Draft digital commerce act draws mixed reactions

A draft of the new digital commerce law has drawn mixed reactions from industry people and customers alike as some believe a legal framework is necessary to prevent fraud while others opined that it would lead to increased bureaucracy in the emerging sector.

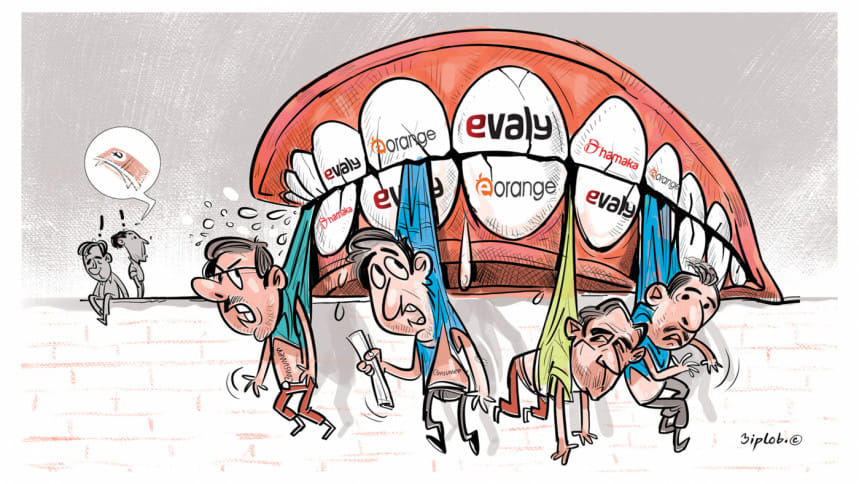

The law comes amid widespread scams centring the e-commerce sector in 2021 as some fraudulent platforms embezzled thousands of crores of taka from customers and merchants.

The commerce ministry has already sent the draft "Digital Commerce Act 2023," to different stakeholders and formed a committee to review it.

In absence of recognised laws in the field of digital commerce, some irregularities have been observed and a legal framework is needed to prevent them, according to the commerce ministry.

The Digital Commerce Act aims to facilitate expansion and maintain discipline by preventing, suppressing and prosecuting fraudulent activities in the sector.

Besides, a Digital Commerce Authority, featuring a director general and three directors, will be established to implement the act.

The Digital Commerce Act aims to facilitate expansion and maintain discipline by preventing, suppressing and prosecuting fraudulent activities in the sector. Besides, a Digital Commerce Authority will be established to implement the act.

Certain players in the e-commerce sector have expressed displeasure regarding the proposed measures, saying that it is unnecessary to form a dedicated regulatory body as the existing legal framework is sufficient to ensure discipline.

"We don't need a new law or regulatory body, what we need is proper implementation of the existing laws," said Fahim Mashroor, chief executive officer of Bdjobs.com and AjkerDeal.

Had not the Directorate of National Consumers' Right Protection (DNCRP) turned a deaf ear to the thousands of complaints on Evaly and other platforms, there would not have been any such scams in the sector.

He then said it is enough to increase the capacity of the DNCRP, the state agency responsible for hearing and addressing consumer complaints about goods and services, to bring discipline in the sector.

Md Hafizur Rahman, additional secretary of the commerce ministry and chief of the digital commerce cell, tried to quell these concerns by stating that the act is merely in its draft phase.

"A committee has been formed to evaluate it thoroughly," he said.

"The law will not do any harm to the sector. There was an instruction from the high court to formulate a law and the national digital Bangladesh committee also directed it," Rahman added.

The Daily Star spoke to several e-commerce customers to get their opinion about the law. Some expressed support, describing it as a positive step forward, while others are suspicious about the effectiveness and see it as damaging for the sector.

Md Jahidul Alam, a private sector employee, said there was enough scope for government bodies to prevent fraud in past years, but they failed in this regard.

"So, I am not sure if it [the proposed law] will bring any positive change or choke off the sector with more surveillance," he added.

However, Md Hussain, a resident of Dhaka's Agargaon, said without a regulatory body and law, it is impossible to weed out deceitful practices in the sector.

Biplob G Rahul, chief executive officer of eCourier, said a new regulatory body is needed for the sector, but the draft should be amended thoroughly.

THE DRAFT LAW

As per the draft Digital Commerce Act, online platforms will be fined three times the value of goods and services sold if they fail to deliver them within the stipulated time. In addition, failure to pay such fines will result in a maximum of three months of imprisonment.

For advertising illegal goods and services or organising online gambling and betting, there will be a fine of Tk 3 lakh or three years of prison or both.

The draft states that arranging lotteries, creating digital wallets and cash vouchers without permission is punishable by a fine of Tk 2 lakh, six months imprisonment or both.

The proposed law also makes it mandatory for online platforms to disclose accurate information about the description, size and measurement of goods and services in the digital marketplace.

A customer can pay cash on delivery or make advance payments and digital commerce organisations should have such alternatives.

As such, customers can use any credit card, debit card or mobile financial services approved by Bangladesh Bank for advance payment, it added.

However, under no circumstance can funds be deposited directly into the bank of the digital merchant or online seller. So, businesses must have an agreement with a payment gateway organisation.

As per the draft, e-commerce platforms will have to specify the maximum purchase orders for a customer. For daily essentials, the maximum purchase order limit is five per product and the limit is two for luxury goods.

However, if the value of a luxury good is less than Tk 1,000, customers can purchase five at a time.

An executive of an e-commerce platform said this will put an end to online business-to-business platforms.

Rahman of the commerce ministry said this provision will be scraped from the draft, enabling customers to purchase as much as they want.

Mashroor of AjkerDeal said making it mandatory to have a digital business identity in the law will discourage women and small and medium sized platforms from entering digital commerce.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments