant workers because of its swift transaction mode and faster transfer of funds to beneficiaries. In the first four months of 2020, bKash alone channelled an inward flow of Tk 138 crore from our migrant workers.

All these stories indicate that the pace for digitalisation has triggered momentum in keeping the wheel of livelihood and the economy moving despite the cruel and traumatic onslaught of the pandemic. With lockdowns, quarantines, social distancing and the fear of virus transmission through the use of cash, there has been a boom in e-commerce. Consumer behaviour is fast changing with remarkable digital adoption. The usage of digital payments and transactions is skyrocketing.

There remain a plethora of challenges as well.

The biggest issue would be the security of transactions. MFS usage must be monitored properly so that these are not abused by unscrupulous elements because, despite all precautions, fraudulent practices can take place.

A few months ago, the government's stipend money sent to the primary school students failed to benefit the recipients because of some fraudulent practices by unscrupulous people.

The success of MFS will also depend on the availability of proper devices and supportive contents. A vast majority of our rural population or the lower-income group, the biggest segment of MFS users, cannot afford smartphones. The government can play a catalytic role by providing subsidised phones, cutting taxes, and encouraging the inclusion of as many utility services as possible.

It is a matter of genuine concern that the government is likely to hike the corporate tax of MFS up to 40 per cent from the existing 32.5 per cent. This may be a significant blow for the budding MFS industry, where providers need to make a massive investment in technological innovations to ensure customer-centricity. None of them has made a mentionable profit yet.

The implementation of the proposed corporate tax would be detrimental to the progress made by the government in the field of digital transactions and financial inclusion.

It is now well-accepted that MFS has been acting like a life jacket, giving us a sense of assurance in cruising through the pandemic challenges. The consumers' reliance on MFS has strengthened a lot and would continue to grow as they realise the comfort, safety and convenience of using MFS. As digital transactions will become the new normal, it would also help narrow down the digital divide sooner than expected.

The author is an analyst. He can be reached at [email protected].

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments