Dyeing sector can’t keep up with robust apparel

No new dyeing factory was set up in Bangladesh last year although the segment is crucial to supporting the roaring apparel sector looking to double its exports.

As local exporters are increasingly embracing man-made fibres and producing high-end items, the country will need more dyeing facilities and high-quality textile clothing chemicals to cater to demand in the coming years.

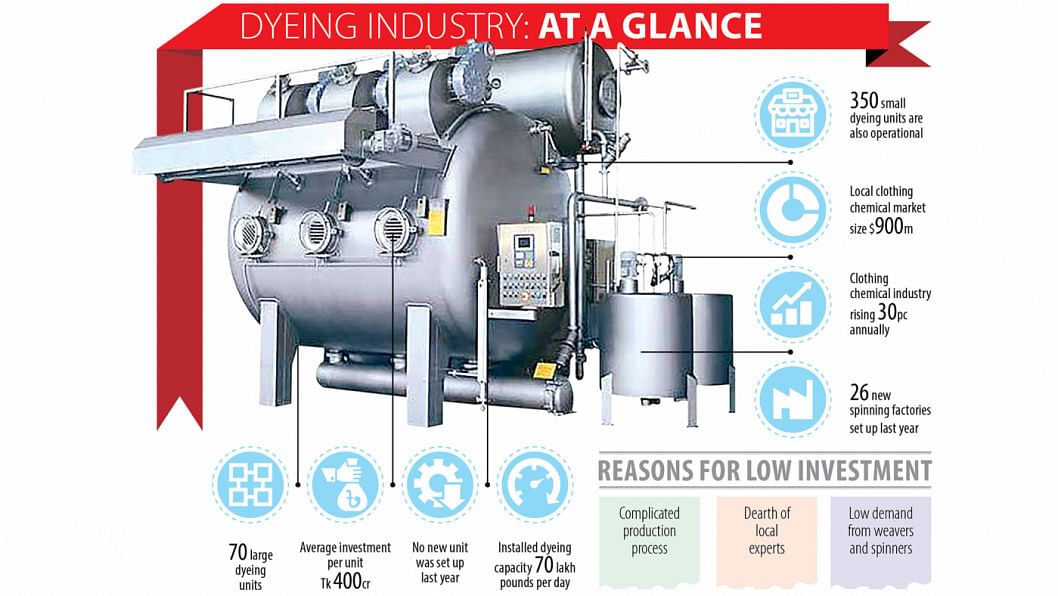

Industry people say entrepreneurs, however, are not interested in pouring money in the dyeing industry because of complicated production process, large investment requirement, dearth of local experts, and lower demand from weavers and spinners.

Dyeing is a critical process to colour fabrics and yarn for finished garment items. It involves a lot of technical people and expensive chemicals.

Two kinds of dyeing processes are required mainly -- solid dyeing that means colouring fabrics and yarn dyeing for making fabrics.

But not a single new dyeing factory was established last year although the spinning segment witnessed the highest amount of investment in a single year of Tk 6,000 crore as entrepreneurs set up 26 new units because of high demand for the yarn from the knitwear and woven garment exporters.

"Dyeing industry needs a lot of primary capital and is expensive to run effluent and water treatment plants," says Monsoor Ahmed, chief executive officer of the Bangladesh Textile Mills Association, the platform for the primary textile sector.

"Entrepreneurs feel discouraged from setting up dyeing factories because of a requirement of a lot of capital, higher chemical prices and dearth of expertise in the industry," said Abdullah Al Mahmud Mahin, chairman and managing director of Mahin Group.

The group runs one of the biggest dyeing units in Bangladesh. It can dye 30 lakh metres of fabrics a month, which includes 15 tonnes of yarn a day.

"We are overbooked with orders from local garment exporters for next four months as international retailers and brands are placing a higher volume of orders with Bangladesh," said Mahin.

There are 70 large dyeing units in Bangladesh with Tk 400 crore investment in each factory, according to the Bangladesh Dyed Yarn Exporters Association.

These large units have a combined capacity of dyeing 70 lakh pound of fabrics and yarn a day against current requirement of 50 lakh pounds. The market size of clothing chemicals, mainly caustic soda, salt and other colour chemicals, is $900 million.

There are many small dyeing units that are not the members of the Dyed Yarn Exporters Association, said Salah Uddin Alamgir, president of the trade body.

Annual consumption of clothing chemical is growing at 30 per cent as local dyers use more chemicals adding more value to export-oriented garment items, according to Syed Mohammad Ismail, country manager of Archroma (Bangladesh) Ltd, a US multinational chemical company.

Archroma (Bangladesh) has a market share of 12.5 per cent.

He says chemical prices are not responsible for the lower inflow of investment in the dyeing segment.

Last year, chemical prices rose 30 per cent mainly because of a 400 per cent hike in sea-freight charge and an increase of prices of other raw materials caused by the supply shortage and supply chain disruption owing to the coronavirus pandemic.

"Despite a lot of challenges, many spinning, weaving and dyeing units are expanding their capacity because of an inflow of orders from global retailers and brands," Ismail said.

Although no new dyeing factory was set up in 2021, many large textile groups expanded their capacity eyeing a big investment in spinning and weaving sectors, he said.

Mahin said previously, a lot of dyed polyester, cotton and blended fabrics used to be imported from China, India and Pakistan. Now, local mills are capable of dyeing all kinds of fabrics and yarn.

It costs at least Tk 1,200 crore to Tk 1,500 crore to set up a dyeing and weaving unit.

Bangladesh needs more investment in man-made fibre as the demand for artificial fibre-made garment items is on the rise worldwide because of changes in weather, fashion and designs, said Alamgir.

"Bigger industries have expanded their capacity to meet the rising demand. In future, the dyeing industry may grow as investment is taking place in the spinning and weaving at a faster rate," said Monsoor Ahmed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments