Dollar kerb market heats up again

The exchange rate gap in the official and unofficial channels in Bangladesh has started to widen after a few months of lull as the US dollar is getting costlier in the informal market, a development that may adversely impact the remittance flow.

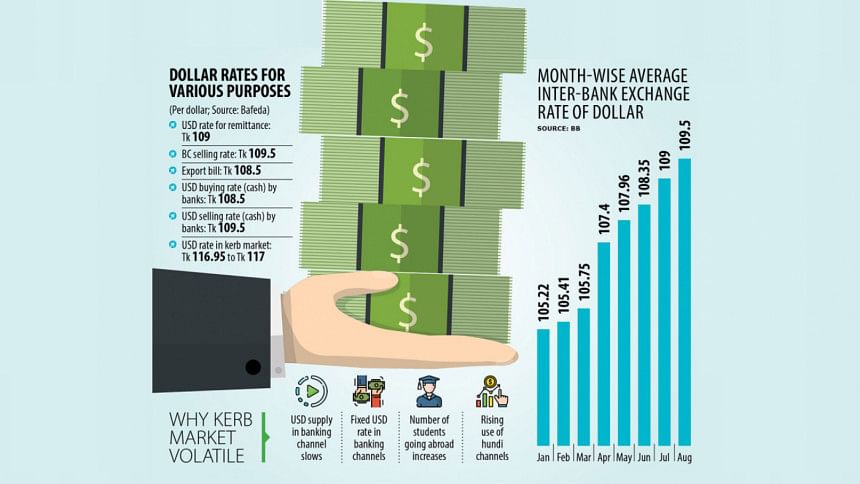

Whereas the US dollar was selling at Tk 109 to Tk 109.50 at banks, it has hit Tk 116.95 to Tk 117 in the informal market, also known as the kerb market.

The gap between the formal and informal exchange rates was low in the last few months.

Industry people blame the lower deposits of the USD in the banking system, the fixed dollar rate, the rising number of students going abroad, and the higher illegal cross-border transactions for the growing gap.

Most commercial banks are also not selling cash US dollars to travellers, forcing them to turn to the kerb market to avail foreign currencies, they said.

Half a dozen money changers in the capital's Motijheel area told The Daily Star yesterday that they were selling the USD at Tk 116.96 to Tk 117.

Travellers and visitors planning to go to other countries for medical purposes are struggling to buy American greenback, said one of them.

Money changers are displaying a foreign currency price list where the USD selling rate was cited to be Tk 112 and the buying rate was quoted as Tk 110.50, but the rates are hardly followed.

Helal Uddin, secretary of the Money Changers Association of Bangladesh, however, said the trade body will take action against any business if they are found to be not complying with the declared rates.

The fresh volatility in the forex market comes although the Bangladesh Foreign Exchange Dealers Association (BAFEDA) and the Association of Bankers, Bangladesh (ABB) have agreed to carry out transactions as per fixed rates.

They determine the rates of the US dollar every month as per an informal directive of the Bangladesh Bank.

On August 1, they fixed an exchange rate of Tk 109 per dollar for remittances. A rate of Tk 109.50 was fixed for importers and Tk 108.50 was set for exporters.

"The fixed USD rate in the banking channel has helped create an additional demand in the kerb market," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

He said when Bangladeshi expatriates get Tk 117 per dollar in the informal market, they will avoid sending remittances through the formal channel.

"The central bank should introduce a market-based exchange rate as per conditions agreed with the International Monetary Fund."

The global lender advised the central bank to introduce a market-based USD exchange rate to replace the fixed rate regime when it approved a $4.7 billion loan for Bangladesh.

The volatility was also driven by the slower inflow of remittances in August.

Between August 1 and August 25, Bangladeshi expatriates sent home $1.32 billion, which was lower than the same period last month.

Hussain said students and travellers are not getting adequate US dollars from banks and were forced to buy the currency from the money changers and other informal channels, pushing up the rates.

Banks are allowed to open files for students who are planning to go abroad to study. But most banks are not opening any files for the shortage of the currency.

BAFEDA Chairman and Sonali Bank Managing Director Md Afzal Karim said that if money changers impose a higher rate than the declared rate, the central bank will take action against them.

The spike in the dollar rate may hit the inflow of remittance as remitters turn to the illegal hundi markets to send funds to the beneficiaries.

In Bangladesh, a one-per cent deviation between the formal and informal exchange rate shifts 3.6 percent of remittances from the formal to the informal financial sector, said the World Bank in May.

Migrant workers sent home $1.97 billion in July, down 5.86 percent from a year earlier although a record number of workers left the country for jobs abroad in recent times.

In the last fiscal year of 2022-23, Bangladesh sent a record 11,44,993 workers abroad, up 15.8 percent from a year earlier, according to data from the Bureau of Manpower Employment and Training.

The forex market has been going through volatility for more than a year owing to a sharp fall in reserves, fuelled by higher import bills caused largely by the Russia-Ukraine war.

On August 23, the gross international reserves stood at $23.16 billion, way lower than the pre-war levels, BB data showed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments